Growing experience

17 November 2014Proteak group, a fresh name in Mexican wood panel manufacturing, is promising to break the established sector's mould, opening up a new plantation-fed mill in the south of Mexico, reports Richard Higgs.

Proteak is a young national forestry specialist with little industrial experience, but with expertise in growing teak hardwood. It has a track record of inspiring investor confidence and plans a bold project to launch MDF production in southeast Mexico next year.

The Mexican group is investing US$180m in an integrated scheme to build a 280,000m3 per year continuous-press MDF plant at Huimanguillo, in the sub-tropical state of Tabasco, based on local, fast-growing, eucalyptus.

With all the country's panel plants now congregated in north and central Mexico and reliant on communal natural pine forests for their wood, the Proteak plant will draw its fibre from its own certified eucalyptus plantations.

Proteak is part of a broader revolution in the Mexican board industry, as one of three manufacturers each planning a project to make MDF panels in the country for the first time. The other firms are leading particleboard producer Masisa México, of Durango, and plywood/particleboard manufacturer Duraplay de Parral, in northern Chihuahua state.

Proteak group's offshoot enterprise, Pro MDF, the only one of the three firms with a project in the south, is aiming high as a sector newcomer. If its ambitious plan, in partnership with panel line supplier Dieffenbacher, runs to schedule, it intends to launch its line ahead of the others.

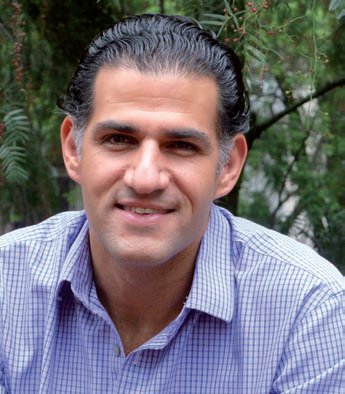

Not only that, but with its first venture in the board sector, Proteak also aims to become the lowest-cost manufacturer in Mexico and, perhaps, one of the lowest in the world, according to Proteak's ebullient chief executive, Gaston Mauvezin.

The Mexican group believes it has a series of built-in advantages working for it, not least its ownership and control of the wood source, its use of low-priced natural gas and cogeneration energy, and important savings in the cost of resin.

"This is the only fully sustainable project in the MDF business being developed in Mexico. It's quite unique. Certainly, it is the largest forestry/industrial project in the country in the last 10 years," declared Proteak's CEO.

The Mexico City-based group, which has 8,000ha of productive teak plantations in Mexico, last year invested more than US$30m to acquire 8,500ha of mature FSC-certified plantation eucalyptus in the south. It bought this from the industrial group Grupo Kuo, former owner of the panel maker Rexcel, which it sold to Masisa.

Over the past decade, Proteak has established southern Mexico as one of the world's most productive teak growing regions. It also grows the hardwood in Colombia and Central America and now sells it - and teak solid wood products - in North America, Asia and in Europe.

Proteak, which claims to be the largest private plantation forest owner in Mexico, aims to increase the productivity of its eucalyptus plantations by at least 30-40% in the next four to five years.

It is already looking beyond its latest project and is considering further developments in the panel field, including plans for a second board line in Mexico.

As a complete newcomer to wood panel manufacturing, Proteak's management team carried out exhaustive research, with help from top consulting firms, to establish the most efficient board mill possible.

The company hired global consulting and engineering company Pöyry to validate its theory that MDF manufacture would become a big business in Mexico. Perhaps coincidentally, the government of Mexico's Tabasco state also chose Pöyry to advise it on how best to boost the local economy in view of its rich natural resources. Pöyry concluded that an MDF plant was one viable option.

The two clients came together to realise southern Mexico's first MDF project and have worked closely over land, the industrial site and infrastructure.

Proteak, with help from the Boston Consulting Group, also carried out an in depth study of the Mexican wood panels market, 'city by city'; its products and suppliers, market trends, development and its main 'drivers'.

Once it committed to diversifying into wood panels, the forestry group won the full financial backing of institutional investors - Mexican pension funds - based on the success of its previous teak project.

It raised almost US$80m in equity last year towards its latest scheme.

Later, Proteak negotiated a syndicated bank loan of some US$93m through the German banks AKA and Commerzbank, guaranteed by the German government.

This credit contract financed purchase of machinery for the new mill.

Settling on a suitable industrial site was a crucial part of Proteak's planning. It would have to be located within easy reach of the group's existing eucalyptus plantations, with good access to major highways, close to electric power lines and to a ready source of natural gas.

Proteak selected Huimanguillo, less than 70km from the state capital of Villahermosa, for the greenfield scheme, allowing plantation wood to be trucked in from up to 50km.

Proteak directors were only too well aware that they were still novices in the wood panel business, so it was vital they chose the right main supplier for the plant.

"We felt it was not so much about the equipment itself....this is more about getting the service and getting a supplier we can trust. We found Dieffenbacher was interested in a partnership, not just a sale," Mr Mauvezin recalled, when WBPI visited Proteak earlier this year.

In November last year, the group closed a 'turnkey' project deal with Dieffenbacher of Eppingen, Germany, for its first MDF plant. Apart from supplying machinery, the German firm agreed to erect and launch the line and, in addition, to operate it alongside Pro MDF for up to a further 18 months until the line achieves agreed production and quality levels.

Then, this August, Proteak suddenly announced agreement with Dieffenbacher to extend the press to 30m, raising capacity by 40% from 200,000m3 to 280,000m3 per year. The firm took the decision to capitalise on its "competitive advantages" and brighter market prospects. It saved money by dropping some "unnecessary equipment for the first stage," it revealed.

If the revised contract goes to plan, the firm insists it will become Mexico's first MDF manufacturer, because the Proteak/ Dieffenbacher board line is scheduled to turn out its first board before the end of 2015.

In May 2014, site preparation was underway with land levelling, along with drainage; vital in this subtropical region, which is prone to heavy rains and flooding. In July, Proteak reported that it had raised the mill platform by a further metre.

Construction of the plant, including essential grid and electrical connections, was scheduled to be completed by this December, while Dieffenbacher was set to deliver equipment in the final quarter of 2014.

Proteak expects erection of the line and other equipment to be finished by June 2015 and trial production, and the optimisation process, to be completed by the final quarter of 2015, its CEO told WBPI.

Apart from offering ideal growing conditions for forest plantation, Tabasco state has a well-developed infrastructure, thanks to the dominance of the oil and gas industry; and the state's location on the Gulf of Mexico. In its quest to become the lowest-possible cost producer, Proteak decided to go down the cogeneration energy route. It finally settled on using natural gas, since Tabasco can offer low-priced gas in abundance.

Its Pro MDF plant has a highly efficient Dieffenbacher energy system, based on natural gas and thermal energy, with the capture of waste gases from a 9MW turbine. Biomass waste will also be burned to create thermal energy.

This panel producer will also go one step further, by generating more electricity through a second turbine, allowing the plant to sell excess electricity back to the grid.

"Income that we'll receive for this [electricity] will be equal to the cost of the energy production, so in the end we'll have zero [net] cost for energy," explained the project chief and vice-president for MDF, Omar Nacif.

In the case of another raw material cost, resin, Pro MDF plans to buy in urea formaldehyde and mix the resin at the plant.

Its Dieffenbacher line will incorporate the supplier's proven EVOjet M dry resin blending system, with a 25 tonne per hour fibre throughput, which will play a major part in reducing the unit's glue costs.

The new mill includes log chipping, wood preparation, an Andritz refiner and the Dieffenbacher energy plant, with Siemens supplied turbines.

The Huimanguillo plant will produce raw MDF and finished panels from the start, says Proteak. Under the production line supply contract, Pro MDF will also take delivery of a short-cycle press line. "How much [MDF] we finish with melamine depends on how the market will be by then," said the panel division vice-president.

Although demand for finished MDF is still small in Mexico - less than 20% - Proteak plans to offer a full range of value-added panel products. The firm expects that volume demand for melamine-faced MDF will grow once production starts in Mexico.

It is already leaving space for veneer facing - and maybe panel painting - lines at the plant, possibly making use of its own teak for veneers.

Its initial aim is to be first with domestic production; and quick to substitute its panels for a significant slice of imported MDF. The firm is confident that, as in other countries like Brazil, MDF demand will accelerate once local production begins.

"Our target is to sell all our production into the Mexican market. By 2016/17 we think [MDF] consumption is going to reach around 750,000 to 800,000m3 per year," said Mr Nacif.

He believes the firm can use the increased capacity to supply up to 30% of domestic demand through import substitution.

The plant location, in what is Mexico's third richest state, promises to deliver a further bonus to the new MDF producer, since it lies close to largely-unexploited regional markets.

"The southern part of the country hasn't developed because of a lack of [panel] supply. So with our plant in the south it should start to grow there," predicted Mr Nacif. Proteak points to potential markets around Merida and Cancun.

The Proteak team cannot be said to lack determination, but directors still accept that, with three national MDF lines coming on stream together, competition will be fierce and that it may need to channel excess output to export.

With the US market picking up and limited domestic production capacity there after plant closures, Proteak says it can ship its MDF through nearby Gulf of Mexico ports into the southeastern United States. The company reckons that its FSC-certified wood source, and plans to meet CARB II resin emission regulations, mean its board will be well-received in the US market.

Proteak is fully aware it is up against stiff national competition from seasoned panel manufacturers Masisa and Duraplay. Even so, the group is confident it can win its fair share of a growing domestic market.

As for its wood base, Proteak continues to plant eucalyptus, with 182ha added in the second quarter of 2014, despite storms in Tabasco; it plans to add 2,000ha in the full year.

Looking ahead, the firm aims to increase its eucalyptus plantations to at least 15,000ha, through planting and improved growth, over the next four to five years, said Gaston Mauvezin.

"With a combination of better yields and what we are going to plant, we should have enough [wood] capacity to feed at least two [panel] lines. We don't know what the second line will be yet," commented Proteak director and former CEO, Luis Tejado.

He was responsible for initiating the MDF project and his role at Proteak remains one of forward planning.

Ideas come thick and fast at the company, which wants to attract new furniture manufacturing capacity into Mexico.

Proteak is considering seeking an industrial partner and could even dedicate a second panel line to a big customer like IKEA, which has an aggressive growth plan for North America.

One thing is for sure: the bold debut in panel making of this young Mexican group will stir up a hitherto low-key industry and present a real challenge to its more experienced MDF rivals.

Huimanguillo site preparation – Proteak raised the MDF mill platform by a metre in this sub-tropical region, prone to storms and floods

Huimanguillo site preparation – Proteak raised the MDF mill platform by a metre in this sub-tropical region, prone to storms and floods

Part of Proteak's own 8,500ha plantation in Mexico's Tabasco state for use in its new MDF mill at Huimanguillo

Part of Proteak's own 8,500ha plantation in Mexico's Tabasco state for use in its new MDF mill at Huimanguillo