Slowdown runs its course

17 November 2014Our expert industry economist, Bernard Fuller, turns his experienced eye on South America and assesses how the economies, the markets and the producing industry in the major countries of the region might fair in the coming months and years.

In last year's article on the prospects for the economies and wood based panel industries of Latin America, we discussed the impacts of slowing growth in global commodity markets and the resulting weakening in domestic economic activity that was likely to follow.

It was (and is) hoped that commodity dependent countries would be successful in re-balancing their economies to de-emphasise commodity exports and to develop domestic consumption of goods and services.

This analysis is still valid for understanding current and future developments over the next several years and readers are encouraged to re-read the introductory section of last year's article; much of the commentary remains valid and does not need to be repeated here.

Structural reforms in government, society and the economy will definitely be required if the region is to avoid the full negative impacts of the long-term cyclical decline in commodity markets that seems to be gaining momentum.

China's growth continues to shift away from the increased consumption of industrial commodities to greater consumption of consumer goods and services. While other Asian countries are likely to industrialise rapidly over the coming decade, none of these economies will come close to matching China in terms of size and impact on global commodity markets. Consequently, while Latin America will continue to be a producer of commodities, it cannot rely on this sector alone to generate strong and consistent year-on-year economic growth. A vibrant domestic economy, just as in China, will be required to sustain rapid overall economic growth; and such strength will require an educated workforce and more open and equitable societies.

Meanwhile, the global recovery from the devastation of the financial crisis of 2008 continues to be slow and problematic, although the overall story remains positive. However, global political uncertainties and horrors (ISIS, the Ukraine, Gaza, Iraq & Syria), plus growing nationalism (reverberating echoes of pre-First World War political systems on the 100th anniversary of the beginning of that war), all constitute further threats to the strength and sustainability of the global economic recovery over the coming two years.

Economies: Forecasts

Economic forecasts have proved to be generally on the optimistic side over the past few years. Economic recovery from the Great Recession has been hesitant as inappropriate austerity policies in North America and Europe have dampened growth in the developed world; and as China is no longer as dynamic an economic force as it was through much of the first decade of the century.

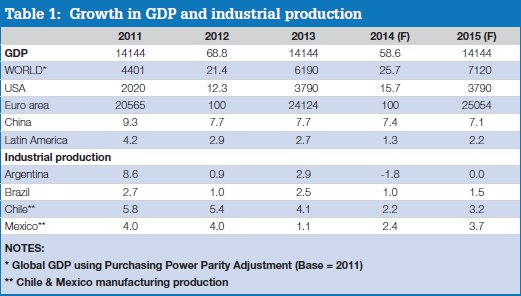

Global growth decelerated from 4.2% in 2011 to 3.5% in 2012 and to 3.2% in 2013. Growth rates will do well to maintain the 2013 pace in 2014 and could well be slightly lower if outcomes in the second half of 2014 are poorer than now anticipated (eg if the Euro area slips back into recession). The consensus calls for accelerating global growth in 2015 (to 3.7%) as: (1) the US recovery gathers momentum (3.3% growth - the fastest in more than a decade); (2) the Euro area grows 1% or faster for the first time since 2011; and (3) China maintains a better than 7% growth rate. Global geo-political uncertainties as religious fundamentalists and neo-czarist nationalists try to throw the world into another Dark Ages, all threaten this forecast outcome. Readers should not be surprised if global GDP growth is slower than forecast in 2014-15 (Table 1).

Latin America as a whole has tracked the slide in global economic activity in recent years. Following on from 4.2% expansion in 2011, Latin America's growth slumped to 2.9% in 2012 and 2.7% in 2013, largely in response to weakness in Argentina and Brazil. Further weakening is anticipated in 2014, to just 1.3% for the region as a whole (as Chile joins the ranks of slumping economies) before growth rates improve in 2015, albeit to a modest 2.2% (well below the more than 3% average in 2011-13).

Argentina has fallen into recession as it wrestles with New York-based vulture funds - and the US courts that support them in their endeavours to 'get blood out of stone' (otherwise known as full payment of principle and interest on Argentine bonds held by the New York vultures).

Raging inflation and a sclerotic political system, in addition to a lack of access to international credit markets, mean that Argentina will struggle to recover from recession in 2015. Our assumption is that Argentine GDP will do well to flat-line in 2015, following on from a 1.8% contraction in 2014, and will struggle to break into positive territory in 2016. However, industrial output should gain a little in 2015, following three years of decline, as some boost to exports is realised by a depreciated currency.

This outlook is therefore quite negative for domestic producers of wood based panels in Argentina - primarily particleboard and MDF. Increased attempts to export wood panels from Argentina are expected, given the domestic market weakness and the ongoing devaluation of Argentina's currency.

Brazil continues to disappoint. After recovering to 2.5% in 2013, following just 1% GDP growth in 2012, the Brazilian economy slid into a technical recession in the first half of 2014. For the year as a whole, growth of 1% has been forecast, but this number will obviously be lower if there is no rebound in the second half of the year. Hopefully, once this year's elections are out of the way, the country's leaders can focus more on economic management, as well as political and policy reforms, so that Brazil can meet the 2015 forecast of a still-meagre growth rate of 1.5% and faster growth thereafter.

Chile's slowdown became fully evident in the second half of 2013. This weakening worsened in the first half of 2014 as the prospects for the all-important copper industry slid in parallel with the economic slowdown in China and increased global copper mining capacity.

Increased uncertainty in the business environment as changes in tax policies are slowly legislated have reduced investment spending and made consumers think twice before opening their wallets. Chile's growth in 2014 is forecast to be just 2.2% - a little more than half the 2013 pace - and more than three points below the 2011-12 average of 5.6% per year.

The slowdown is expected to have run its course by early 2015 and the re-acceleration of growth is forecast to result in a 3.2% increase in Chile's GDP for the whole of 2015.

Mexico seems to have recovered from a weak 2013, when GDP growth dropped to just 1.1% after two successive years of 4% expansion in 2011-12. For 2014, we look for GDP growth of 2.4%, accelerating further to 3.7% in 2015, largely on the back of a stronger US economy and improvement in domestic spending. Growing industrial output will be a major contributor to this outcome.

However, the signals from Mexico are mixed. Growth rates slower than those anticipated here, particularly for the rest of 2014 and early 2015, would not come as a complete surprise. Nevertheless, the prospects for growth among the four Latin American countries tracked here remain strongest for Mexico in the near-term.

Production and markets: Brazil

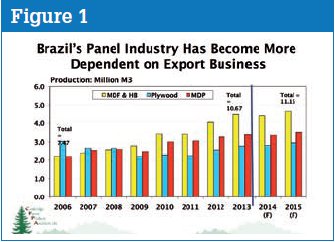

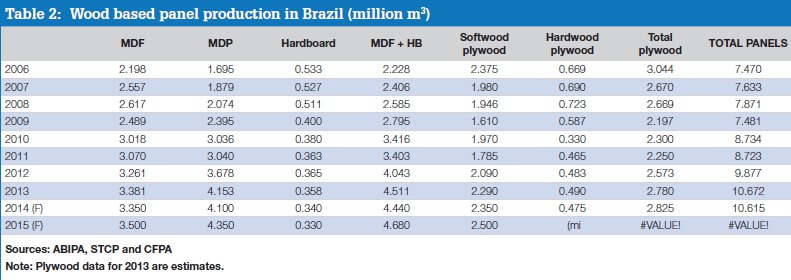

Preliminary estimates for 2013 show Brazil's production of wood panels (excluding OSB) jumped to 10.67 million m3, 8% above 2012 (Table 2 and Figure 1). Increased MDF output led the way (+13% to 4.15 million m3), but our estimates for plywood suggest that this panel enjoyed a healthy 8% production increase, to 2.78 million m3. Increased exports to North America and to Europe supported this gain.

In contrast, MDP (medium density particleboard) production rose less than 4%, to 3.38 million m3, and hardboard output slipped by 2%, to 0.358 million m3.

Weak domestic economic growth in 2014 is likely to offset any boost from exports. Consequently, the forecast for 2014 shows a small drop in total panel production, led by MDP and MDF. Meanwhile, a small increase in plywood production is anticipated in response to growing European and North American demand. At 10.62 million m3, Brazilian panel production in 2014 would be 0.5% below 2013.

An even greater contraction would not be a surprise if the domestic economy sinks into recession.

Given the capacity expansion in MDP and MDF/HDF over the past several years, any faltering in the growth in production means that average operating rates will tumble to even lower levels, putting increased downside pressure on mill pricing.

For Brazil's panel producers, the forecast 5% increase in total panel production in 2015, to 11.15 million m3, will be a welcome reversal of recent trends. Nevertheless, the pressures for shake-out, consolidation and mill closures among panel producers will accelerate through 2015 as panel profit margins remain squeezed.

Production and markets: Chile

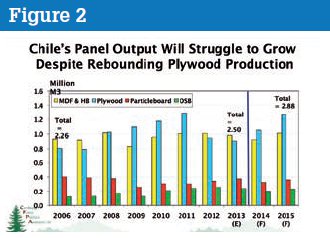

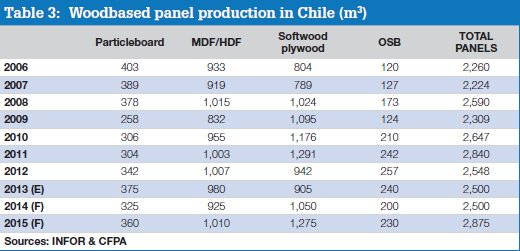

Chile's production of panels has yet to recover to its previous peak of 2.84 million m3 recorded in 2011.

The plunge in plywood production, following the complete destruction by a wildfire of the Arauco mill in Nueva Aldea, has yet to be reversed, in spite of the opening of the rebuilt Arauco mill and CMPC's expansion of its plywood capacity.

Cambridge Forest Products Associates (CFPA) estimates that 2013 panel production in Chile was just 2.50 million m3 (12% below the 2011 high), with only particleboard production up year-on-year, by an estimated 10%, to 0.375 million m3.

In contrast, MDF/HDF production of 0.980 million m3 was down an estimated 3% and plywood output of 0.905 million m3 was off 4% from 2012 - and 30% below the 2011 peak of 1.29 million m3.

Meanwhile, OSB production slipped an estimated 7% in 2013, to 0.240 million m3 (Table 3 and Figure 2).

The large devaluation of the Chilean peso over the past year should boost exports, but as of mid-2014, it is hard to detect any such surge.

A major port strike early in the year disrupted trade flows, while the benefits of the currency shift may only become apparent in the second half of 2014 and in 2015.

For 2014, the forecast shows total panel production at 2.50 million m3, unchanged from 2013. Drops in MDF/HDF, OSB and MDP output are expected to be offset by higher plywood production (because of improved exports).

For 2015, the outlook for a stronger domestic economy, plus higher levels of economic activity in key North American and European end-use markets, should boost total production by 15% to a record 2.875 million m3.

In this scenario, plywood production of 1.28 million m3 will come close to matching its 2011 high and all other panel types will record healthy increases in output. Weaker than expected economic growth in 2015 in Chile and in the 'near abroad' would hamper this recovery in Chilean panel output.

Production and markets: Mexico

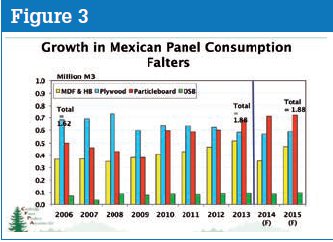

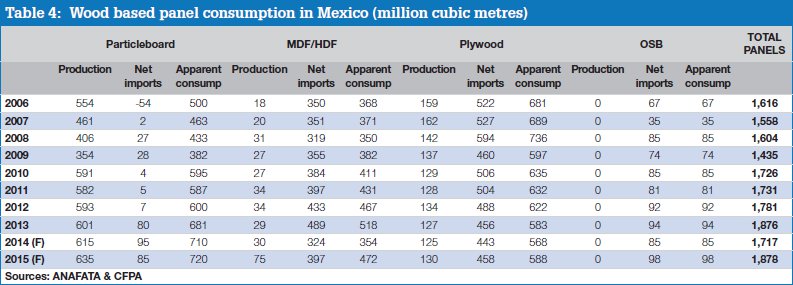

Mexico's consumption of wood panels set a new modern record in 2013, at 1.88 million m3. Particleboard accounted for 36% of the total (0.681 million m3); plywood for 31% (0.583 million m3); MDF/HDF for 28% (0.518 million m3); and OSB for 5% (0.094 million m3).

While plywood volumes (and shares) have trended lower since the turn of the century, significant growth has been recorded in MDF/ HDF, particleboard and OSB (see Table 4 and Figure 3).

Unlike Brazil and Chile, much of the Mexican consumption of panels is supplied by imports. Net panel imports in 2013, of 1.12 million m3, represented 60% of the total supply of panels consumed in Mexico. Imports are particularly important in supplying the MDF/ HDF and plywood markets. In addition, all the OSB consumed in Mexico is imported.

While the economic prospects for Mexico are expected to strengthen in 2014, this strengthening has not been reflected in the panel import data through the first half of the year. In particular, the reported data show substantially lower imports of MDF/HDF. These data seem suspect and are subject to revision. However, we have used the reported data to help set the consumption forecast shown in Table 4. Consequently, for the year as a whole, total panel consumption is forecast to slip 8%, to 1.72 million m3, before recovering in 2015 to match the 2013 peak. Potentially, the drop in 2014 will be less than shown here and the recovery in 2015 would then be to a higher level.

The issue of the size of Mexico's MDF/ HDF market is of particular concern for the companies building three new MDF mills in 2015-16.

Between them, Masisa, Duraplay and Proteak will add approximately 680,000m3 of capacity to Mexico's fibreboard capacity base of 50,000m3. The forecast presented here shows a small jump in Mexican MDF/HDF production in 2015 on the assumption that at least one of the three new operations will have started up before the year-end. However, the biggest production increases will occur in 2016-17 as the three mills ramp-up. Significant displacement of domestic imports is to be expected.

Potentially Mexico will also become a net exporter of MDF/HDF, particularly to the US, where Mexican products could displace imports from other sources.

Given excess MDF/HDF capacity elsewhere in Latin America, the growth in Mexican output is likely to disrupt attempts by Brazilian, Chilean, Venezuelan and Argentine producers to ship increased volumes of MDF/HDF to Mexico in order to more fully utilise the excess capacity located in those countries.

However, perhaps the single most interesting unanswered question is whether the availability of a significant supply of MDF/HDF will help boost domestic flat panel furniture output in Mexico, thus providing additional support to the 'on-shoring' of furniture production into North America from Asia.