US housing market still slumping

23 May 2012While the immediate situation in the housing market in the US is still not good, there are positive signs of recovery, according to a study carried out by Al Schuler for Virginia Tech University. North America correspondent Steve Ehle interviewed industry expert Mr Schuler to bring this assessment of the future

You can slice and dice all the statistics relative to the housing construction market - both commercial and residential - any way you want, but there's no denying the North American situation is not out of the dark, according to some recently compiled statistics.

A study recently released by Virginia Tech in Blacksburg, Virginia, paints a picture of how the building industry is more a spider web of statistics than a linear, predictable picture of the industry.

Non-financial corporate debt as a percentage of GDP on a worldwide scale is interlinked and is thus an indication of how the market is affecting all sectors, including government, household and financial areas, according to The Economist magazine.

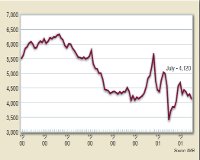

The United States ranks midway down the ladder - in a positive sense - of struggling economies on a global scale, with Canada doing better, according to the study. But it's not just new housing that has suffered since 2008. The single family resale market is "still very weak and many sales are "distressed" according to the study, compiled by Al Schuler, a long-time industry observer.

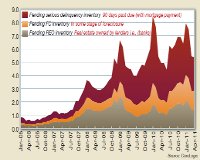

"New home sales continue to languish," says Mr Schuler. "[We] can't compete with distressed resale prices. This trend will continue until foreclosures are brought under control, [however] that won't happen until the job market improves, including good jobs."

Mr Schuler adds: "The foreclosure mess will continue to be a problem for several more years, at least....home price versus rent prices are back in sync but distressed sales are the driver - distressed sales are still the problem."

These distressed, or forced, sales - which represent 30 to 40% of transactions - "will remain significant for the next two years," Mr Schuler predicts.

However, there are signs of recovery that are related to the housing market.

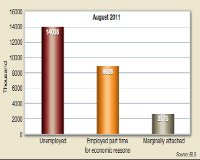

"The unemployment situation in the US has improved some," Mr Schuler says. "But, still, our biggest problem is we're still not creating enough jobs to bring down the unemployment rate. One problem is that business, although flush with cash, is confused over the future direction of the economy - so they're not investing. What's missing? I'd say leadership, but I still think the future of housing looks good," Mr Schuler says.

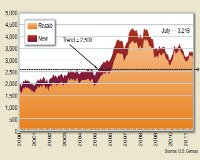

"Immigration, plus household formation are the keys," he continues. "In fact, if we add household formation, plus replacement demand, plus second homes ... we'll need about 1.7 million new homes per year. This year we'll build less than 600,000 [units]. So if you do the math, the future looks good for housing. But, there is one caveat - we need to fix the economy first."