OSB line second act

20 June 2019Norbord is embarking on the second phase of expansion at its OSB mill in Inverness in Scotland. Sally Spencer reports

Almost a year on from Norbord’s £110m expansion of its Inverness OSB mill, the company is investing a further £35m in phase two of the development. The project was always predisposed for a second phase of expansion but the speed at which it has been able to implement this second wave of investment has pleased the company enormously.

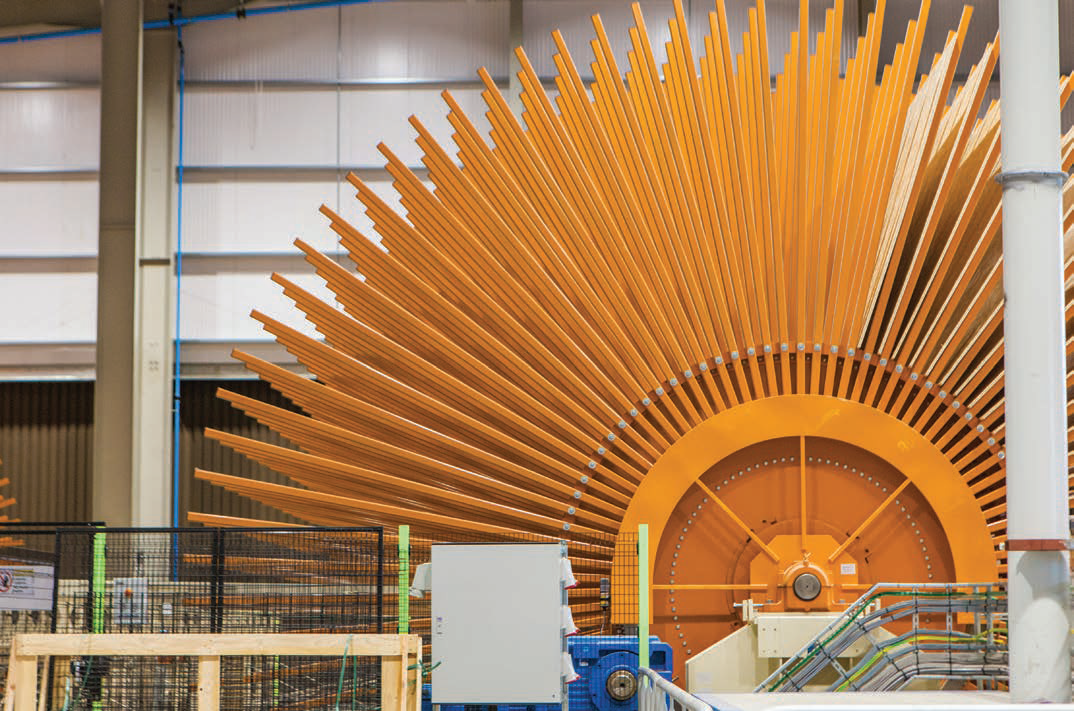

The initial investment – 10 years in the planning and three in the construction – saw the installation of a 2.9x55.3m Dieffenbacher continuous press that gave Norbord a 290,000m3 increase in annual production capacity to 640,000m3. The two original eight-daylight Siempelkamp press lines it replaced were dismantled towards the end of last year to make way for a new finishing line, which is now up and running.

Visitors to the site last year may have noticed a large gap and a truncated belt section next to the dryer and this, said Simon Woods, European sales, marketing and logistics director, is where the £35m comes in. A second wood room, heat energy plant and dryer are being installed to debottleneck the pre-line operation.

“We knew output would eventually be dryer limited, so this was always part of the plan,” said Mr Woods. “The good news is that we envisaged it being 2023 before we did this but the strength of the market is enabling us to start in 2020, with expected completion in 2021, so we’re well ahead.

“What this demonstrates is that our confidence in the market when we invested the £110m is still there, if not more so.”

The line is performing well and is “on track” to produce the targeted volume for this year, said Mr Woods. The investment was not just about capacity, of course, and the quality and smoothness of the board is garnering praise from Norbord’s customers.

“We used to have to sand the boards three or four times but now the line is so good it is producing an excellent finish. Our customers are telling us it is much better than the Inverness product of old – and that was a really good product.”

The continuous line has also enabled the use of pMDI, rather than formaldehyde resin and Norbord now produces a zero-added formaldehyde (ZAF) board SterlingOSB Zero. The line, along with the new finishing line, also enables the company to produce larger boards, opening up market opportunities.

“The offsite and timber construction markets need a different product to the standard 8x4 panel and we can fulfil that,” said Mr Woods.

Other market opportunities will be targeted towards more value adding products.

“We’re doubling output at Inverness so new product development is very important to us,” said Mr Woods.

“We launched SterlingOSB StrongFix in 2017 and will give that a [marketing] boost and in the next 12 months we’ll be coming to market with an increasing portfolio of new products, so watch this space.”

He added that although OSB is accounting for the lion’s share of Norbord’s investment, product development will run across all board types, from MDF, which is produced at the Cowie mill and particleboard, which is produced at Cowie and at South Molton (which also has an added value factory producing kitchen carcasing). A recent example is the launch last year of CaberAcoustic, an upgrade of the company’s CaberFloor P5 particleboard flooring product.

“Our customer proposition is based around our business being a multi-product one and we are continually improving our particleboard and MDF mills,” said Mr Woods. “We just tend not to talk about the smaller investments.”

But back to OSB. Later this year Norbord Europe is also investing in a new T&G facility at its OSB mill in Genk, in Belgium and this will bring a more balanced portfolio of product to the market. The company has no doubt about the market’s capacity to soak up additional volume, not just from Norbord but from other manufacturers, too.

“Despite the increases in OSB capacity that have happened in the last few years, 2018 and the latter part of 2017 were very short of product," said Mr Woods. "For the majority of 2018 we and pretty much all our competitors were on allocation of some description.”

Growth in demand for OSB can be attributed to the impetus behind housebuilding and, within that, the increasing market share for offsite and timber frame, he added.

“That increase will mean more OSB, MDF and particleboard, because all three of those products go into housebuilding,” said Mr Woods. “And there will also be growth from the continuing substitution of plywood.”

In Germany, he added, the OSB to softwood plywood ratio is 80:20 in OSB’s favour. “In the UK it is more like 50:50 so there is plenty more growth to be had here. Our role is to accelerate that growth and substitution.”