Two new mills break stagnation

12 October 2017This is the first edition of our two-part survey in which we list all the particleboard mills operating in Europe and North America as at the end of 2016. Part 2, listing mills in the rest of the world, will appear in the next issue.

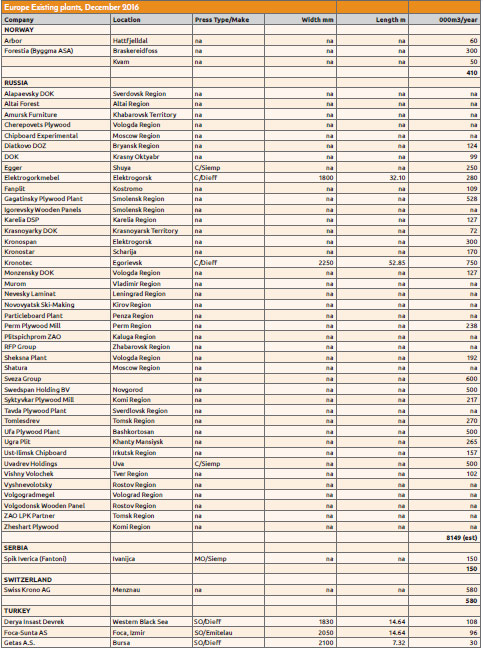

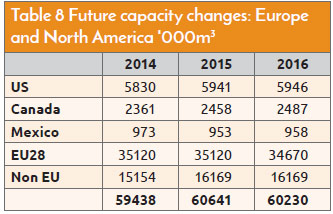

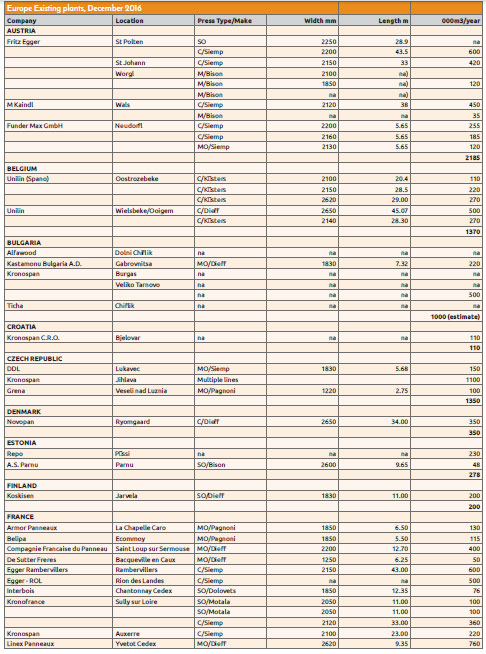

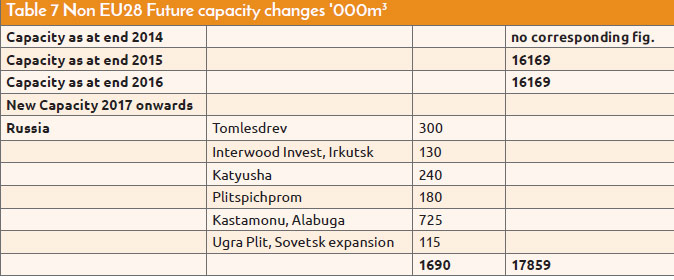

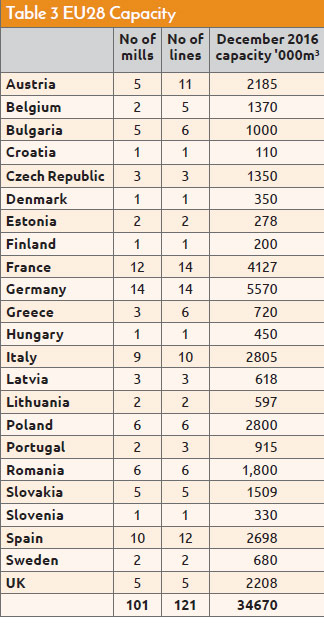

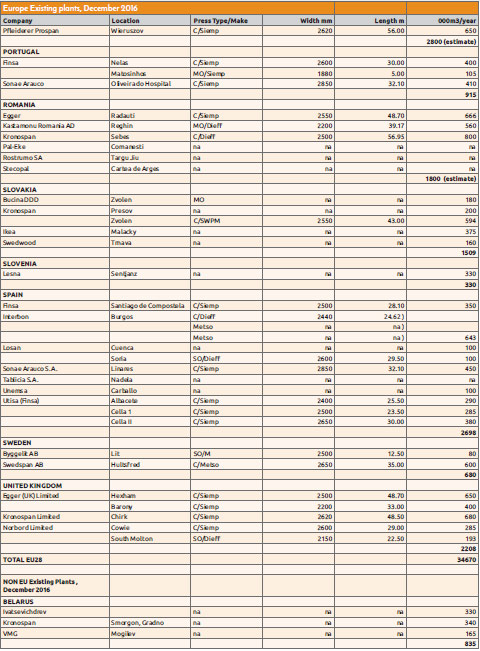

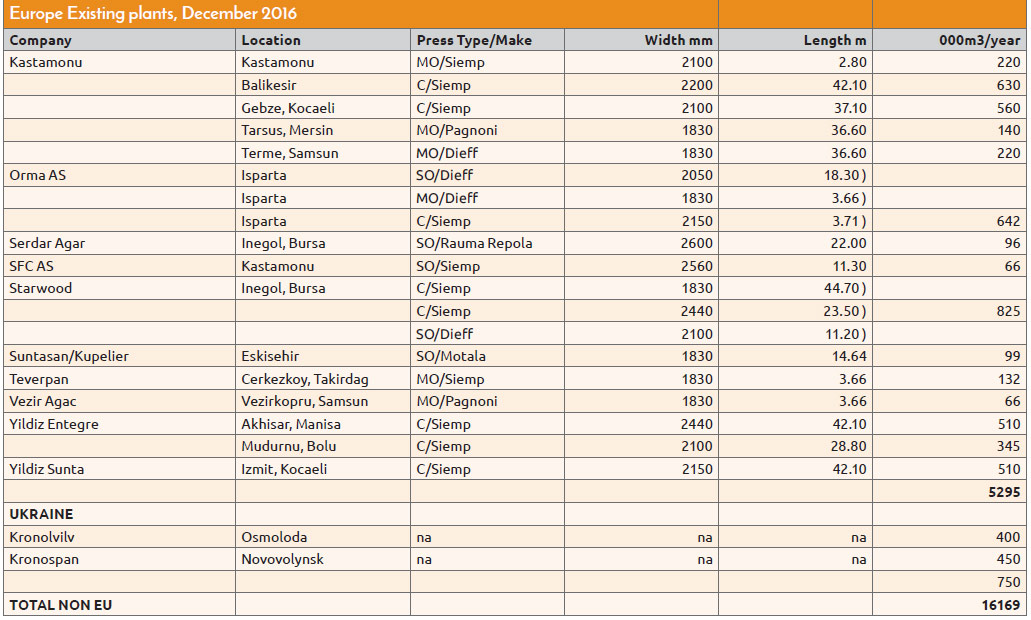

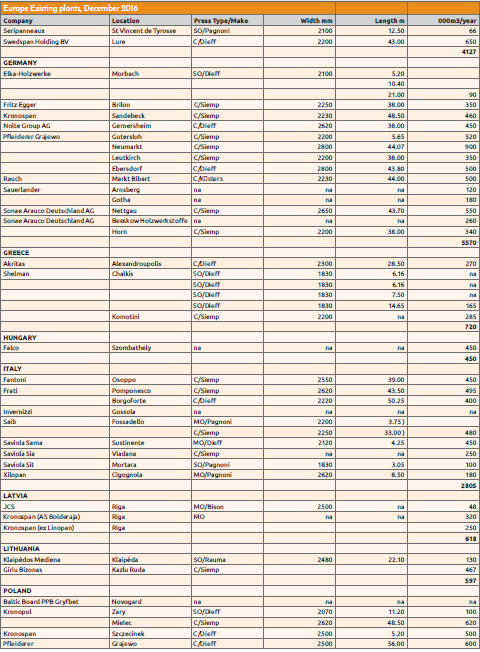

Our survey begins with Europe. On the surface there has been not much change in the capacities, or the production, of European mills. Beneath the surface there has been activity, if not exactly frantic activity; and the results of it will appear in a year or two.

Particleboard production (as opposed to capacity) rose in 2016, by 0.8%. At end of that year it stood at 30.2m3. Those figures are from the European Panel Federation, who point out that, even given the increase, output remains far below the peak of 37.8m3 seen in 2007. Romania, Italy and Austria grew strongly. Germany remains, as ever, the largest European producer.

Capacity, on the other hand, has shrunk. The change is by 2.2%. Most of this amount is due to Europe’s single mill closure of the year, experienced by France. In 2015, the particleboard mill owned by Darbo at Linxe in South-west France was bought by German-Swiss investment company Gramax Capital AG. It was reported at the time that competition from Eastern Europe had made the mill unprofitable. Darbo was a subsidiary of the Sonae group. Gramax announced large investment plans for the mill, totalling €11m, in re-tooling, in carving our Darbo’s operations from Sonae’s, and in expansion of the sales network. The investment did not materialise, however, and in October 2016 the plant closed and 130 jobs were lost. Acrimony has followed, not only from the former employees but also from local authorities, who were reported to have given considerable sums in aid.

Other changes appear more cosmetic. Glunz AG, operator of the 550,000m3 capacity mill at Nettau in Germany, underwent a change of name. Its owners, the joint venture Sonae Arauco, have re-named it Sonae Auaruco Deutschland AG. This is intended to tie the subsidiary more closely to the parent company.

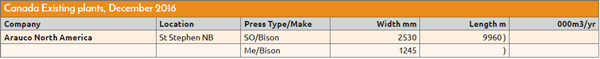

Sonae Arauco itself, of course, is a new creation. The merger between the Portuguese giant Sonae and the Chilean group Arauco was completed in 2016. Mills that formerly appeared in our tables as operated by Sonae now gain the full double-barrelled name.

One or two minor capacity changes appear in our table. These are due to upgrades rather than to replaced heavy machinery. In that context, Arauco – given the paragraph above I should say Sonae Arauco - has plans for its mill at Beeskau in Germany. The two single-daylight presses there, of capacity 290,000m3, are to replaced by continuous presses. Although the final decision has not yet been made, the plan has been in the offing for several years, and is under active consideration by the directors.

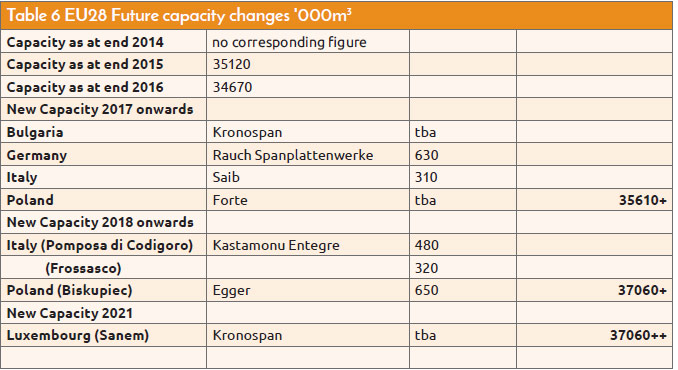

Our Table 6, of future capacity changes for 2018 and beyond, sees some significant entries. Egger’s new plant in Biskupiece, in Poland, is under construction and due to go into operation in 2018.

Its 2.80m continuous press will be of 650,000m3 capacity, so this will be no small line, and options have been announced to increase that to 720,000m3 – though no dates have been given. We therefore do not include the extra 70,000m3 capacity in our table.

Another new capacity comes out of Italy – or more precisely, out of Turkish investment in Italy. In 2013 the Italian company Gruppo Trombini went bankrupt. The Turkish Kostamonu group acquired two mills as a result of the insolvency, at Pomposa di Codigoro and Froscasco, and has announced its intention to restart them. Since they have been idle for many years and had therefore ceased to appear in our tables, we list them in Table 6, under ‘new capacity’ – 480,000m3 for Pomposa, 320,000m3 for Froscasco. Kronospan produced the first board from its new particleboard plant in Bjelovar, Croatia in December 2016. This appears in our main table.

Looking at longer-term new capacity, also from Kronospan, the company has announced a new particleboard mill at Sanem, in Luxembourg, as part of a major expansion of its site there. The first phase of the expansion involves the construction of biomass plants and modernisation of the existing MDF plant. The particleboard line comes in the second phase, due to start in 2021. It will run on 100% recycled timber; capacity has yet to be announced. The overall picture in Europe is therefore fairly static, with overall capacity little changed.

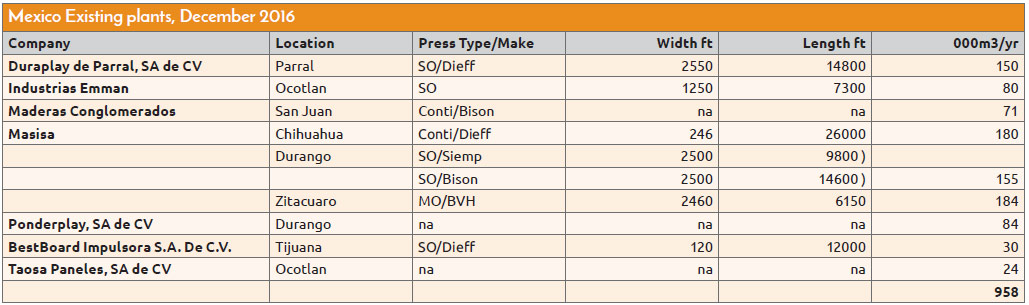

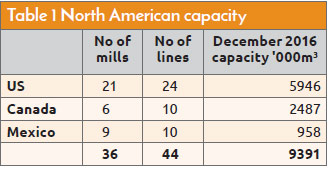

North America

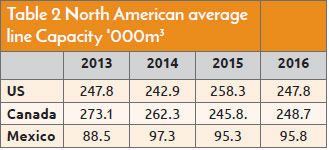

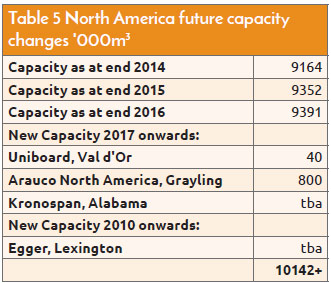

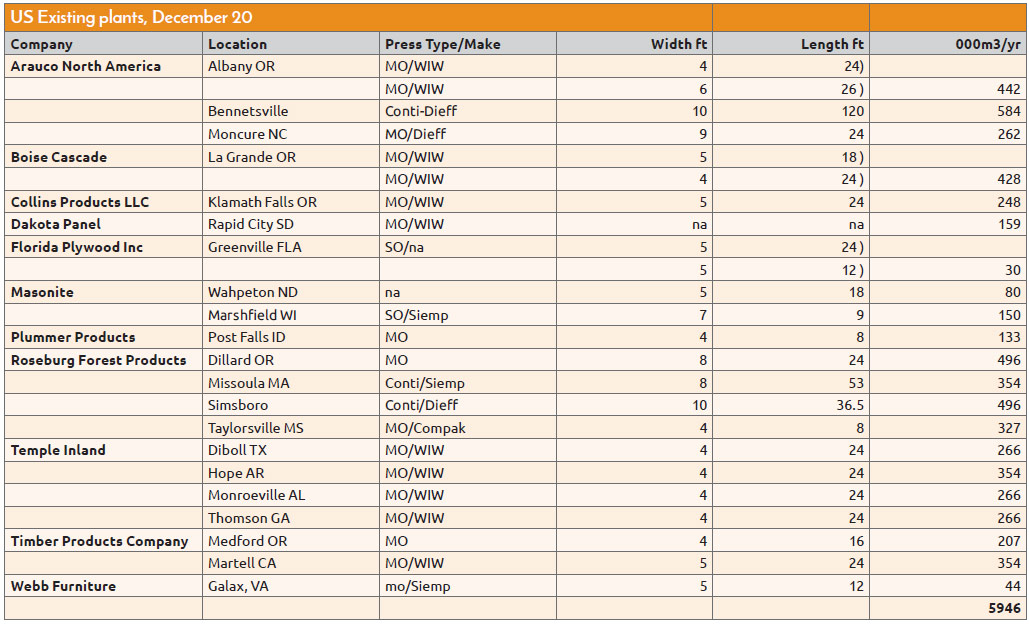

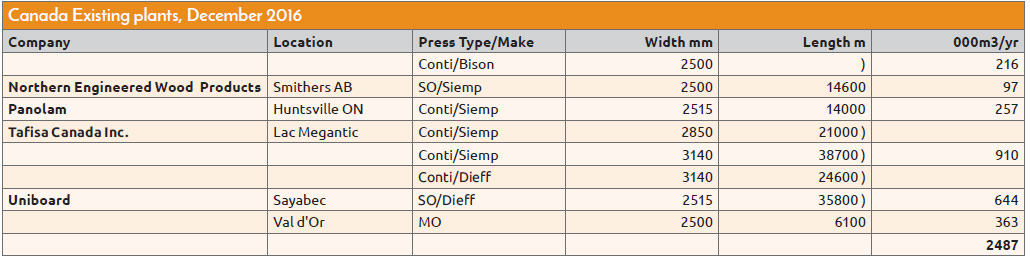

North America sees a similar picture, of sluggish to non-existent capacity growth in the immediate term. Again, though, looking to the future, big changes are coming. No new greenfield-site particleboard mill has been constructed in North America since 2001. But mills are like buses: you wait 16 years and then two come along at once. Egger is building a plant in Lexington, North Carolina; and Arauco is working on another in Grayling in Michigan. Both are significant developments for their owners as well as for the industry.

Arauco’s is scheduled to commence production first, in late 2018. The plant will not only be the first in North America since 2001; it will also be largest particleboard mill on the continent. Its capacity is to be 800,000m3/year. The huge US$325m commitment will occupy 60ha of a 250ha site.

Site preparation began in July 2016. Permits and approvals were completed by October and supply contracts signed in November. The press is to be a Dieffenbacher 10ft x 51m continuous CPS+. The facility is expected eventually to employ 250 employees. A significant source of feedstock will be residual wood from nearby sawmills.

Turning now to Lexington, the Austrian group Egger that is building there has been until now an exclusively European operation. But it has just bought a particleboard plant in Argentina, (see page 29, and interview), and in July 2017 it announced a major greenfield project in the US. The first of three phases will be a particleboard and coating plant at a cost of some €260m.

Construction is to start at the end of 2018, with production to begin in 2020. The plant will occupy 40ha of a 90ha site, the remaining 50ha being for later phases.

Egger has been planning its overseas expansion since mid-2015. In Latin America it decided on acquisition of an existing plant.

A similar strategy was contemplated for the United States; but despite the presence of many mothballed mills, curtailed since the crash of 2008, the decision was made, after examining many of them, to construct afresh.

Lexington has several advantages. It is not new to the panel industry. Six panel mills or former panel mills are within a 100 miles.

Potential customers are close by in the form of Ashley Furniture Inc, one of the largest, if not the largest, furniture manufacturers and dealers in the US, which has a site 15 miles away.

And, as with its Argentina purchase, Egger is moving into an area where it already has sales and marketing experience. As part of its preparatory planning the company has been expanding its sales activities in North America, establishing a sales headquarters in Atlanta, Georgia. These activities have already shown that the products on offer and the price structure of Egger’s portfolio will be attractive, and distribution is also a positive factor. “The planned production location in Lexington will play a decisive role for Egger’s increasing presence on the North-American market for wood based materials, as well as ensure product availability and delivery speed for our customers,” said Walter Schiegl of Egger Group Management Technology/Production, echoing remarks that his colleague has made to WBPI in the context of Latin America.

The plant will create some 400 jobs over six years. Production is scheduled for 2020. Two further building phases will follow. No announcement has been made as to what those will be, though a total investment of €700m and 700 new jobs by 2032 have been stated. A grant of US$5.3m from the NC Economic Investment Committee has been approved, with other grants in prospect.

With two major particleboard plants coming on-stream in America, the stagnation in the panels industry which has gripped the continent since the financial collapse of 2008 seems at last to be giving way to expansion.