Mixed fortunes in the two Europes

10 July 2012In this, the first part of our annual survey of the MDF producing industry worldwide, we look at the mills and their capacities in Europe and North America in 2011 and at the prospects for the industry in 2012 and beyond

Regular readers of our unique annual surveys of the MDF industry will not be surprised to read that there is little change in sentiment in the markets for MDF in Europe and North America since our last report. This, of course, is due to the economic crisis which is still gripping both regions.

Our last two annual reports painted a picture of low demand from the principal markets of house/commercial building and furniture manufacture; and continually rising costs of wood, resin, energy and transport. Not much has changed for 2011.

While there do seem to be flickers of light at the end of the North American tunnel, these are tentative and easily extinguished by winds of change in the overall economy.

To an even lesser extent, and a dimmer flicker, the same applies to the European market, as forecasts of possible moderate growth in MDF markets there at the beginning of the year look less probable, with continuing revelations of further economic woes in countries such as Spain, Italy, Ireland, Portugal and, surprisingly to some observers, the Netherlands, in the second quarter of 2012. And there may yet be more unpleasant surprises to come.

This year's survey provides listings of existing capacity in the two regions at the end of 2011. Furthermore, drawing upon a range of sources, including the industry itself, we show the changes expected to capacity during 2012, 2013 and beyond.

The survey continues to be published in two parts; the second part will deal with the 'Rest of the World' and will be published in the August/September issue of WBPI.

We remain grateful to all those organisations that took the time to complete our online enquiry form and to all those other industry professionals such as panel equipment suppliers, trade associations, etc, who made valued contributions. We are happy to receive all new information regarding capacity changes at any time during the year when it is most convenient. As a reminder to those considering their input for part two of our survey, or the upcoming particleboard survey, you may make your submission at www.intermark.plus.net

European capacity

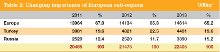

Total European capacity reached 20,465,000m3 in 2011, a minimal increase over 2010 (20,261,000m3).

Many mills continued short-time working and extended closure arrangements, which influenced effective capacity.

From the end of February, European producers did see some upturn in demand, but this reportedly fizzled out later in March. While the upcoming Easter holidays in early-mid April were thought to be partly to blame for slightly reduced demand, improvements after Easter were not obvious, with prices under pressure.

Some manufacturers' resolve weakened for standard grades of MDF and prices fell - sometimes to levels that some manufacturers were not prepared/were unable to meet.

However, things can't have been too bad as market-related stoppages became rare and short in duration, though some continued to produce with their lines running at a reduced speed.

For the sake of correctness we advise that there was a change of name in 2011 for the Nuovo Rivart mill of the Mauro Saviola Group at Radicofani, Italy, and it is now known as Gruppo Mauro Saviola srl.

European capacity changes

As we reported last year, western and central Europe have no projects for new capacity under way and the existing players appear to be having trouble selling the production capacity they already have.

At the end of April 2011, Varioboard formally closed its MDF/HDF mill at Magdeburg, saying that it could not recoup rising raw material and energy costs in sales prices. The firm could not finance modernisation of the mill and said it would sell off the plant if possible. It is rumoured it may go to Belarus. Capacity removed for 2011 was 205,000m3.

In Spain, the Intamasa mill in Cella, run by Utisa, part of the Finsa group, was formally closed at the end of November 2011. It was the oldest MDF mill still in operation in Europe, having been opened in 1977, reported industry newsletter Euwid. Capacity was 120,000m3. The location shown in our previous listings was incorrect as Teruel, not Cella.

As the mill had not been producing for some time, it has been removed from the listings for 2011.

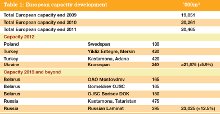

Eastern Europe and Turkey are the areas where additional capacity is still planned.

In last year's report, we stated that Belarus firm Gomeldrev OJSC was to build an MDF plant during 2011, but this appears to have been put back. The company has been in wood products since 1879. According to the website of the belarussian Universal Commodity Exchange (BUCE), Gomeldrev is holding an open tender to choose a general contactor to build an MDF and laminate flooring plant near Rechitsa, in the Gomel region.

The deadline for applications was February 27, 2012.

According to BUCE, The OJSC ASB Belarusbank had already signed a loan agreement with a consortium of German banks to finance the acquisition of an MDF production line, worth over €40m, to OJSC Gomeldrev under its contract with Siempelkamp.

It seems likely this project will now go into production in 2013 at the earliest, so we have included it in the European capacity development table (Table 1) for that period.

In Russia, Russian Laminat (also known as Derevoobrabatyvajuschij Kombinat OAO), which has a Siempelkamp ContiRoll particleboard plant in Igorevska, Smolensk region, under construction, is now planning an MDF line there with an Andritz refiner and a Siempelkamp ContiRoll press line. Capacity will be 395,000m3 (8mm basis). The contract was placed in January 2011, but a start-up date is still not currently available.

Also in Russia, we believe there to be a mill owned by ZAO PDK Apsheronsk of 300,000m3 also for 2010 start-up, so this has also been added to this year's main listings for 2011. We would be grateful for any confirmation that this mill is indeed running.

Swedspan Poland's MDF/HDF mill in Orla produced its first board in July 2011 but was temporarily shut down on November 7, during ramping-up of production, by the environment agency in Bialystok, due to complaints by farmers about pollution of the local river. However, there was not found to be any problem and the mill only stopped for four days. It is shown in Table 1 for 2012 as it was not in full production by the end of 2011. The mill has annual capacity of 130,000m3.

In Turkey, Kastamonu's 420,000m3 line at Adana did not come onstream in 2011, so is now listed for 2012 as that will be its first full year of operation.

Staying with Kastamonu, but this time in Kazan, Tataristan, Russia, its 475,000m3 line is due onstream in March 2013.

Back to Turkey and Yildiz Entegre's new mill in Mersin, with a capacity of 420,000m3/year (not 495,00m3 as stated wrongly in last year's survey) is due onstream in 2012.

As far as we are aware, Swiss Krono's line in Ukraine started production in 2011, with a capacity of 240,000m3, but is shown in Table 1 for 2012 as the first full year of production.

The first Dieffenbacher MDF line (2250mm x 32 m) in Belarus, for OAO Mostovdrev will be producing 500m3/day of MDF (or 700m3/day of HDF) when in full operation. Dieffenbacher supplied from debarking and chipping to the short-cycle lamination area. A start-up date is not yet finalised.

From the foregoing information it is apparent that, as in last year's survey, Kastamonu remains the manufacturer to watch, with new mills in Turkey and Russia.

Kastamonu was shown in last year's report as having plans for a 300,000m3 mill in Ukraine. The company has advised us that this is no longer part of its plans. However, it appears the mill did start up during 2010 with a capacity of 250,000m3 under the ownership of Art Progress of Kiev. The mill is in Korosten and is thus shown in our main listings. Again, we would appreciate any information about this mill.

Table 2 summarises the impact of the new capacity and minor capacity adjustments in the European regions from 2011 to 2013.

This year we have dropped the rather irrelevant division between the old EU15 and 'other EU' and combined them as just 'Europe', while still separating Turkey and Russia due to their great significance in the changing capacity scene.

We can see that the decline of Europe continues, although it does now mask the fact that the 'older' European players' share is falling the fastest.

Meanwhile, Russia and Turkey seem set to represent near 36% of regional capacity by 2013 - up again slightly on last year's one-third.

North American capacity

This year, we received responses on our dedicated website from the vast majority of mills in both Canada and the US, for which we are very grateful.

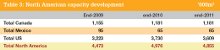

Total capacity as at end-2011 was 3,609,000m3 for the US, 1,181,000m3 for Canada and 65,000m3 for Mexico (this is down by 30,000m3 compared to last year's report, due to reduced capacity advised by Macosa). The total for the region comes to 4,855,000m3 - a net reduction of 121,000m3 compared with end-2010.

Overall, the situation in North America is little changed from last year's report. In that edition, we mentioned the addition of Uniboard, Moncure, North Carolina when its line went into production during 2010.

This year, we can confirm that this mill was taken over by Arauco of Chile on 24th January 2012. We can also state that the capacity is revised from 400,000m3 to 331,000m3, due to new information received from a reliable trade source. The mill is still listed as Uniboard in our main listings, because that is who owned it in 2011.

In another major takeover, International Paper (IP) bought out Temple Inland, with its Mount Jewett, Pennsylvania MDF mill and other building products concerns, and, presumably more importantly for IP, its corrugated packaging business.

In the takeover, IP merged its wholly-owned Metal Acquisition Inc subsidiary into Temple Inland, making Temple Inland a wholly-owned subsidiary of IP.

The takeover became effective on the 14th February 2012. Similarly, the mill remains as Temple Inland in our main listings because that was the situation in 2011.

Capacity changes in N America

The North American MDF capacity in 2012 comprises 14 mills in the US, five mills in Canada and two in Mexico.

There are no planned new mills or capacity expansions of which we are aware at the time of going to press and we would have been very surprised if there were.

We have, however, been advised of one closure, in the US - that of Sierra Pine's Rocklin mill in California, which closed its doors on 16th December 2011. This removed 80,000m3 of capacity.

Table 3 gives a complete breakdown of the capacity in Mexico, the US and Canada from 2009 to 2011 and shows a fall of around 2.4%between 2010 and 2011 for the region as a whole.

In its Particleboard and MDF Commentary for January 2012, global forest products consultancy RISI (www.risiinfo.com) said that it does not expect a significant rebound in panel (particleboard and MDF) consumption before 2013, but admitted that the housing market could turn faster than it is forecasting.

It said that US consumption of MDF in 2011 was 5.9% above 2010 and that it expected similar growth in 2012.

Business barometer

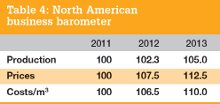

Table 4 shows the 2011 index as '100' and the 2011 and 2012 results for North America show the trends rather than statistical precision.

However, it does underpin the view in the business barometer that prices may well rise by an average 10% during 2012/13, compared with only 7 or 8% in last year's barometer, and that costs are expected to rise by an average of 8%.

The industry expectation of price changes is entirely driven by costs, so it is not surprising that both selling prices and costs are anticipated to rise.

It is also not surprising that production is expected to show a very modest increase, in the light of current - and apparently anticipated future - poor demand in North America.

Regrettably, insufficient data was returned by European manufacturers to compile a meaningful business barometer for that region. However, it seems reasonable to expect that similarly lack-lustre figures would apply to that region as well, at least in western and central Europe.