Capacity set to top 100 million cubic metres!

13 August 2015In this second part of our annual survey of the worldwide MDF industry, covering the countries outside Europe and North America, independent specialist consultant Geoff Rhodes summarises the position for this panel in the ‘rest of the world’ and looks at the current and future situation for the global industry as a whole.

MDF capacity continues to increase significantly, particularly in the South American and Asian regions.

Following on from MDF Part 1, our survey of the industry in Europe and North America (WBPI issue 3, 2015), we now focus on the existing MDF mills in the 'rest of the world' as at the end of 2014; and on those under construction in 2015 or planned for 2016 and beyond.

For the 'rest of the world', after a number of updates and corrections from across the globe, we can now see an increase in installed capacity in 2014 of 1,197,000m3, to 64,478,000m3, while further investments identified for 2015 bring the total to 66,115,000m3.

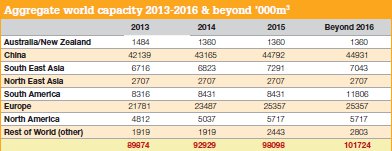

For 2016 and beyond, this figure grows substantially again, to 70,912,000m3, and when this is added to the European and North American figure (including Mexico) of 31,074,000m3 for the same period, we see global MDF capacity topping 100 million m3 for the first time, at 101,986,000m3 - really quite remarkable after reflecting on MDF's early evolution at the end of the 1960s!

This year's survey once again provides complete listings of capacity in the various regions as at the end of 2014, plus the growth expected during 2015, 2016 and beyond.

From the tables it can be seen that the increases in 2015 and beyond are accounted for by Brazil, China, Iran, Pakistan, Paraguay, South Africa and Vietnam and we also include a further two plants (ca 368,000m3 combined) for 'West Asia', that we understand have been contracted for, but which have not yet been publicly revealed by the investors, both in terms of final location and plant site.

China and North East Asia

Over the past five years, average annual growth has been relatively strong, with the exception of Japan, where GDP growth declined by 0.1% on average.

GDP growth averaged more than 9% in China, and almost 3% in South Korea. Projections are for continuing strong GDP growth across the three countries out to 2017, with considerably stronger growth (2%) in Japan and in South Korea (3.5%), offsetting still strong, but somewhat less buoyant, growth in China (7%).

Asia's MDF market under-performed in 2014 due to a slowdown in global demand and prices have weakened as a consequence, aided further by a cooling Chinese economy and depreciating domestic currencies across Asian countries against the US dollar.

China is still forecast to produce 90% of the furniture in North Asia by 2017 and the strong growth in the region will influence not only the aggregate consumption of all wood panels, but also the proportion of use by each sector.

Approximately 25-35% of the annual production of furniture in China is exported to a wide range of countries, with the largest volumes destined for the United States, Japan and Europe, while the domestic market continues to grow year on year. Recently though, some furniture factories have had to close down due to raw material shortages, labour issues, higher wages and dwindling exports. The drive by the authorities to move industries from inner cities has also led to an exodus of some Taiwanese furniture factories from China, relocating to Vietnam. MDF production capacity in China has grown rapidly over the past five years, increasing dramatically to 43,165,000m3 at the end of 2014. Based on current, announced and assumed expansion plans, production in China is projected to grow less rapidly over the next three years, peaking most likely in 2015/16 and then declining marginally by 2017.

In China, where consumption has increased so strongly, forecasts are for it to increase at an average annual rate of just 1% in the region over the two years to 2017, as China shifts to a focus on more domestic growth in consumption, possibly at the expense of some exports, such as furniture.

In the last nine to 12 months, commercial activity in the Chinese MDF industry has decreased as the government tries to rein in the country's dramatic economic growth of recent years.

However, in spite of all this, we can still report lots of dynamic activity in China. Fifteen new multi-opening lines across China (all supplied by D-SWPM), with a combined capacity of 750,000m3, are still under construction and due on stream by end-2015.

We also see for end-2015 and beyond more 4ft continuous press lines being supplied by D-SWPM and under construction, with the three investments by Liaoning Deer New Material Co, 132,000 m3, Heihe Shenghui Forestry and Panel Developing Co 132,000m3 and Jiangxi Green Continent Wood Based Panel Co, 165,000m3, making an additional 429,000m3 in all for this period.

For 2016 and beyond in China, we can also see three more new lines supplied by Siempelkamp, with investments made by Changge Tianzheng in Henan 116,000m3, Gixiang Shishu City, Hubei 168,000m3 and Luyuan IV Luoding, Guangdong 230,000m3.

As mentioned last year, with the difficulty in obtaining totally accurate information on all Chinese capacity, including all the small mills, we have had to make some informed assumptions in arriving at a total.

South East Asia

Along with North Asia, the South Asian economies are set to be among the world's fastest-growing out to 2017. Four of the five countries - India, Indonesia, Malaysia, Thailand and Vietnam - are expected to have an average real GDP growth rate of 5% per annum or higher, the exception being Thailand, which is expected to grow at a slightly slower pace.

However, the following factors will help support stronger residential construction activity over the medium term which will, in turn, be a positive driver leading to more demand for MDF: Economic development will strengthen household income, which will support residential construction; the number of households increased by more than five million per year over the decade to 2011 and this level of growth is projected to continue; and urbanisation will generate demand for dwellings in the major cities; improved transport links will support the establishment of new or enlarged urban centres, while an existing shortage of housing should help buttress residential construction; a gradually growing middle class should support a trend to improved housing quality.

In Vietnam, the MDF industry has fared better than some other countries, due to more foreign direct investments and strong exports to the US. The large Dongwha/VRG joint-venture mill is running well. Additionally, Vietnam Rubber Group itself has ordered an MDF plant to be built in Kien Giang, 200km south of Saigon, with a 4ft x 33.3 m ContiRoll press. The mill is due to start up in 2016 /17.

Then there is the Quang Tri continuous mill supplied by Imal of Italy, due on-stream in 2016. Also in Vietnam, Thang Nam (May) Forestry Joint Stock Company (JSC) started the first phase of its 175,000m3 mill in Ving Nghe An during 2014, so is added to the main listing. Its second phase is expected during 2017.

Moving on to Thailand, with more than three million m3 of MDF produced annually, Thai furniture manufacturer Kijchai in Rayong, with its 300,000m3 MDF line, is now running well, as is the second major new MDF line in the region, built by Panel Plus at Hat Yai in southern Thailand, with a capacity of 330,000m3 per year.

Also as reported last year, Metro-Ply of Thailand continues to say that it definitely plans to add further MDF capacity.

In Malaysia, we see no new investment plans. Latest mill data has just been updated to reflect the fact that the capacity of the Evergreen Fibreboard plant (ex Takeuchi) at Masai, Johor, is actually 60,000m3 and not 120,000m3 as previously listed.

The Middle East has been the only consistently growing market in recent years, so the importance of this region should not be under-estimated.

Developments in South America Argentina, Brazil and Chile, with a combined population of over 250 million, appear to have an underlying demand of well over one million housing units annually. All three economies have come out of the financial crisis with strong upturns in the past three years and, despite slow growth in 2014, are well positioned now for a stronger economic performance through to 2017, led by construction.

Virtually no MDF was produced in Brazil in 1998 and it now has the largest production capacity in South America. Key producers in the region include Masisa, Arauco, Duratex, Fibraplac, Floraplac, Eucatex and Berneck. On current plans, it is projected that production capacity in South America will exceed 11 million m3 by the end of 2017.

In Brazil, the two newest MDF lines to come on stream were the Arauco 500,000m3 line at Jaguariaíva, Parana state and Duratex's 520,000m3 Itapetininga line and these are both now fully operational.

Fibraplac of Porto Alegre continues to expand its original Glorinha plant and the one in Campinas São Paulo, so for 2014 its two MDF lines should now be rated at 420,000m3 and 250,000m3 respectively, making a total production capacity of 670,000m3.

Eucatex in Salto (São Paulo state) reached the nominal 275,000m3 capacity for its MDF/ HDF line at the end of 2013.

For 2016 and beyond, by far the biggest planned panel project is still Duratex's US$550m, 1.45 million m3/year two-line complex at Novo Monte Carmelo (Minas Gerais state), in the heart of its big forest base there. Duratex aimed to start construction of the complex in 2014, with a 700,000m3/year unit set to run in 2016 making MDP/MDF on a 77m press; and a 750,000m3/year unit for MDF due on stream in 2017, but these have now slipped back slightly.

But, with an eye on Berneck's latest decision to start a big 840,000m3/year MDP line further south in 2015, the São Paulo based group has now shelved the final product decision until 2015. At this stage, it now looks likely to actually dedicate the first 700,000m3 line to MDF. Duratex has also left space there for a third line later, for either MDF or MDP.

Placas do Brasil, a consortium of furniture producers originally planning a 180,000m3 line at Pinheiros, (Espirito Santo state) has now revealed plans for a 300,000m3 plant, with start-up in 2017/18. The delay is put down to a relatively slow market and waiting for further build-up of the local Eucalyptus plantations, Floraplac (in northern Pará state) with 430,000m3 at Paragominas was also due to start up its second line sometime this year, but it now appears more likely it will be in 2016.

Asperbras, an industrial and agri-business group in Mato Grosso do Sul state, is a complete newcomer to panels, but serious. We already reported that the company plans to use its eucalyptus plantations to feed a 220,000m3 Siempelkamp ContiRoll line, expected to be up and running in 2015, but this has now slipped to 2017. Additionally, the group has recently announced plans to add a second line - with a capacity of about 240,000m3 - when its forest base grows further.

In Brazil, we must include another significant project under way by one of the smaller southern players, Guararapes Paineís in Caçador (Santa Catarina state). Already running a 120,000m3/ year D-SWPM batch press line, the firm recently ordered a 1,000m3/day Siempelkamp continuous thin fibreboard line, set to produce commercially in March 2016 and bringing the total capacity up to 330,000m3/year.

We reported last year that Aglomerados Cotopaxi of Ecuador was preparing to invest in a 250,000m3 continuous MDF line at Lasso. It seems there is a change in plan and it has now opted to upgrade its particleboard production instead.

In Ecuador we also have an updated annual capacity for the main MDF 2014 listing for the existing Cotopaxi MDF line, to 85,000m3/year, up from last year's 58,000m3/year.

In Paraguay, a modest project to build its first MDF plant, a 55,000m3/year unit in Coronel Oviedo, (department of Caaguazú) has been given the green light by the Industry & Commerce Ministry there. It is planned by Agroindustria del Paraguay SA as its first venture in panel manufacturing and it will be taking advantage of fiscal incentive legislation for national and foreign investors to assist its investment of US$6.7million in imported machinery.

Masisa is concentrating on its US$132m 200,000m3/year MDF plant in Mexico, which means there is little capacity expansion in Chile at present.

In May 2014 Tricoya Technologies Limited's partner in Latin America, Masisa, took a step forward with the extension of its licence option and agreement to carry out an evaluation of Tricoya with the launch of Masisa Tricoya Super MDF. The option agreement (originally signed in April 2012), if exercised, grants Masisa exclusive production and distribution rights for Tricoya for the Latin American market (excluding Brazil, for which the sales and marketing rights are non-exclusive) in consideration for the payment of technology and royalty fees by Masisa to TTL. During the evaluation phase, the Tricoya product will be supplied to Masisa by Medite Europe.

Moving on, with both the 2014 World Cup and the 2016 Olympics being held in Brazil, despite government assurances that infrastructure projects would, when finished, eventually benefit the Brazilian people, the effect on Brazil's economy and construction sector (including demand for MDF) has actually been rather small.

However, consumption of MDF in South America overall is projected to increase to around seven million m3 by the end of 2017.

Most of this will be in Brazil, which will be consuming 74% of all MDF in South America by then, although consumption will also expand in other countries, such as Ecuador, Peru, Uruguay, Venezuela and Chile and also other non-producing South American countries, providing strong export demand regionally.

World Summary

The aggregate world capacity table lists the capacities in the various regions of the world from 2013 through to 2016 & beyond. In order to also have an overview of other important MDF producing countries globally, and to complete the picture, we are providing a short update now where information is available and relevant.

Australia has enjoyed uninterrupted growth, without a major recession, for the past 20 years. Most recently it has performed better than most advanced economies, in part due to its inward investment and trade links with Asia - especially China.

MDF production in Australia actually peaked back in 2006/7 and, despite a relatively strong economic performance, by 2012 production had declined to a level that was more than 40% below the peak levels. Yearly production has declined annually over the past five years, including the closure of the Fletcher Wood Products MDF mill, Kewdale, a few years ago.

As a result, MDF exports from Australia have declined significantly and the exchange rate has been unfavourable.

The three producers in Australia that remain are Alpine MDF, producing raw board and painted door skins and mouldings, owned by Japanese company Sumitomo, which is also the owner of Nelson Pine in NZ; Laminex Group, owned by New Zealand-based Fletcher Building which is surface-covering a large percentage of its output; and CHH Oberon, owned by Borg Industries, which is also laminating a large proportion of its production.

Housing construction has been relatively weak in 2013 and 2014 but a stronger recovery in Australia is projected for 2015 and 2016, driven by lower interest rates, strong population growth and pent-up demand in key states. This will drive an increase in demand for MDF.

In New Zealand, the economy, which is highly trade-exposed and export-dependent, especially in the forest products sector, responded to the global financial and economic crisis with vigour.

The building and construction cycle is forecast to shift to a strong growth path in New Zealand (albeit from a small base) over the next two years, with housing approvals projected to rebound strongly, peaking at approximately 24,000 units in 2015, which is still below the peak of 31,000 reached in 2004.

MDF production in New Zealand is forecast to increase gradually and stronger increases in production will be contingent, eventually, on capacity expansion. The major producers in New Zealand are Nelson Pine, owned by Sumitomo which has also invested in an LVL line which started up in 2014; Daiken, formerly CHH and now owned by Japanese company Itochu; and Dongwha Patinna, formerly Rayonier and now owned by Korean-based Dongwha. Approximately 75% of the MDF produced in New Zealand is exported.

Domestic consumption of MDF in New Zealand is projected to increase at a rate of 3% annually to 2017, in view of the projected stronger housing market, and should peak at 219,000m3 by 2016, which is above the peak of 211,000m3 reached in 2004.

Although consumption relative to total production capacity is low, on a per-capita basis, New Zealand is one of the biggest consumers of MDF in the world.

With North Asia, China, South Asia, West Asia and South America already mentioned or discussed in detail, that just leaves our rest of world 'other' category, which this year refers only to South Africa, Iran and Pakistan.

In South Africa, two mills are under construction (as reported last year) and are to be added into the capacity, most likely in 2015, for a total of 314,000m3. These are PG Bison at Boksburg with 114,000m3; and FX Veneers at Mpumalanga Highveld with 200,000m3.

On average, private sector housing in South Africa is projected to grow by 12% annually to 2017 and the demand for furniture in South Africa has strengthened considerably over the past decade.

As a point of reference, furniture consumption values more than tripled from US$574m in 2003 to US$1.8bn in 2012. Despite the sharp declines in the two years following the global economic crisis, MDF consumption increased by 5% annually over the past five years. The relatively strong growth in production and consumption of furniture in the past decade, as well as projections for strong growth to 2017, suggest that it will be a key sector driving growth in the consumption of MDF and particleboard.

South Africa currently does not have the capacity to produce enough MDF to meet its domestic requirements. Net imports over the past five years have amounted to approximately 60,000m3 annually. While an excess of imports over exports is expected to continue, the balance is expected to change, with exports exceeding imports by 2017. Based on new production and consumption projections, MDF exports could be around 170,000m3, and imports less than 50,000m3 annually.

There are currently only two producers in South Africa: PG Bison and Novabord (Sonae), but production capacity is now growing, driven by PG Bison and FX Veneers.

In Pakistan, ZRK Industries (Pvt) Ltd announced a brand new investment in an MDF mill with a continuous line in Mardan, which is being supplied by Dieffenbacher, with start-up planned in 2015. The ZRK group is the largest wood based panel industry in Pakistan, producing both MDF and particleboard.

Having state-of-the-art plants from Europe and China, it has a distributor network throughout Pakistan, Afghanistan and Central Asia and claims to be covering the building industry needs of more than 300 million people. Its Wood Processing Division is vertically-integrated and the group consists of Pakistan's largest, brand new, fully-automated particleboard plant, paper lamination & impregnation lines; and also now, Pakistan's largest brand new MDF plant is under construction.

The company states that its future direction and vision "Is to be a world class, verticallyintegrated, wood processing industry, blending advanced technology with innovative thinking".

Finally we look to Iran. Adding to the current installed national capacity with nine mills producing 834,000m3 of MDF annually, there is one new MDF mill under construction.

This is an investment by the Arian Saeed Industrial Group Inc, with a 200,000m3 MDF plant planned, anticipated to start production in 2016.

So, as previously stated in this MDF review, western Europe and North America are currently rather stable, with the growth in Europe only coming from the eastern region. In North America, the growth comes predominantly from Mexico.

For the rest of the world, we must watch developments in Brazil, China, Iran, Pakistan, Paraguay, South Africa, Vietnam and also West Asia.

In summary then, our final aggregate total for global MDF capacity at the end of 2014 is 92,929,000m3 and it looks set to reach 98,098,000m3 by the end of 2015. Beyond 2015 and into 2016 we could reach 101,724,000m3, based on current information. The global growth continues for this most amazing wood based panel product.