Momentum builds in North America

2 May 2018North America is finally shrugging off the long grasp of the global financial crisis as idled mills are brought back to life. Keren Fallwell reports.

The positive murmurings that could be heard during WBPI’s OSB survey last year have gathered volume and strength and the North American industry has a new energy not seen since the financial crisis in 2008.

Optimism grew steadily during the year as demand, and prices, rose, giving companies the encouragement they needed to take the dust covers off mothballed mills.

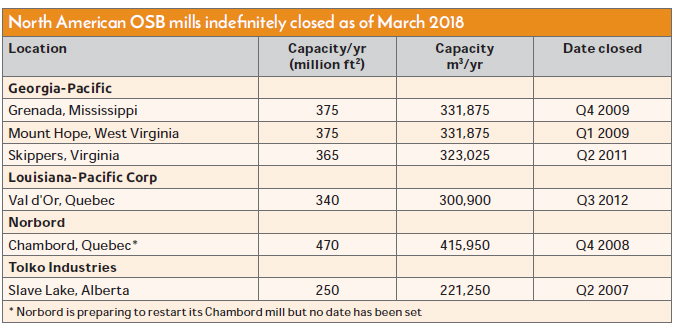

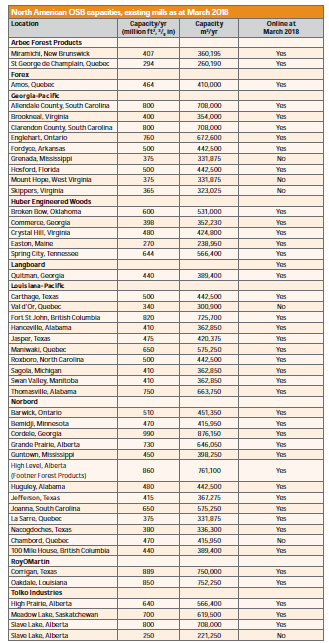

This time last year RoyOMartin was the sole company opening a new mill and the plants that had been idled for some years were still silent. Later in the year, however, there was a new momentum as Norbord, Huber Engineered Woods, and Tolko Industries all made decisions to restart plants, while LVL manufacturer Forex has installed an OSB line at its mill in Amos, Quebec. At the same time, OSB production at Louisiana-Pacific’s facility at Dawson Creek, British Columbia, was due to cease in the fourth quarter as the company is converting the production line from OSB to siding. This provides a net capacity gain of 1,834,850m3.

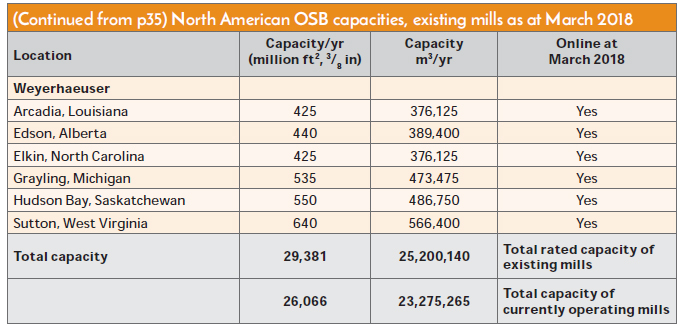

As the market fundamentals improved during the year, North American manufacturers gained confidence and steadily raised output each quarter. According to the APA-The Engineered Wood Association, North American OSB production in 2017 totalled 20,196,000m3, up 3.9% from 19,434,000m3 in 2016. From 2014-16 bigger increases were recorded in Canada than in the US, but last year the pattern changed. US mills raised production by 4.9% to just over 13 million m3 (2016: 12,391,000m3). Canadian OSB output rose by 2.1% to 7,194,000m3 (2016: 7,043,000m3). In its annual report published in February, Norbord said its North American mills produced at 96% capacity, up from 94% in 2016. Seven of its North American OSB mills achieved annual production records.

The North American industry’s higher production has slightly increased OSB’s share of the region’s overall structural panels production. It now accounts for 67.4% of the total output of just over 30 million m3 thanks to growth in the US. In Canada there was no change in OSB’s share but in the US it gained six percentage points and now accounts for 61.8% of structural panel production.

Reflecting the continuing competition OSB poses to plywood, in the first and fourth quarters of 2017 OSB production increased by a greater percentage than softwood plywood, although in the second and third quarters growth of the two products was roughly similar.

Of course what has provided the industry with a surer footing is the forecast increase in housing starts. In 2017 US housing starts were anticipated to be 1.2 million and are forecast to rise by approximately 7% this year to around 1.3 million. Housing starts fell unexpectedly in December – by 8.2%, the biggest drop since November 2016. However, the number of building permits issued rose, and these should be converted into housing starts in the coming months.

The largest growth will be in single-family dwellings, which account for the biggest share of the housing market, and the biggest consumption of OSB.

In Canada last year, housing starts held steady at the highest level since 2008, according to the Canada Mortgage & Housing Corporation. In contrast to the US trend, in recent months the growth as been in multi-occupancy dwellings rather than single-family houses.

This potential growth in demand has been the motivation for Norbord, Huber Engineered Woods, RoyOMartin, Tolko Industries and Forex to all boost their OSB production. In our OSB survey last year we reported that Norbord was preparing to restart production at Huguley, Alabama, which it mothballed in Q1 2009. We reported that the press had been rebuilt and the mill was ready to be put back into production within nine months. As it happened, the gestation period was slightly shorter and Norbord resumed production at Huguley in October.

The mill has a capacity of 442,500m3. Norbord is also preparing to restart OSB manufacturing at its facility in Chambord, Quebec, which has been idle since late 2008, although no date has been set.

President and CEO Peter Wijnbergen said preliminary engineering work at Chambord was progressing and Norbord expected to begin investing in certain long lead-time items to prepare it for an eventual restart.

“A restart decision has not yet been made and, similar to our approach at Huguley, we will continue to evaluate the timing of a comprehensive investment based on demand from our key customers,” he said.

Norbord took ownership of the 415,000m3 capacity facility in 2016 when it did a mill swap with Louisiana-Pacific, handing its closed mill in Val d’Or, Quebec, to LP, in exchange for Chambord.

Huber Engineered Woods is to restart production at its facility in Spring City, Tennessee, in April. The mill opened in 1997 but production was halted during the housing market downturn in 2011.

The Spring City plant has undergone upgrades in preparation for manufacturing speciality products, including AdvanTech sub-flooring and ZIP System sheathing. The mill was the first in North America, and the second in the world, to use a continuous press and, according to Huber, remains one of only five continuous presses in North America dedicated to OSB production.

RoyOMartin’s new OSB mill in Corrigan, Texas was also on track to come on stream in the first quarter. While the company said it preferred not to divulge production capacity, WBPI reported last year that designed output would be more than 750,000m3 per year.

In Canada, last year Tolko Industries announced it was to restart its facility in High Prairie, Alberta. The mill was closed in Q1 2008 when North American housing starts fell to a generational low. The plant, which has an annual capacity of 566,400m3, was due to resume production in the first quarter of this year.

President and CEO Brad Thorlakson said the improving housing starts in North America, and the Alberta government granting a five-year extension to the existing Tolko High Prairie forest management area, were key in the decision to restart the mill. In preparation for reopening the facility, Tolko upgraded the line with two pocket batch feeders from Kadant.

Canadian LVL manufacturer Forex has also boosted North America’s OSB capacity with a new line at its LVL mill in Amos, Quebec. It is Forex’s first OSB investment. The Dieffenbacher multi-opening press, which has an annual capacity of 410,000m3, produced the first boards late last year.

Weyerhaeuser has also been investing in upgrading its OSB production. A new multi-daylight press for its mill in Grayling, Michigan, was scheduled for installation in the first quarter. The 8x24ft 16-opening press from Siempelkamp will replace a similar press from the 1980s. It will be integrated into the existing production line at Grayling and is expected to start up in the summer. It will produce OSB in thicknesses ranging from 6.3-31.8mm.

Siempelkamp has been contracted to supply the multi-daylight press with the necessary loader and unloader unit, and automation, drive and control technology, including Dahmos software. The press and its components, as well as the complete hydraulic and electrical systems, have been designed and built in Krefeld, Germany.

The stronger demand in North America has had a positive impact on prices. Last year prices increased by 31% year-on-year on the strength of continued economic growth and solid market fundamentals. In turn, the higher prices raised manufacturers’ revenues and earnings.

For the year ended December 31, 2017, Louisiana-Pacific’s OSB division reported a 27% increase in full-year sales of US$1.3bn compared with 2016. Adjusted EBITDA for 2017 was US$488m compared to US$246m in 2016. The increase in selling prices favourably impacted operating results and adjusted EBITDA from continuing operations by approximately US$293m for the year as compared to 2016.

“We expect housing demand to remain strong in 2018,” said CEO Brad Southern. “As LP looks to the future for new products, major trends such as urbanisation and the continued shortage of skilled labour will influence our decisions. We remain focused on growing our speciality products business and are committed to producing value-added products and solutions that deliver distinct value for our customers, as well as our shareholders.”

Norbord has also reported “ongoing growth” in OSB demand in both North America and Europe, which contributed to the 75% improvement in adjusted EBITDA of US$672m for 2017. It is expecting a strong performance in 2018 and it, too, is pinning its expectations on the positive forecasts for housing starts in the US.

Norbord expects supply and demand to remain finely balanced as the new and restarted mills will take time to reach full strength.

“Combined with further growth in other OSB end uses and limited volumes expected from capacity restarts in ramp-up mode, we believe that the industry demand-to-capacity ratio will remain firm,” Peter Wijnbergen said in Norbord’s annual report.

Norbord has made big investments in OSB in the past few years, with its new line in Inverness, Scotland starting up last year (see p27) and the engineering work at Chambord, Quebec.

Mr Wijnbergen said the company would continue to invest in 2018.

“We have plans for US$175m in capital investments, which include a range of upgrades to enable us to continue improving mill productivity, reduce manufacturing costs and expand production for speciality products,” he said.

Norbord’s long-term target is for special end uses (industrial applications and export markets) to account for 50% of sales volume and it is making progress towards its goal. Last year 25% of sales volume went to speciality uses, up from 22% in 2016.

“The budget also includes higher maintenance investments to ensure our mills can operate reliably in the current high OSB demand environment,” said Mr Wijnbergen.

In March, Norbord announced it was suspending production at its 100 Mile House mill in British Columbia for around a month from May 14 because of a shortage of wood.

The wildfires last summer which forced the mill to close for about five days damaged logging areas near the mill and, combined with severe weather this winter, have affected supply.

In Weyerhaeuser’s investors’ presentation in March, the company said demand for OSB was rising steadily, driven by strong growth in repair and remodelling and the increase in singlefamily home starts, but there was a slight shift in its stance on supply. In November it had stated that the recent additional production capacity would be able to satisfy the rising demand; in March it anticipated that more industry capacity was needed to meet the rising demand.

Weyerhaeuser also stated it expected pricing and operating rates to remain favourable. While the decisions to increase capacity, and production, are predicated on the forecasts for growth in housing starts, these scenarios could easily be dented by political moves and the end to the long period of low interest rates in the US.

Joe Elling, market research director at APA-The Engineered Wood Association, acknowledges that OSB demand is being powered by continued improvement in single-family construction and repair and remodelling, but he has a word of caution.

“I am getting a bit concerned about the apparent lack of fiscal responsibility in Washington, DC and what that could mean for interest rates in the second half of this year and into 2019,” he said.

Although OSB prices dipped towards the end of 2017, the dominant trend was rising prices in line with the growth in demand. That growth has also stimulated the industry to bring more capacity online. As even the novice economics student knows, maintaining supply and demand equilibrium is a finely-tuned balancing act and the introduction of additional capacity risks eroding some of last year’s price gains.

Some industry commentators predict that the additional capacity will cause OSB prices to soften in the short term. As long as housebuilding activity remains buoyant, however, the longer-term view is positive.