The slow and painful recovery has begun

15 February 2010A year ago (Issue 1, 2009, p54) we were trying to assess the damage caused by the 2008 financial meltdown and the resulting crisis. At the end of 2009 and early in 2010, the consensus is that the worst of the financial crisis is behind us; that the Great Recession is retreating; and that the global economy is in recovery.

Fiscal and monetary stimulus throughout the global economy have helped avoid a much deeper and more wounding economic outcome. Higher government debt resulting from these policies (despite the frothing and fuming of knee-jerk conservative policy makers) will prove to be a much smaller total cost in both the short- and long-term than the alternative; a deeper and more prolonged recession would have had far greater economic and social costs.

For the North American wood panel markets, 2009 was equivalent to Round 14 in a knockdown heavyweight 15-round fight that has been going on for far too long. Hopefully 2010 will be the final round in which the opponent (slumping markets) will be knocked out, and the industry will again enjoy volume growth as well as improving and positive margins!

Key to this improvement, of course, will be the pace and timing of the recovery in US housing markets. While US housing starts hit bottom in the first quarter of 2009 and subsequently improved, the recovery so far has been akin to a ‘dead-cat bounce’ (see Figure 1). Pessimistic thinking still dominates analysts’ 2010-11 housing outlooks. Following on US housing starts of around 0.55 million in 2009 (the lowest level in the post-Second World War period), forecasts for 2010 show starts recovering to a range between 0.60 and 0.90 million units. Even the most ‘optimistic’ forecasts show housing starts running well below both underlying demand and any other year apart from 2009.

Pessimists emphasise the continuing problem with foreclosures; the 2010 end of government tax breaks for housing; high unemployment; and falling home prices.

Optimists emphasise low mortgage rates and falling home prices and the resulting improvement in affordability; declining inventories of unsold new and existing homes; and the return of economic growth to the overall US economy.

In past recessions, housing has started to recover even as unemployment flirts with cyclical highs so this should not be an insurmountable barrier.

Ultimately, the over-riding fact is that the US is simply under-building homes in relation to long-term demand. Entering 2010, the excess inventory of homes resulting from the mid-decade housing bubble is close to being exhausted. Therefore, given the levels of starts contemplated over the next few years, pent-up demand will start to build.

In Canada, we are already seeing signs of a shortage of homes for sale and this is being reflected in an upswing in housing starts from their early-2009 lows. Consequently, Canada’s share of North American housing starts in 2009 will be close to 20%, up from just 10% in 2005.

This analyst confesses to being generally optimistic about the prospects for US housing over the next several years. At some point (sooner rather than later) housing production needs to return to underlying demand levels. Also at some point in the next cycle, annual starts will again exceed underlying demand, if only to meet some of the pent-up demand accumulated.

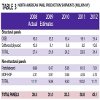

In the short run, the problems facing housing will continue to be serious and will hold down housing activity for several years, but housing’s recession will pass, providing the overall economy is reasonably healthy. For purposes of forecasting wood based panels, CFPA’s housing assumptions are in Table 1.

Most, if not all, of the recovery in US housing production in 2010 will likely be concentrated in the single-family sector as credit conditions for major commercial projects (such as multi-family homes) remain tight. However, for wood products producers the news of the increase in single-family home production is good, as these units are more intensive consumers of wood.

The relatively healthy performance of the Canadian housing sector will also support recovery in North American construction end-use market consumption of panels, lumber and millwork. Table 2 illustrates the significant (albeit declining) share of Canadian housing starts in the North American markets over the next few years.

In summary, housing starts in the whole of North America will finally exceed the one million mark in 2011 and are expected to be close to 1.6 million units in 2012. (By way of comparison, the 2012 pace will be close to the North American average of the late 1990s.)

What does this mean for wood based panel demand/production in the region?

The first point to note is that total panel demand is more than just consumption in new home construction, as other end-use markets also contribute to demand, particularly non-residential construction, residential repair and remodeling, furniture production (especially for particleboard and fibreboard), and other industrial markets (packaging and crating as well as products made for consumption).With the US and Canadian economies expected to sustain growth in GDP and industrial output over the next three years, panel consumption in these other end-use markets is expected to climb at least moderately.

Figure 2 illustrates our expectations for North American panel consumption over the next three years and compared with the 2005 peaks. In all panel types, consumption is not expected to get back to 2005 levels before 2012, although MDF/HDF will probably come close.

Given the importance of housing starts in determining OSB demand, it is not surprising that OSB’s anticipated recovery will be faster than that for other panel types, just as the earlier OSB crash was greater than for other types. For plywood, the loss of market share to OSB has moderated from a decade ago, but the primary end-use markets for softwood plywood (industrial, residential repair and remodeling) will also be among the slower ones to improve over the next few years. Consequently, plywood consumption will struggle to recover to 10-11 million m3 over the next few years. This contrasts with an OSB market rebounding 61% from a low of around 13 million m3 in 2009 to approximately 21 million in 2012. But this is still 20% off the record of 2005.

For particleboard and MDF producers, 2010 will see little or no recovery in demand from 2009 levels. This reflects the longer lags between a pick-up in construction activity (eg. housing starts) and increased consumption of panels in cabinets, flooring, millwork and, eventually, in furniture for new homes. Also, import competition will remain a serious problem in furniture markets – a particular and continuing concern for North American particleboard makers.

Table 3 presents data on production (rather than consumption). As North America imports significant volumes of softwood plywood and HDF (as well as smaller volumes of other panels), its production will be lower than consumption, but the tracks of both consumption and production will be similar, if not parallel.

In all cases, production will either bottom in 2009 (in the case of structural panels) or in 2010 (in the case of non-structural panels such as particleboard and MDF/HDF). By 2011, structural panel production is expected to be back to 2008 levels (largely because of OSB strength), while for particleboard and fibreboard it will not be until 2012 that production climbs above 2008 levels.

While no new records will be set in consumption or production in North America over the next several years, profitability is likely to improve significantly from poor 2008-9 levels.

As of early 2010, the North American industry is largely no longer chasing consumption lower. For OSB in particular, the massive amount of permanent and temporary closures has brought supply in line with demand. And this process is happening throughout the wood products industry (panels and lumber).With inventories of panels low throughout the distribution system, and demand starting to tilt higher, the probability is that small disruptions in supply channels and/or higher-than-expected demand could quickly lead to substantial volatility in markets. Market improvement will require inventories to be rebuilt (although dealer confidence and credit lines will first need to be restored before this happens). Subsequently, mills will consider reopening lines and/or entire operations.

However, panel producers will initially be cautious about re-opening facilities and will want to feel that the recovery is well in hand so that their risks are minimised.

So, expect pricing volatility and higher average profit margins in 2010, to be followed by capacity expansion in 2011-12. Therefore, while 2010 should be an improvement over 2009, it will not be without its share of frustrations and worries! Nevertheless, the generally positive direction of markets will be a vast improvement over the experience of the past several years.