Brazil and China continue to Invest; Egypt has new project

23 September 2019In this second part of our annual survey of the global MDF industry, for the countries outside Europe and North America, Geoff Rhodes looks at new developments and summarises the current and future position for MDF.

Increases in MDF capacity continue, notably in Thailand with new start-ups, while Brazil and China have both announced new investments.

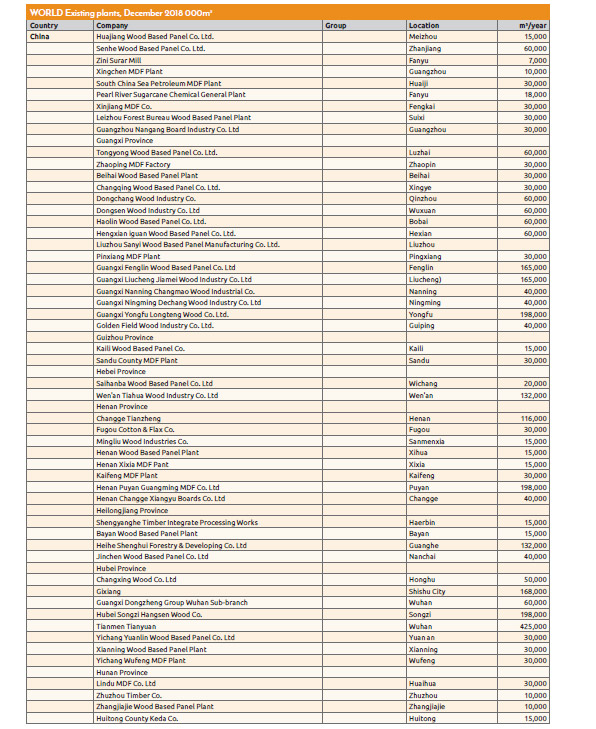

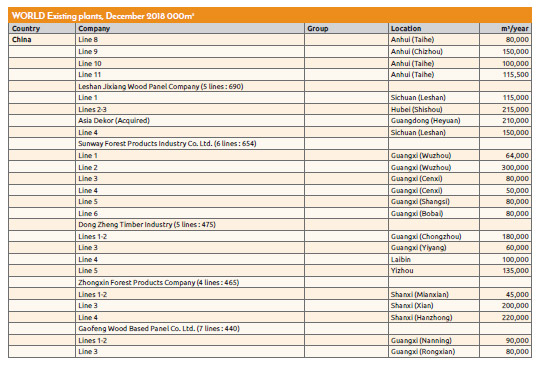

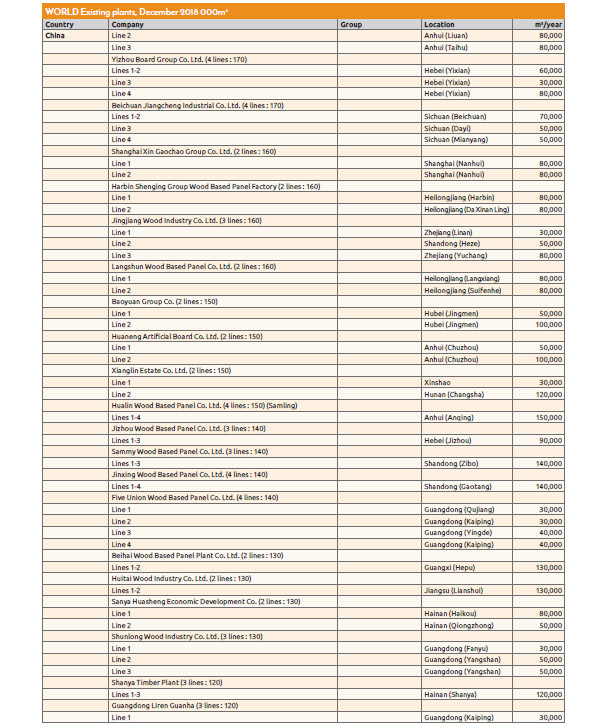

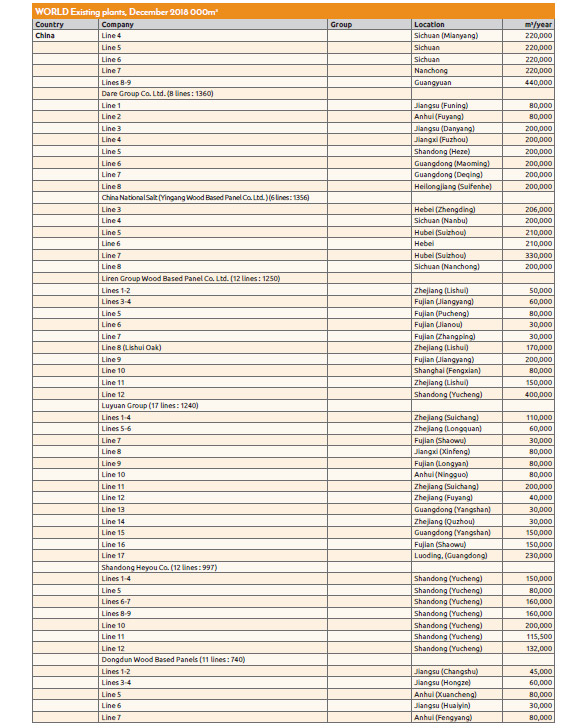

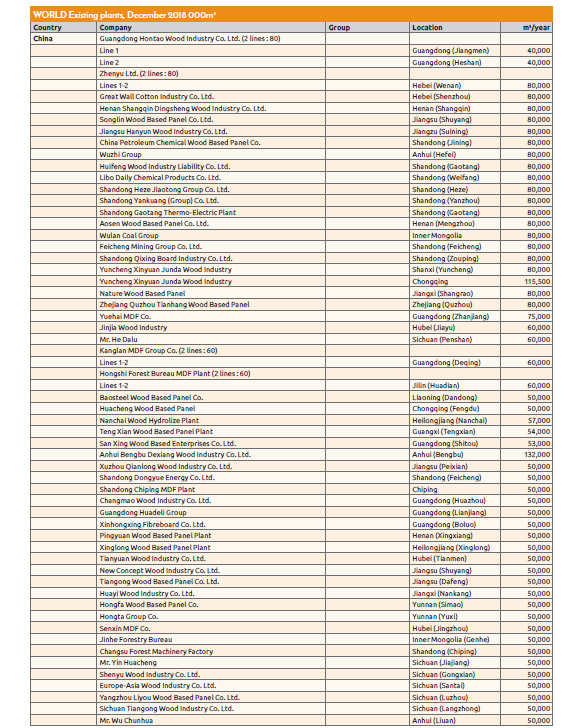

Following on from Part 1 – our survey of the industry in Europe and North America – we now focus on the existing mills in the ‘rest of the world’ as at the end of 2018; and on those under construction in 2019 or those planned for 2020 and beyond.

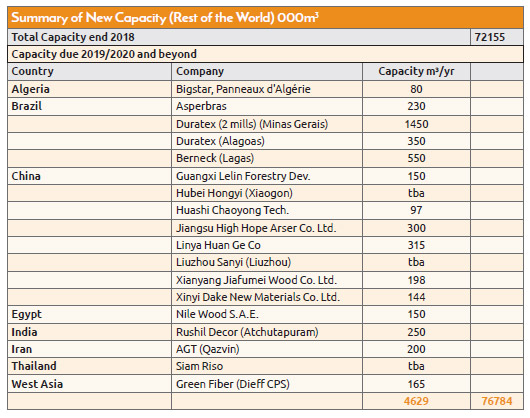

For these ‘rest of the world’ areas, after a number of updated and corrected data inputs, we now show an increase in installed capacity in 2018 of 72,155,000m3, while further investments identified for 2019 and beyond bring the total to 76,784,000m3.

So, for 2019/20 and beyond, when this figure is added to the European future capacity of 29,633,000m3 – and the North American figures (including Mexico) of 6,379,000m3 for the same period, we see global MDF capacity exceeding last year’s predicted figure and reaching 112,796,000m3.

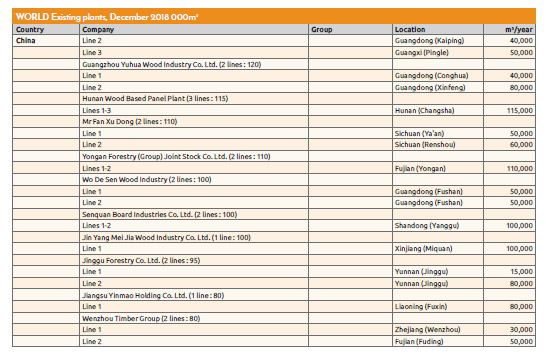

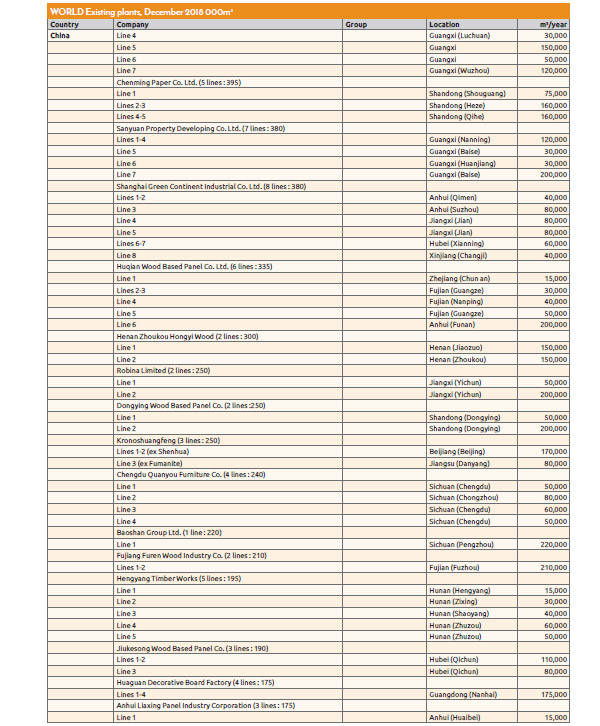

China and North-East Asia

Over the past five years, average annual growth has been strong in this region, except for Japan, where GDP growth declined but is now recovering more strongly.

In 2018, China reported GDP growth of 6.6%, with 2.7% in South Korea and 2.9% in Japan. Projections are still strong for GDP growth across the three countries out to 2020.

China and North-east Asia’s MDF markets continued to under-perform in 2018 due to the slowdown in global demand, so prices remained relatively weak, aided by a cooling Chinese economy and continuing depreciation in currencies across Asian countries against the US dollar.

However, China is still forecast to produce 85% of the furniture in North Asia by 2019/20.

Approximately 30% of annual furniture production in China is exported to a wide range of countries, with the largest volumes destined for the US, Japan and Europe, while the domestic market continues to grow year-on-year.

As reported last year, some furniture factories have had to close due to raw material shortages, labour issues, higher wages and dwindling exports. The drive by the authorities to move industries to inner cities also led to an exodus of some Taiwanese furniture factories from China, relocating to Vietnam.

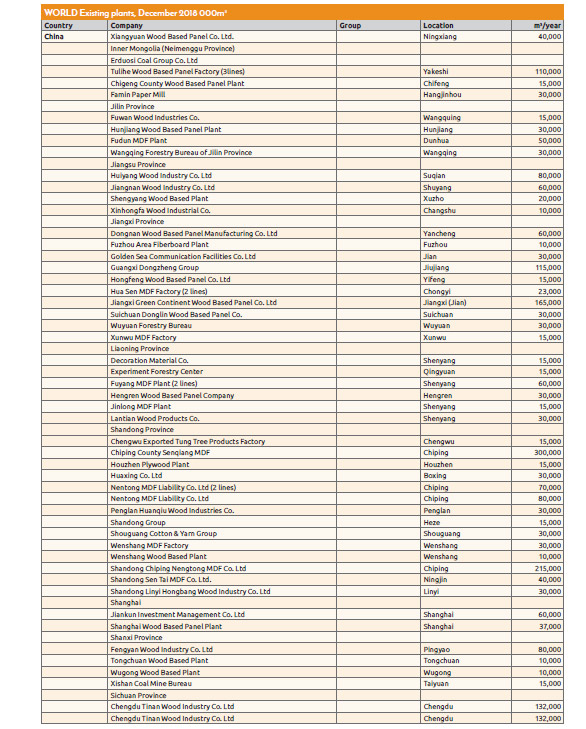

In China, MDF production capacity has continued to grow, increasing to an impressive 45,548,000m3 at end of 2018. As previously, consumption has increased strongly. Forecasts are for it to increase at an average annual rate of just 1% in the region out to 2019/20 as China shifts to a focus on more growth in domestic consumption, possibly at the expense of some exports such as furniture.

Real commercial activity in the Chinese MDF industry has continued to slow as the government tries to rein in the country’s dramatic economic growth of recent years. However, despite all this news, we can report new investment, now in the main listing, by the Chinese Yekalon-Jingyuan Panels, to expand its MDF/HDF production lines with the help of Siempelkamp.

It is now aiming to produce 300,000m³/ year of MDF/HDF after the start-up of its new line.

Also, Chinese panel manufacturer Chiping Senqiang MDF, Chiping, Shandong, which ordered an EVO-56 refiner from Valmet Oyj, Finland, expects the potential to deliver an additional 300,000m3/year at the plant when operating to full capacity at the end of 2018.

This plant is now added to the main listing, as is the 198,000m3/year MDF facility by Anhui Jiahe at Chuzho, Anhui, which started up in September 2018.

New investments currently under construction in China include a THDF plant producing ultra-thin boards, primarily for use by furniture makers, being built by Dieffenbacher for Guangxi Lelin Forestry Development Co Ltd near Nanning, Guangxi, with start-up planned for Q3 2019, with a capacity of 150,000m3/year, utilising eucalyptus.

Last year we learned of two more new MDF investment projects for China by Dieffenbacher – one by Hubei Hongyi in Xiaogan and the other by Liuzhou Sanyi in Liuzhou. Volumes of both mills, and more details, are awaited.

Now we can note another two new MDF investments, by Xianyong Jiafumei Wood Co and Huashi Chaoyang Tech.

Siempelkamp group has three more and will supply complete ContiRoll lines to Linyi Huan Ge, Jiangsu High-Hope Arser, and Xinyi Dake in China.

These eight mills are added to our new investments listing for 2019/20.

In September 2018, Linyi Huan ordered a complete forming and press line for MDF, capacity 315,000m3/year, with start-up anticipated in November 2019.

Linyi Huan Ge Co, Ltd, founded in March of 2017, is a subsidiary of plywood maker Linyi Fu Da Wood Co Ltd. Linyi Huan Ge was founded to produce high-quality MDF panels for interior construction. This line is Siempelkamp’s second to produce MDF with a thickness of 1mm in China and the plant is designed for thicknesses up to 9mm.

Jiangsu High-Hope Arser Co Ltd ordered a fibre sifter, forming and press line in July 2018 (8ftx28.8m), with a planned capacity of 300,000m3/year. Start-up is anticipated by the end of 2019. Jiangsu High-Hope Arser produces, among other things, film faced plywood, blockboard and melamine faced products. It exports to more than 20 countries in Europe, North and South America, Asia and the Middle East. This is its first MDF line.

Xinyi Dake New Materials Co Ltd ordered a complete forming and press line with a planned increase in its MDF capacity at the Xinyi factory of 144,000m3/year. Xinyi Dake New Materials Co Ltd is a 100% subsidiary of Huqian Forest Industry & Technology Co Ltd, based in Zhejiang.

Xinyi Dake makes MDF panels under the brand names Songcheng and Huqian. It has a 4ftx42.1m ContiRoll press. For the first time, Siempelkamp is supplying a 4ft-wide ContiRoll to manufacture MDF in thicknesses of 12-40mm, with a quality suitable for milling. The start-up of the line is also scheduled in 2019.

As mentioned in previous years, with the difficulty in obtaining totally accurate information on all the Chinese capacity, including all the small mills, WBPI continues to have to make some informed assumptions about this country’s MDF capacities. This will remain under constant review.

South-East Asia

The South-east Asian economies are still set to be among the world’s fastest-growing to 2019/20. The four countries: Indonesia, Malaysia, Thailand and Vietnam – are still expected to have an average real GDP growth rate of at least 4-5% per year.

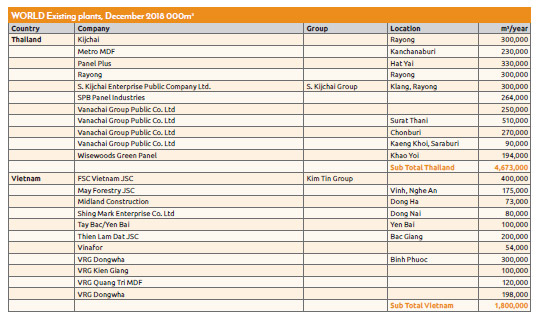

In this part of Asia the MDF market has generally been doing well, driven by increasing demand, rising adhesive prices and some shortages of wood and raw material availability. However, recently in Vietnam, the Ministry of Industry and Trade has said that it would strengthen trade barriers to protect domestic MDF manufacturing, starting by an anti-dumping investigation into imported MDF products from Thailand and Malaysia.

The MDF industry in Vietnam has fared relatively better than some other countries in recent years, due to more foreign direct investment and strong exports to the US, but recently it has faced strong competition from very competitively-priced imported MDF.

Thien Lam Dat JSC and Dieffenbacher contracted last year for a complete MDF plant in Bac Giang, about 50km east of Hanoi. The press, 8ftx20m, with planned capacity of 200,000m3/year, has now started up and has been added to the main listing. The raw material is coming from Thien Lam Dat’s plantations, mostly of acacia.

We can also now report that FSC Vietnam JSC of Kim Tin Group recently began its expanded 400,000m3/year operations at the VND2.3 trillion (US$98.7m) MDF plant in the Nam Dong Phu Industrial Zone in the southern province of Binh Phuoc’s Dong Phu District and is also added to the main listing.

This facility has a capacity of 400,000m3/ year, apparently meeting 20% of Vietnam’s market demand. Construction of this second facility was started in August 2016.

Vice-chairman of the provincial People’s Committee, Nguyen Tien Dung, said the province has advantages and potential for developing MDF plants.

In Thailand, with 4,673,000m3/year of MDF capacity installed, furniture manufacturer Kijchai, with its 300,000m3/year plant, continues to run well, as does the second major new MDF line in the region, built by Panel Plus at Hat Yai in southern Thailand, with its capacity of 330,000m3/year.

Both are now in the main listing. Last year also saw the announcement of Kijchai expanding production capacity by a further 300,000m3/year with a new THDF line. The CPS+ was Dieffenbacher’s fifth sale in Thailand in two years.

S Kijchai Enterprise PCL, in Rayong, has produced MDF from a Dieffenbacher plant for the past five years. Kijchai will now produce 1–32mm boards from rubberwood.

The new THDF plant enables the company to more than double its capacity. This will strengthen its position as one of the leading manufacturers of MDF in Thailand.

Also in Thailand, 2018 saw the MDF investment announced by Thai Vanachai Group, which has ordered a Siempelkamp complete forming and press line for MDF/ HDF with an 8ftx25.5m ContiRoll to manufacture boards from 1.0mm thickness.

The company planned to produce 250,000m³/year of MDF/HDF with this new line, which has now started up and is in our main listing.

A new player for MDF in Thailand is also emerging with SPB Panel Industries Co Ltd, which initially broke into the panel market in 2006 with the commissioning of a Dieffenbacher particleboard plant. Now, a new THDF/MDF plant has been installed and started up on the same site in Surat Thani, Thailand.

It again selected Dieffenbacher. It has a 28m CPS+ press. With a capacity of 264,000m3/year, the plant can produce both extra-thin THDF panels – from 1.5 mm – and MDF panels up to 32mm. This mill is also added to our main listing.

In terms of new investments in Thailand, we can now note the decision by Siam Riso (an existing producer of particleboard) to add an MDF line by Dieffenbacher, due to start production in 2020. A capacity figure is awaited.

In a further development, South Korea’s top wood materials manufacturer, Dongwha has, since last year, acquired Agro Fiber’s MDF manufacturing unit in Prachiburi, Thailand, for US$20.5m.

Established in 1998, Agro Fiber was a subsidiary of copy paper maker Double A, producing around 100,000m3/year of MDF. Lee Si-Joon, senior vice-president of Dongwha said: “We expect the acquisition can create synergy with our branches in Malaysia and Vietnam so we can raise our profitability”. Dongwha also said the acquisition will help it secure a favourable position in the South-east Asia market as the company plans to explore more business opportunities in Thailand.

For Malaysia, no new investment plans are seen and our latest MDF mill listing shows the country’s capacity at 1,505,000m3/year.

Apart from domestic sales and Singapore, the Middle East market has been a consistently growing one in recent years, so the importance of this region for the export of MDF from Malaysia cannot be underestimated.

In a recent statement from Johor Baru, Evergreen Fibreboard Bhd (EFB) reported that it wants to strengthen its position as one of Asia’s largest MDF manufacturers in the region and to be among the top 10 in the world, based on production volumes. MDF is still the core business of the company, followed by lamination and furniture making activities.

In recent news, Accsys Technologies, the fast-growing chemical technology group, confirmed in January that it was exploring opportunities for new manufacturing plants outside Europe.

Accsys announced that its subsidiary, Tricoya Technologies Ltd (TTL), has now entered into an agreement with PETRONAS Chemicals Group Berhad (PCG) to evaluate the feasibility of jointly funding and operating an integrated acetic anhydride and Tricoya wood elements production plant in Malaysia.

It is envisaged that Tricoya wood elements produced at the plant would use acetic acid from PCG’s existing joint venture in Malaysia. It would then supply the MDF and panel industry in South-east Asia, under licence, as the key raw material for the formation of Tricoya panels for the region’s construction industry.

Under the terms of the agreement, the parties have agreed to carry out the evaluation exclusively for a period of at least 18 months.

For Indonesia, alongside traditional plywood production, we now see MDF as a major product, with nearly 1.3 million m3/year capacity, in 10 lines. No new investment plans have been seen in the last 12 months.

South Asia

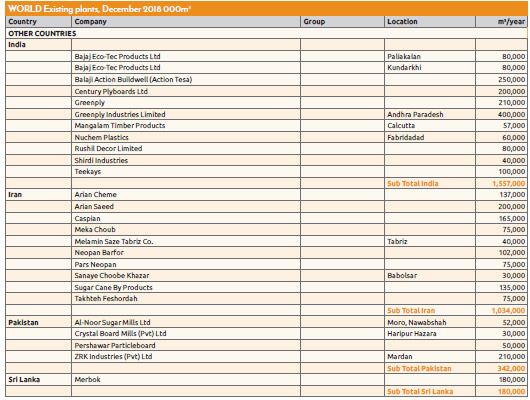

In India, the wood based panel manufacturer, Greenply Industries Ltd (400,000m3/year, with its MDF rebranded as Greenpanel); the Indian Plywood and laminate manufacturer, Century Plyboards Ltd (200,000m3/year); and panel producer Balaji Action Buildwell (Action Tesa) in Udyog Nagar and part of the Action Group (250,000m3/year) are running well.

Century Plyboards, in making the investment decision for MDF, we understand revived plans made several years ago but previously postponed.

The new plant, with production capacity of 200,000m3/year, was constructed as a greenfield investment in the Hoshiarpur district in Punjab. Century Ply claims to be the biggest producer of plywood, and the third biggest producer of laminates, in India.

We have seen Indian capacity grow by a further 8-900,000m3 in 2018 and all plants are in the main listing. Greenply Industrie’s new line in Chittoor District, Andhra Pradesh, with its 56m Dieffenbacher CPS press, is the longest continuous press in Asia.

India now has installed capacity of 1,557,000m3, which is significant for a country not so long ago heavily dependent on imports.

Additionally, the Indian wood materials manufacturer Rushil Décor commissioned Siempelkamp to supply a 250,000m3/year MDF plant in India. With the new plant in Atchutapuram, Rushil will utilise plantation eucalyptus and over-mature mango trees. To meet local market needs, Rushil Decor will, with this investment, “significantly expand its capacity” above its current 80,000m3/year. It will have an 8ftx28.8m ContiRoll press. Machinery delivery was scheduled to begin in Q4 2018 and the start-up is scheduled for Q4 2019.

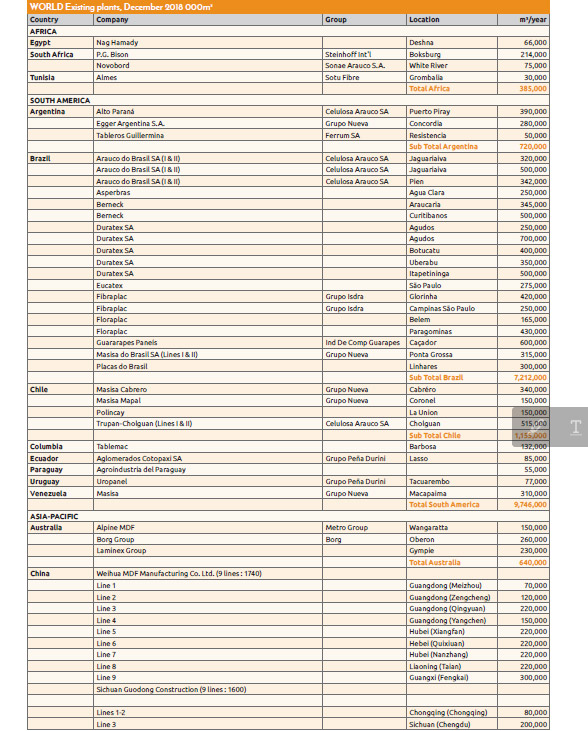

South America

With a combined population of over 250 million, Argentina, Brazil and Chile have an underlying demand of well over one million housing units annually, which in turn is good for MDF consumption. New mills, new entrants, new associations… the panel industry in South America is constantly moving ahead.

South American economies have not been so buoyant recently and there have been currency crises; political crises; economic crises and, as a result, as seen last year, short-term demand for MDF has declined. However, in December 2018, Brazilian company Berneck S A Painéis e Serrados ordered its fifth panel production plant, with a Siempelkamp Generation 9 ContiRoll MDF press (9ftx48.8m) in Lages, with a design capacity of 550,000m3/year.

The scope of supply also includes all five Berneck panel lines being equipped with Siempelkamp’s Prod-IQ Next system.

Following the plant’s start-up, scheduled for spring 2021, the new Berneck factory in Lages will manufacture 1,665m³ of MDF daily. The installation of the plant is scheduled to begin in Q2 2020 and production of the first board is forecast for that December.

South America remains a continent of change, development and expansion and one that is hardly in the doldrums.

Two major items of news give us a real focus on Latin America: first came the sale by Masisa of its MDF making facilities in Argentina, Brazil and Mexico (Mexico was covered in WBPI’s Focus on MDF Part 1). The MDF plant in Argentina found a buyer in Egger, a newcomer to the continent, but a newcomer which now appears to have global ambitions.

Masisa’s assets in Brazil found a purchaser in the Chilean group Arauco, through its subsidiary Arauco Brazil.

The transaction was finalised in 2018, having had to be approved by the Administrative Council of Economic Defense (CADE), a body of the Brazilian government equivalent to the SEC in the US.

Amazingly, virtually no MDF was produced in Brazil back in 1998 but it now has the largest production capacity in South America. Key producers in the region have included Masisa, Arauco, Duratex, Fibraplac, Floraplac, Eucatex and Berneck.

For 2018/19 and beyond by far the biggest planned panel project is still Duratex’s US$550m, 1.45 million m3/year two-line complex at Novo Monte Carmelo (Minas Gerais state), at the heart of its big forest base. Duratex aimed to start construction of the complex with a 700,000m3/year line set to run in 2016 making MDP/MDF on a 77m press; and a 750,000m3/year MDF line due on-stream in 2017, but these have now slipped back due to economic conditions and remain under review.

However, Duratex confirmed its investment commitment in the construction of a new MDF facility in Alagoas, Brazil. The project, which began with Caetex (formed as a joint venture between Caeté Agroindustrial and Duratex), was approved by the State Council for Economic and Social Development (Conedes) on April 27th 2017.

With the approval, the company will have fiscal incentives foreseen in the Integrated Development Programme (Prodesin) to install another industry in Alagoas.

According to the project, “the coming of giant Duratex was guaranteed, with an investment of R$1.1bn and generation of 460 direct jobs.” Duratex has 20 industrial units in Brazil and decided, some years ago, to implement a unit in the north-east. Alagoas was chosen as the ideal site for its strategic location, tax incentives and the possibility of partnership with local companies.

In order to maintain a laminate manufacturing unit, also to be built in Alagoas, Duratex needs up to 20,000ha of eucalyptus forest. In Alagoas, the partnership with the Caeté Plant was announced at the end of 2014, with the creation of Caetex. Since then, the company has already planted another 6,000ha of eucalyptus.

The MDF and MDP panel manufacturing plant is scheduled to start operating early in 2019, with a production capacity of 350,000m³/year.

Placas do Brasil, a consortium of furniture makers originally planning a 180,000m3/year line at Linhares, (Espirito Santo state) has constructed a 300,000m3/year plant, which started up in 2018 and is now in the main listing. The initial delay was put down to a relatively slow market and waiting for further build-up of the local eucalyptus plantations.

As previously reported, Asperbras (producing now under the brand name GreenPlac) is an industrial and agri-business group in Mato Grosso do Sul state and is a complete newcomer to panels. The company is using its eucalyptus plantations to feed a 250,000m3/year Siempelkamp ContiRoll line, which was also running in 2017 and is in the main listing. Additionally, the group has recently announced plans to add a second line – with a capacity of about 230,000m3/ year when its forest base grows, making a potential combined capacity of 460,000m3.

We will review this again next year. Brazil is the world’s fifth largest country by area. Its vast and varied forest sector now comes under the common umbrella of IBA, the Association for the Planted Tree Industry.

This was formed just four years ago. In Paraguay, the modest project to build Paraguay’s first MDF plant of 55,000m3/ year in Coronel Oviedo, (department of Caaguazú) was given the green light by the Industry & Commerce Ministry.

It was planned by Agroindustria del Paraguay SA as its first venture in panel manufacturing and it is taking advantage of fiscal incentive legislation for national and foreign investors to assist its investment of US$6.7m in imported machinery. The mill, which we understand came on stream in 2018, is in our main listing.

In Chile, there is no new capacity expansion at present. Celulosa Arauco y Constitucion (Chile) has continued to expand its panel products’ global reach (including MDF). With the international joint venture with Sonae Industria SGPS SA (Portugal) in Europe, the recent expansion in Mexico and the acquisitions in Brazil, the company has really made its mark internationally and is clearly recognised now as a leading global player.

Consumption of MDF in South America overall is projected to increase to around nine million m3/year by end-2019. Most of this will be in Brazil, which is forecast to consume 74% of all MDF in South America by then.

Consumption will also expand in Argentina, Ecuador, Peru, Uruguay, Venezuela and Chile and other nonproducing South American countries, providing strong export demand within the continent as well as overseas, particularly to the US. Let’s also not forget that the continent contains some 26 countries, each with different economic conditions.

Rest of the World Summary

As previously, the aggregate world capacity table now lists the capacities in the various world regions from 2017, 2018 and through to 2019 and beyond.

Also, and to give an overview of other important MDF producing countries globally and complete the picture, we are providing a short update where information is available and relevant.

With much-appreciated input from Bernie Neufeld of Neufeld Group Pte in Sydney, and industry veteran Murray Sturgeon at Nelson Pine New Zealand, we can report that Australia has been one of the strongest performing advanced economies in the world over the past decade. It has the enviable reputation of not having had a recession in more than 27 years; a unique global record.

Economic production has shifted from a dominant mining and resource sector to a greater emphasis on the production of goods and services. While both housing and non-residential construction have been booming over the past decade, a moderation in residential construction activity began in 2018 and further declines are expected in 2019 until mid-2020.

Australian exports and imports of MDF averaged less than 100,000m3/year over the five years to 2018. In 2018, imports were substantially above 100,000m3, as a result of exceptionally strong demand.

Key export markets are China, Taiwan, Hong Kong, Japan, Malaysia, New Zealand and South Korea. MDF is imported mainly from China, Germany, Malaysia, New Zealand and South Korea. The industry is highly concentrated, with only three producers, and has operated at near-full capacity over the past five years.

While demand will moderate over the next two years, in the long term there is potential for an increase in production capacity, and imports, as a result of a strong domestic market, and export markets in Asia.

In New Zealand, the economy, which is highly trade-exposed and export-dependent, especially in the forest products sector, continues to respond to the global financial and economic challenges with vigour.

The building and construction cycle is still forecast to shift to a strong growth path in New Zealand (albeit from a small base) over the next two years. Housing approvals were still strong in 2018.

Just over 75-80% of the MDF produced in New Zealand is exported, coming from a total production of 720,000m3 in 2018, with destinations being Japan, China, South-east Asia and a small volume to the US. Production of MDF in New Zealand is forecast to increase gradually and any increases in production will be contingent on eventual capacity expansion and raw material availability.

The three producers in New Zealand are the well-known Nelson Pine in Richmond, Nelson, owned by Sumitomo of Japan; Daiken Southland Ltd, at Mataura (formerly CHH) and now recently acquired by the Japanese company Daiken, themselves a part of the large Itochu group; and then the other Daiken MDF operation in Rangiora (formerly owned by Rayonier), Canterbury region.

So, all the MDF facilities in New Zealand are owned by Japanese based corporations. It is felt unlikely that any new MDF plants will be established soon, although capacity in existing plants may be increased to meet export demand.

A key constraint to adding new production capacity is the highly competitive market for raw materials; there is a general shortage of logs for processing. So, with this in mind, Sumitomo purchased 30,000ha of radiata pine forest in the Nelson region. The estate was previously owned by Hancock investors of the US and this purchase will strengthen the raw material base for Nelson Pine and provide fresh opportunities.

Domestic consumption of MDF in New Zealand is projected to increase at 3% annually in 2019/20, in view of the projected stronger housing market, and was estimated to reach 225,000m3 in 2018, above the previous peak of 211,000m3 reached in 2004, boosted by imports.

Although consumption relative to total production capacity is low on a per capita basis, New Zealand is one of the biggest consumers of MDF in the world.

With North-east Asia, China, South-east Asia and South America already mentioned or discussed in detail, that just leaves our rest of world ‘other countries’ category, which this year refers only to Algeria, Egypt, South Africa, Iran and Pakistan.

Building on last year’s investment news for our global survey, now North Africa, with Algeria, is set to join the MDF producers soon.

In Q3, 2017, the Algerian company Bigstar Sarl, via its subsidiary Panneaux d’Algérie, gave Dieffenbacher an order for a complete system for producing MDF at its site in El Tarf in the far north-east of the country.

This complete MDF plant, with a CPS+, is Dieffenbacher’s first greenfield project on African soil and the first continuous press operating in North Africa.

Although Bigstar has been active in the panel trade for many years, it had never produced its own materials before this project.

Bigstar CEO, Guelai Mohamed Chiheb, explained: “There is a rising demand for MDF in Algeria and imports from other countries are becoming increasingly costly.”

The 6ftx14.5m CPS+ for Bigstar will be supplied from Eppingen, Germany whilst Dieffenbacher’s Shanghai Wood-Based Panel Machinery Co (SWPM) will be responsible for the remainder of the scope of supply and for project management. Plant assembly began in Q2, 2018, with an expected startup in 2019 with a production capacity of approximately 80,000m3/year.

For North Africa, and now in Egypt, we can record the investment decision by Nile Wood SAE to add an MDF facility. Egyptian Kuwaiti Holding (EKHO) said its 99.99%-owned subsidiary, International Co for Financial Investment, will start to establish a factory to produce MDF in two phases, with a total estimated investment of LE2bn.

The investment cost of the first phase amounts to LE1.1bn, with LE900m for the second phase. The facility will be built in Beni Suef.

It is expected that the trial run of the first phase will be in the first half of 2020, with a production capacity of 150,000m3/year.

In South Africa, from research we have undertaken, it seems that only one MDF mill has been under construction in recent years: the PG Bison line at Boksburg in Gauteng Province, with a capacity of 214,000m3/year.

This volume has now been added into the country capacity for 2018/19.

On average, private sector housing in South Africa is still projected to grow by 12% annually to 2019/20 and the demand for furniture in South Africa has strengthened considerably over the past decade.

Despite the sharp declines in the first few years following the global economic crisis, MDF consumption increased by 5% annually over the past five years. The relatively strong growth in production and consumption of furniture in the past decade, as well as projections for strong growth to 2019, suggest that it will be a key sector continually driving growth in the consumption of MDF and particleboard in South Africa.

There are currently only two MDF producers in South Africa: PG Bison and Novabord (now Sonae Arauco SA), and the installed production capacity of 289,000m3 has been driven upwards by PG Bison’s recent investments.

In Pakistan, the ZRK Industries (Pvt) Ltd investment in its continuous MDF mill in Mardan is running well. The ZRK group is the largest panel-making business in Pakistan, producing both MDF and particleboard.

Having state-of-the-art plants from Europe and China, it has a distributor network throughout Pakistan, Afghanistan and Central Asia and claims to cover the building industry needs of more than 300 million people. Its Wood Processing Division is vertically integrated and the group consists of Pakistan’s largest, brand new, fully automated particleboard plant, paper lamination and impregnation lines; and now Pakistan’s largest new MDF plant, which is fully operational.

Pakistan imports MDF from a variety of countries and is a major export market for Sri Lanka’s only MDF producer, Merbok. Turning to Iran, and adding to the previously-reported installed capacity listing with various mills producing to serve an expanding domestic and regional export oriented business, our main listing shows Iran’s national capacity up to an impressive 1,034,000m3/year, but this may be underestimating the national MDF capacity; this will remain under review.

Apparently, the Ministry of Industries, Mining & Trade in Iran has recently banned the export of timber, particleboard and MDF in a letter to the Customs Administration. The measure is said to be aimed at regulating the domestic market, as producers and businesses in the field have recently complained of scarcity and high prices of raw materials.

Also in Iran, and as per a recent memorandum of understanding signed by the director-general of Turkish company AGT, Sirzat Subasi, and that of Qazvin Industrial Parks Company, Hamidreza Khanpour, the Turkish side will invest €70m in building a factory producing engineered wood including MDF, MF-MDF, panels, profiles, parquets and different types of floorings in the Iranian province’s Caspian Industrial Zone.

“This is the second-largest foreign investment made in Qazvin, Iran in 2017/18 and that’s why it’s really important to us. Moreover, it is the first investment made by AGT in a foreign country, making it [also] significant for them,” an official spokesman said.

The official noted that the investment will be accompanied by technology transfer.

“The Turkish company has a 60% share in the Iranian market for these products [engineered wood]. Therefore, in order to keep their market in Iran and reduce their costs, they have decided to construct a factory in the country. Qazvin was chosen due to its strategic location and its proximity to the capital, Tehran. Moreover, the availability of required infrastructure was considered in selecting the factory’s location.”

Apparently, there are over 1,000 firms active in the cellulose industries and some 25 companies producing MDF and particleboard in Iran, but unfortunately WBPI does not have all production company details available currently. Any new information would be gratefully received.

In this geographical region (and as previously reported), we can still only advise that the new MDF mill project for Green Fibre, which we understood and reported as being developed as a project in ‘West Asia’, with the line being supplied in the future by Dieffenbacher, is actually for a destination as yet unspecified publicly as well. The specific details as to where and when it will be installed have not yet been openly declared.

So, at the time of going to press, we are just noting the additional volumes for the future in this part of the world and will keep this project under review – Green Fibre, West Asia, with a capacity of 165,000m3/ year.

Fresh Global Dynamics

So, as previously stated in this two-part global MDF review, western Europe and North America are currently seeing fresh dynamics, with the growth in Europe coming from Lithuania and the eastern region, driven mainly by Turkish and Russian investments.

In North America the rice straw MDF plant is nearing completion, while the strong capacity growth still comes from Mexico. For the rest of the world, we must still carefully watch the developments in Algeria, Brazil, China, Egypt, India, Iran, Thailand and Vietnam.

In summary, our final aggregate total for global MDF capacity at the end of 2017 was 102,734,000 m3 and it reached 105,598,000m3 by the end of 2018.

From 2019 and out into 2019/20 and beyond, we could reach 112,796,000m3, based on our current information …...the global production capacity growth continues, for this most amazing wood based panel product!

How the listing was compiled

The WBPI listings published in 2019 were reviewed and modifications made, using other published sources and data received directly from the mills and industry experts.

Published information was reviewed for news of capacity changes. These sources include relevant trade magazines, association reports, press releases and equipment suppliers’ reference lists.

Self-completion enquiry forms were distributed to mills internationally, requesting current and future capacity data.

The form was also posted on a special WBPI website, which is now in the process of being modified for future use.

The mills own reported capacities are used wherever possible because this is the basis upon which they can make their estimates of future capacity and production changes.

Where this information is not available, published sources are used, usually on a basis of 330 operating days per year.

Conversion of 1,000ft2/year to m3/year is made with 1,000ft2 equal to 1.77m3.