China’s markets continue to retrench

17 August 2009Nowhere has escaped the economic meltdown, but perhaps China has suffered less than most. While it has been savaged by losses in export markets, a still-solid domestic economy (supported by government stimulus) has moderated the negative impacts of global economic stress.

For China, the worst part of the recession probably came in the last quarter of 2008 and first quarter of 2009 but recovery will initially be slow, if only because exports will drag through 2009 and well into 2010.

This is expected despite the increase in tax rebates for exporters (which may simply help to cushion the thin profits of exporters rather than immediately be reflected in lower prices and higher volumes).

There is growing concern that the domestic economy could falter in 2010 without another bout of stimulus. Unlike North America and Europe, where the effects of stimulus programmes will be felt more in late 2009/first half of 2010, the Chinese government stimulus announced in November 2008 will largely impact in 2009.

It is not clear that China understands the need to fundamentally change its business model.

The increased VAT rebates to exporters will not enamour the Chinese to their trading partners! Neither does it reflect an understanding of the nature of current economic problems; any attempt to generate export-led growth is unlikely to bear much fruit in a global economy unwilling to increase its consumption of consumer goods.

However, it is understandable why the government reacted this way, given the acute pain throughout much of the export sector.

Clearly, more emphasis needs to be placed on stimulating the domestic economy in China (and in other developing countries such as Brazil). The significant commitment of new funds to help to improve China’s health delivery system is hopefully just the first downpayment in a series of policy changes that will improve the social security safety net in China. In turn, these improvements will underpin increased domestic consumption as savings rates fall in response to a greater feeling of personal security.

Gross domestic product (GDP)

This re-structuring of Chinese consumer behaviour will take time, but the thrust of these changes over the next several years will result in further increases in consumer spending on housing, furniture and other commodities utilising wood products. At CFPA we assume that 2009 will be the trough year for Chinese economic growth.

GDP growth is assumed to be close to 7% this year, down from 9% in 2008 and 11.9% in 2007. Growth is forecast to climb

moderately to 7.7% in 2010 and to continue to climb subsequently, albeit not to the heights scaled in 2006/7 (see Table 1).

Housing

Meanwhile, after slipping 3.5% in 2008, housing completion activity will likely also edge lower again in 2009, dropping another 3.4%. Recent reports of a rebound in housing activity in China tend to confuse an increase in home sales with the level of new residential construction and/or completions.

With a large inventory of unsold homes resulting from overbuilding in late 2007/early 2008, the housing market needs to work off that inventory in 2009 before construction activity picks up later in 2009 and in 2010.

Industrial Production

Industrial markets for wood products have sagged over the past 12 months, not only because of lost export business, but also the massive global inventory correction at all levels of production and distribution.

Growth in China’s industrial output dropped to 12.9% in 2008 from 18.4% the previous year. For 2009, CFPA estimates growth in total industrial output of around 7.5%, to be followed by 9.5% in 2010.

Furniture Production

Lastly, the all-important furniture sector experienced its first drop in output in over a decade in 2008. A 1.9% decline was not catastrophic, but following growth of over 20% in 2007, the 2008 outcome was a major setback for China’s panel producers.

Recent developments require a re-think of furniture industry investment strategies as future export growth will likely be slower than over the past decade and increased attention will need to be focused on developing domestic furniture markets.

For 2009, CFPA forecasts just 1% growth in furniture production (higher domestic demand more than offsetting further weakness in exports). But with strength in both the domestic and export sectors in 2010, CFPA projects a 6.4% increase in total

furniture production next year (Table 1).

Production and exports

Recently-released data from China’s State Forestry Administration indicate that panel production in China in 2008 totalled 94.1 million m3, a 6.4% increase over 2007.

Table 2 summarizes the key components of this production (plywood, blockboard, particleboard and fibreboard; the remaining 5.2 million m3 was all other types of panels).

Through the first half of 2008, production across the board was up year-on-year. However, weakness in the second half resulted in small drops for the whole year for both plywood and blockboard (down 0.6% and 1.4% respectively). In contrast, the ongoing growth in capacity in particleboard and fibreboard led to year-on-year production increases of 37.8% and 6.5%, respectively.

Plywood production continues to lead the product pack. At 35.41 million m3, it represented 38% of total output in China in 2008, though this was down from 40% in 2007.

Blockboard’s share also slipped between 2007 and 2008, from 15 to 14%.

Fiberboard’s share held at 31%, while particleboard’s jumped from 9 to 12% as particleboard production leapt a surprising 3.1 million m3 to 11.42 million m3 (Table 2).

In part, production weakness in 2008 was induced by direct losses in export markets. Chinese exports of all panel types fell by close to 18%, from 11.3 million m3 in 2007 to 9.3 million in 2008. Plywood continues to dominate Chinese panel exports, but at 6.75 million m3, was at its lowest level since 2005 (Table 3). This decline was more than that for production as domestic demand held up better than offshore. Chinese fibreboard exports have soared in recent years, but also proved vulnerable to the global slowdown in 2008 and dropped 17.5% to 2.08 million m3.

Forecasts

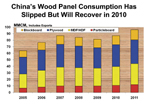

Given the economic outlook discussed earlier, it is no surprise that further declines in consumption, exports and production are projected for 2009 (Figure 1). These declines largely reflect weakness early in the year; improvement is likely in the second half, continuing into 2010. But despite this reversal, total wood panel production for the whole year is forecast to drop nearly 9% in 2009, led by double-digit declines in plywood and particleboard (see Table 2). Again, weakness in exports will lead the way. Given the data reported in the first five months of the year, CFPA projects a 35% drop in total panel exports, led by over 40% declines in fibreboard and particleboard volumes (see Table 3).

However, the improvement in domestic and export markets in the second half of 2009 will be reflected in the 2010 data. With total panel exports rebounding 24%, CFPA forecasts Chinese panel production in 2010 will jump nearly 7%. Nevertheless, 2010 production will continue to remain below 2008 levels. China’s panel industry will need to wait until 2011 before setting any new production records. Further moderate erosion in plywood’s share is also anticipated.

Conclusion

After a decade of frenetic growth throughout China’s panel industry, the consumption pattern since 2007 either represents a momentary break in the previous hectic pace or a new paradigm.

We lean toward the latter belief. Pressures on log supplies (eg Russian log export taxes), higher manufacturing costs, and excess capacity, have all squeezed profitability.

At the same time, growth in key construction and furniture end-use markets will be slower over the next decade than the last, if only because these markets have passed their juvenile growth period and are entering ‘middle-age’. But given the large size of the Chinese panel industry, while growth rates over the next decade will be low compared with recent history, the volumes produced and consumed will nevertheless increase

substantially.

This article was written by Bernard Fuller, Cambridge Forest Products Associates www.CambridgeForestProducts.com. Questions and comments are welcomed and should be sent to: Bernard.Fuller@CambridgeForestProducts.com.