Consolidate and optimise

17 July 2014In this, the first part of our annual survey of the MDF producing industry worldwide, we look at the mills and their capacities in Europe and North America in 2013; and at the prospects for the industry in 2014 and beyond

The last few annual surveys of the MDF industry in Europe and North America have not presented a particularly optimistic view overall.

In our last survey, we reflected that there certainly has been investment activity in Turkey and eastern Europe, with several new projects being listed in both areas.

At the time of writing, we are able to confirm that the three substantial new MDF lines in Turkey: AGT Antalya; Beypan Kayseri; and Divapan Düzce, highlighted last year, are still scheduled for start-up during 2014 or early 2015.

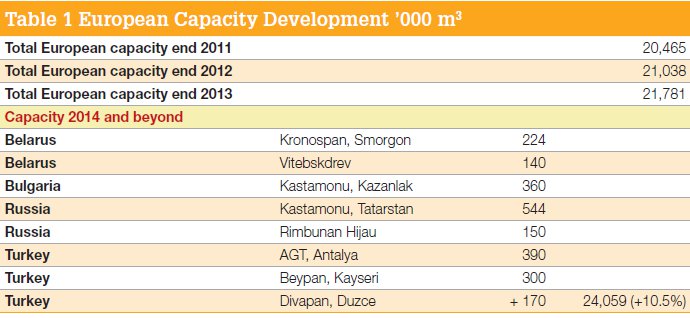

Also, a new country is entering the world of European MDF manufacturing, with Bulgaria announcing investment by Kastamonu with its new mill at Kazanlak. Kastamonu says start-up in Bulgaria is scheduled for end-2015, with the main press being a Siempelkamp ContiRoll of 2.8 x 55m, with a design capacity of 360,000m3/year. All these mills are listed in Table 1.

Over and above these developments, the news from 2013 in Europe is mainly of mergers, acquisitions, takeovers and the optimisation of existing plants, rather than new capacity.

In North America, as was suggested might be the case in last year's report, MDF production and sales had a great recovery in 2013 and the industry had a much-improved year, with many plants operating at capacity, driven particularly in the US by the strong dynamic of the domestic housing market, which is starting to move positively after five years or so of stagnation. Prices are reported to have increased by 10- 20%, depending on the product and region, and certainly the overall trend is upward.

Canada did not join in the excesses of the US banking industry and as a consequence was not so badly affected by the downturn. Here, MDF business has remained consistent, with a gentlyimproving market in the last year, and Flakeboard (Arauco group) the dominant player. In Mexico, we are seeing some interesting positive capacity developments and these are reported on in more detail later in this article.

Last year we suggested that a gradual recovery across Europe might be on the horizon and the 'flickers of light' hoped for country-bycountry in western Europe has been seen in some cases, but not across all markets.

This year's survey once again provides listings of capacity in the two regions at the end of 2013. Furthermore, drawing upon a range of sources including the industry itself, we show the changes expected to capacity installed during 2014, 2015 and beyond.

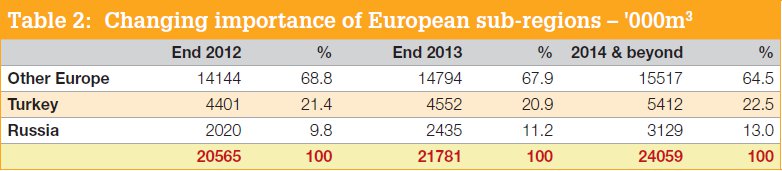

Total all-European installed capacity reached approximately 21,781,000m3 in 2013, compared with 21,038,400m3 in 2012.

Some MDF mills continue short-time working, with specific extended closure arrangements which influence effective capacity. Others are working hard at optimising the capacity installed and looking for continual production refinements in order to maximise the opportunities that exist within the existing facilities. Optimisation has become a really key word within the industry.

This survey continues to be published in two parts; the second will deal with the 'Rest of the World outside Europe and North America' and will be published in the August-September issue. The author, and the editor of WBPI,

remain grateful to all those organisations and manufacturers who took the time to complete our online enquiry form and to all those other industry professionals, such as panel equipment suppliers, trade associations and trade journals who made valued contributions to the narrative.

We are happy to receive all new information regarding capacity changes at any time during the year when it is most convenient.

As a reminder to those considering their input for part two of our survey, or the upcoming particleboard survey, you can make your submission at www.intermark.plus.net.

European capacity changes As reported last year, western and central Europe had no projects for new capacity under way and the investment announcement by Kastamonu in Bulgaria, mentioned earlier, is the first new mill story for some time.

The IKEA-owned Swedspan company took over the Pfleiderer Novgorod mill in Russia in the first quarter of 2013. The mill has a design capacity of 500,000m3/year of MDF/HDF so is one of the largest in the world. With that name change, we have moved this mill from Table 1 to the main listing (of mills active in 2013).

The other development involving Pfleiderer was by Divapan, the Turkish MDF manufacturer, which bought the forming and pressing line at the closed Pfleiderer plant in Nidda, Germany, to assemble alongside its existing line and this is now up and running, as far as we understand. As a recap on this group, after the insolvency procedures in March 2012 at Pfleiderer, the company sold off a lot of companies in other parts of the world. The business that was left was then split into two divisions: western Europe and eastern Europe.

In the western Europe division there are five panel production locations in Germany, four of which are particleboard: Neumarkt, Arnsberg, Gütersloh, Leutkirch and Baruth (MDF), all belonging to Pfleiderer Holzwerkstoffe GmbH. In the eastern Europe division, there are three manufacturing sites in Poland. Nowadays the group still employs about 3,500 people in total. Pfleiderer is owned by Atlantik in Luxembourg. In Spain, the Interpanel MDF mill - formerly owned by Tablicia and located in Villabrazaro, which went into liquidation in December 2012 - was bought by Kronospan in December 2013, so is therefore listed under its new ownership, but the mill is not yet in operation as we understand at the time of writing.

Also strengthening the Kronospan group's position in the Iberian Peninsula, a further acquisition and consolidation move was made in September 2013, with the purchase of the 250,000m3/year Unopan MDF mill in Burgos Spain. Again we have shown this new ownership in our listings.

With regard to Belgium and changing ownerships in the sector in 2013, respected industry newsletter Euwid, and other industry experts, provided commentary: "The Belgian group Spano has now reached several agreements in the sales process running since the fourth quarter of 2012. The Unilin group, which belongs to Mohawk Industries, will take over all shares in Spano Group. The Spano particleboard mill in Oostrozebeke, the Dekaply laminating mill in Erembodegem and the lacquering plant in Merchtem will be integrated into Unilin group.

"At the same time, the Spano group will sell its 50% stake in the joint venture Trinterio, which includes the MDF/HDF producer Spanolux and the laminate flooring producer Balterio, to its joint venture partner Balta Group. Balta will in turn sell Trinterio as a whole to the IVC Group".

So at the end of this process, the Spanolux MDF mill at Vielsalm, Belgium, which has a capacity of 250,000m3/year now, stands alone under the ownership of the IVC group. Jan Ede, well known over many years for his association with the Spano group, has left to take up another industry-related position.

Italy, as one of the pioneering countries in the development of MDF in western Europe, continues to be caught up in the challenges caused by the ongoing decline in furniture production locally (down approximately 40% since 1999). This, coupled with the construction sector's reduction in activity as a consequence of the economic crisis, has had the result of a fall in MDF production in the last years, with only a small increase actually seen in 2013.

One interesting evolution to note in Italy is at Nuova Rivart in Radicofani, a company in the Mauro Saviola Group. The organisation enabled it to produce, beside MDF panels, tannin, a substance widely used in tanneries and pharmaceutical companies. Publicly stated, the group's philosophy is to try to take complete advantage of the raw materials it works with. Since Nuova Rivart works a lot with Chestnut as its raw material, which is rich in tannin, we understand that the business is focusing heavily, as a diversification, in the production of tannin and is unique in being a producer of both MDF panels and tannin from a single raw material. In Turkey, the progressive dynamics seem to continue strongly. With large markets available both domestically and into the Middle East and former Soviet states, that growth continues.

MDF Moulding manufacturer AGT ordered a Siempelkamp ContiRoll Generation 8 press line of 55.3m x 8 feet for its site in Antalya. This makes it the seventh ContiRoll press of that length that Siempelkamp has sold to Turkey.

The line has a design capacity of 1,030m3/day (ca 340,000m3/year) on a 16mm basis, with startup scheduled during 2014

Also in Turkey, Beypan's MDF investment in Kayseri is on track for an end-2014/early-2015 start-up, as is the expansion at Divapan Düzce. Furniture production trends from Poland, the Czech Republic and Romania are reported to be slightly up in 2013 - good news for MDF.

With Homanit ( Homann Holzwerkstoffe, Germany) having bought the Hardex, Krosno hardboard mill in Poland, industry rumours suggest the intention is that they will soon invest in a new thin MDF line, possibly by Siempelkamp, to service this growing sector.

In Austria, Binderholz has announced it is closing its 15-year-old plant, MDF Hallein, which has now stopped production but in the meantime, and at the time of writing, is giving its existing customers a chance to order additional material and was expected to continue shipping this up until probably the end of April/early May 2014.

Owner and managing Director Hans Binder said he "regretted the closure of MDF Hallein, which will result in 111 job losses", but said the business had no choice due to financial pressures and rising raw material costs, while its flooring and furniture sector customers migrated production to eastern Europe and the Far East. This mill thus remains in our listing of 2013.

According to our Russia correspondent Eugene Gerden, who has just updated last year's information, Russia, which has been for some time the centre of attention for panel investment and development in eastern Europe, has seen a number of mills not actually brought to fruition. Based on this information, three mills: Abinsk MDF, Abinsk 150,000m3/year; Plitspichprom, Kaluga 30,000m3/year; and Sharyaplit Kronostar, Sharija 200,000m3/year, which were all in last year's main listing, have now been removed. He had previously commented that, according to analysts writing in the Russian magazine Furniture Business, further market decline may lead to suspension of implementation of some projects that have been announced by producers in recent years and this appears to be the case.

With the political uncertainties currently affecting Ukraine, and the dynamics involving a number of former-Soviet states and Russia, we may see negative impacts on the MDF sector throughout this region in the months ahead. Currently the Rimbunan Hijau 150,000m3/year project has been delayed and the large project currently being implemented by the Turkish company Kastamonu Entegre, which involves the building of a plant for MDF production in the Alubuga free economic zone in Tatarstan, are both included in Table 1, for 2014 and beyond. In Belarus we have added Mostovdrev,

Gomeldrev and Borisovdrev to the main listing from Table 1 in last year's survey, as they were shown as starting up in 2013.

Also, as far as we are aware, the two mills planned by Kronospan and Vitebskdrev for startup in 2014/2015 are still on track and are now also shown in Table 1. So, for expanded capacity in 2014 and beyond in Europe as whole, we have the two new plants planned in Belarus (Kronospan and Vitebskdrev); the one in Bulgaria (Kastamonu); two in Russia, Kastamonu Tatarstan and Rimbunan Hijau; and three in Turkey - AGT, Beypan and Divapan. Taking our main table listing, showing a total of 21,781,000m3 capacity already installed, plus the new mills listed in Table 1, we now have a forecast figure of 24,059, 000m3 as a total capacity of the European continent in 2014 and beyond. This is an increase of 10.5% over 2013.

North America

Here the industry has had a much improved year, with many plants operating at or near capacity.

MDF production and sales had a great recovery in the US and Canada last year, but not so for the past four or five months, and this has caused the sector to rethink the timing, and the extent, of the anticipated ongoing recovery. So far, 2014 has been characterised by tepid markets and the sector expects only modest growth in domestic shipments this year, with particleboard probably doing better than MDF. The slow start to the year is explained partly by the remarkably severe winter experienced by many parts of the US and Canada.

Weather conditions hurt housing starts, consumer purchases, hospitality sectors and manufacturing generally. It is also fair to say that the US economy is not improving at a pace that was hoped for this year. The start of 2013 was better and manufacturers can only hope that there is a surge of favourable economic activity in the second, third and fourth quarters of 2014.

Meanwhile, Georgia Pacific has acquired the wood composite, gypsum and kraft paper assets of Temple Inland. This move, it is suggested, was driven by GP's interest in growing its gypsum and paper business. It does not appear particularly interested in the composite panel business, so expect other moves, possibly to sell off the particleboard and MDF assets, probably later this year, according to information received.

Flakeboard, which was acquired by Arauco in 2012, is currently in the process of purchasing SierraPine. This is perhaps mainly as far as MDF is concerned and its interest in the Medford 'Medite' MDF plant, which has performed quite well through the downturn.

This Flakeboard acquisition of SierraPine is not yet concluded and has been delayed for months. This is due to a US Department of Justice review - the standard anti-trust review which occurs in such cases - mainly due to the concentration of MDF capacity in the western US/Canada region which will result from such a takeover (four suppliers reduced to three, with the new Flakeboard having a large historical market share). The approval of the sale could come soon - perhaps mid-year, but it's not there yet.

There are no other consolidation moves that we have heard about, but consolidation has certainly been a theme for the North American industry over the past two years.

Perhaps the only other significant event for MDF is the pending finalisation of the Federal EPA regulation on formaldehyde emissions from composite wood products/hardwood plywood.

Somewhat patterned after California's ATCM (Atmospheric Chemical Transport Model) regulation, there are additional provisions which could prove more onerous for the industry. It is also expected that the FedEPA regulation could be finalised this year and the California Air Resources Board (CARB) is proposing amendments to its regulation to be compatible with the proposed Federal regulation.

Uniboard's plant in Moncure, North Carolina, has been renamed Flakeboard in our main listing, following its takeover by Arauco of Chile, which already owned Flakeboard. The name of Temple Inland's Mount Jewett mill, bought by Georgia Pacific in December 2012, is also changed in the 2013 listing in this issue.

In Mexico, concluding our North American overview, we see three new projects reported publicly, with details included here from each of the individual company's press releases: Masisa's board of directors has approved, on July 4, 2013, the construction of an MDF plant, a melamine coating line and the expansion of the alreadyexisting resin plant at its industrial complex located in Durango, Mexico.

The new MDF project and the coating line will have a production capacity of 200,000m3 and 100,000m3/year, respectively.

These advanced-technology projects represent an investment of approximately US$132m, which will be funded through the Company's operational cash flow generation and the structured divestiture of some non-strategic forestry assets in southern Chile.

Masisa has been in Mexico for over 10 years with industrial and commercial operations, developing the MDF and particleboard market for furniture and expanding its customer base throughout the country. By investing in a local MDF manufacturing facility, the company will complete its production mix, reduce its costs and achieve increased logistic efficiency.

These new investments are in line with Masisa's growth plan and consolidate the company's leading position in a market that has attractive projections due to an increasing Mexican domestic demand and the possibility of serving other markets. The beginning of construction is subject to approvals to be obtained according to Mexican laws.

Duraplay de Parral, a leading manufacturer of panels in Mexico, announced its expansion into MDF production with an investment in a new plant with capacity of 200,000m3 per year.

The investment is planned to reach over US$80m.The company signed a contract with Dieffenbacher to act as leading contractor to supervise erection and start-up of the new plant: a contract arrangement which includes four other European machinery suppliers. The new plant will be installed within its manufacturing premises in Chihuahua, Mexico. Production is planned to start in mid-2015.

Duraplay says it has more than 50 years' experience in the panels market, currently producing particleboard, softwood and hardwood plywood and panels with decorative surfaces. With the new MDF plant, Duraplay plans to offer the widest panel range manufactured in Mexico. Emilio Ayub, ceo of Duraplay, pointed out: "...this investment indicates our confidence in the future growth of our industry and therefore we are quite glad to make this announcement to our customers, as we will now satisfy all their MDF needs with the same high-quality service they [have come to] expect from Duraplay... This investment is also great news for our local wood suppliers as this ensures them the long-term sustainable harvesting of their forest". Duraplay will fund the investment with a financial structure involving Mexican and international banks.

Thirdly, the Mexico City-based Proteak Uno, which specialises in plantation teak and solid wood products , has unveiled a plan to establish a 155,000m3/year MDF plant in Mexico's Tabasco state, utilising eucalyptus wood from plantations in the south of the country.

The company will call the MDF plant PROTeak and plans to build the Greenfield fibreboard plant at Huimanguillo, 67km from the state capital Villahermosa. The facility is understood to be scheduled for completion in the third quarter of 2015, with the complete line, including a continuous CPS press, being supplied by Dieffenbacher. Machinery was delivered to the site in October 2013.

PROTeak is in the process of buying Forestaciones Operativas de Mexico SA de CV, (FOMEX) the national eucalyptus plantation business of Mexican industrial conglomerate Grupo Kuo. The FOMEX deal will give PROTeak FSC-certified eucalyptus plantations in Tabasco and in the neighbouring states of Oaxacap and Veracruz.

PROTeak is said to be investing around US$140m in the Tabasco MDF project overall, including the acquisition of around 8,000ha of eucalyptus forest in the state.

Early this year, Grupo Kuo concluded another deal in which it sold off its Mexican particleboard and resin subsidiary Rexcel, including two board plants with 460,000m3/year capacity, to the Chilean panel group Masisa SA, for more than US$54m.

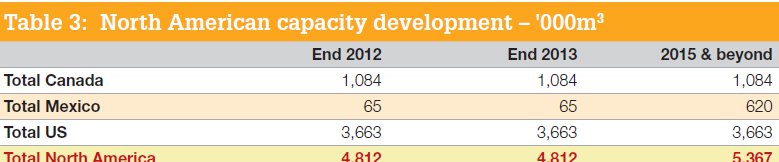

These three new additional mills (see Table 3) will bring Mexico's MDF production to over 600,000m3/year by 2015 - a significant change from the current 65,000m3, which has been stagnant for some time.

Total North American installed capacity remained at approximately 4,812,000m3 in 2013 - the same as in 2012 - but with the new Mexican capacity announcements, and the Mexican mills listed in Table 3 (capacity for 2014 and beyond), we now have a forecast figure of 5,367,000m3 as a total capacity for North America for 2014/15. Business Barometer

Although we have not published a table for the Business Barometer this year, due to a lack of response from enough manufacturers for a meaningful presentation, information from North America shows the pricing trends as upwards, rather than our having actual absolute statistical precision.

The North American business barometer last year suggested that prices may well rise by an average of 15% during 2013/14, compared with 10% in last year's barometer, and that costs are expected to rise by an average of 11.25% (8% last year).

The latest information we have suggests that prices in North America have actually increased by 10-20%, depending on the product and the region.

These industry price changes are a combination of increasing costs and also much stronger demand, allowing better-thananticipated price recovery across the MDF sector.

With reference to European MDF manufacturers, again regretfully, due to insufficient response to our questionnaires on this topic, it has not been possible to compile a meaningful business barometer for this huge and varied geographical region.

However, in general, industry experts suggest that we have seen that the really low-priced, low quality, lightweight, general purpose MDF products have gone up in price in the range of 3 to 7%.

Certainly it seems fair to report that the general trend in prices for MDF could be described as upward.

A problem certainly remains in that the total market demand for MDF across the whole European region (with particular reference to the over-capacity in the flooring sector) is still not strong enough in total to push through, and hold, an overall price increase yet, consistently, country by country.

So we suggest that, at this time, the situation in the MDF market across the European region broadly could still be reasonably described as 'fragile' on the overall pricing front, while the picture for North America remains rather uncertain