Mixed Fortunes

16 May 2016In Europe in 2015, which this report reviews, the story was of two parts. On the one hand demand was good, while on the other, prices were under pressure. Mike Botting reports on countries outside North America.

As we reported in the 'rest of the world' OSB survey in this issue in 2015, from 2009 to 2013, the OSB industry in Europe, and particularly western Europe, was in buoyant mood, with most mills having to run flat out to meet increasing demand.

The story last year (of the market in 2014), however, was less upbeat, with companies in western Europe finding it increasingly difficult to compete with the large quantity of new capacity that was coming on stream in the eastern part of Europe - and which continues to increase today.

Meanwhile the threat to wood supplies from the subsidised 'biomass' energy generation industry in western Europe is only getting worse for those manufacturers who do not have 'ring-fenced' supplies.

This report will focus on the situation for OSB producers in 2015 and offers a more positive outlook than that seen for 2014. Of the western European OSB producers spoken to for this report, all said they had produced to capacity in 2015 and were optimistic about 2016 as well.

This year also sees confirmation of the go-ahead for another new line in western Europe: with the new Smartply line starting up in the Irish Republic as we went to press, Norbord Europe has announced that it is to go ahead with its long-rumoured new OSB line in Scotland, replacing - and significantly adding to - the capacity of its existing two multi-opening lines there.

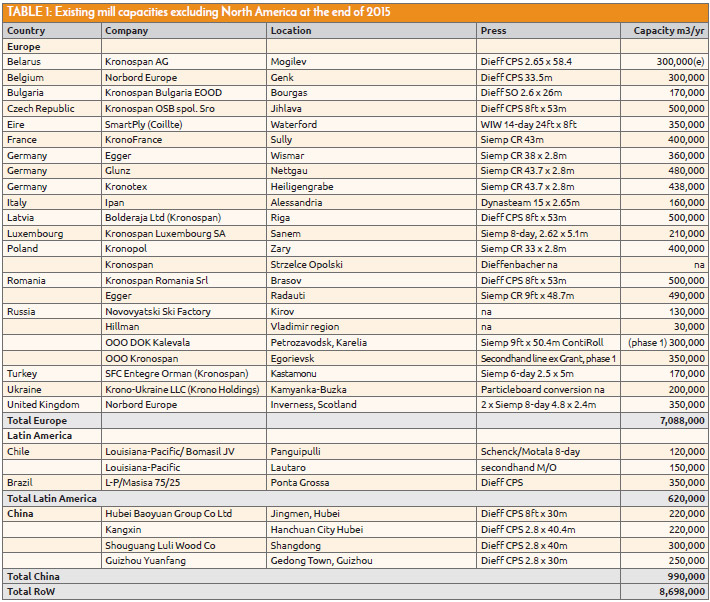

It doesn't seem that long ago that the OSB industry outside North America - and all within western Europe - was struggling to sell a production of around three million cubic metres in total. Now, 'greater Europe' is apparently already shifting most of its 7,088,000m3 of production each year.

However, quantity isn't everything: the price obtained for that volume of boards must also be considered and in general, western European manufacturers appear to be finding it difficult to increase prices and to keep them there. Wood raw material, resin, and transport costs, meanwhile, continue to rise for most producers.

Europe

Starting in the western-most part of western Europe, Ireland, Smartply's new OSB line was due to start production during April.

The MDF and OSB arm of the Irish Republic's state forestry company Coillte, has its new Siempelkamp ContiRoll continuous OSB press installed and running in the existing Waterford site.

The factory's pre-existing 14-daylight multi-opening Washington Iron Works press is to be closed down imminently, though the fate of the machinery is currently unknown.

Initially at least, the same capacity will produced as before - 350,000m3/year - but the new ContiRoll line is designed for a maximum capacity of 500,000m3/year and Smartply intends to increase production towards that maximum "When markets are suitable".

When interviewed in March, a spokesman reported that the original green end from the WIW line had been largely retained, though of course the forming system has been completely replaced.

The finishing line for sawing and T&G of the OSB panels produced has also been completely renewed, employing a Schwabedissen system to perform both functions; the T&G system employs a double-end-tenoning line.

The ground works for the new OSB line began in early 2015, so the complete setup time for the new line has been quite impressive. The ContiRoll line was built in what was warehousing and when it is fully commissioned the old line will be closed and dismantled and the building currently housing the WIW line will then be converted for use as warehousing.

While approaching the inevitable end of its life, the WIW line continued to produce at full capacity in 2015, said the spokesman. "We were able to do that because our core markets remained quite strong. Our UK business particularly remained strong, adding more consumption than usual.

"The only problem was the 'dumping' of board by eastern European manufacturers, making the price low and ultimately unsustainable.

"Apart from construction activity being up in 2015, we also saw a big increase in substitution of OSB for plywood. Confirming a situation that has been the subject of much complaint (in the UK particularly) for some time, the spokesman added: "The quality of much imported plywood is a problem, but OSB ticks every box in terms of grades, quality of production, gluing, etc."

As it is owned by the Irish state forestry company, one would not expect to hear of any problems with wood supply for Coillte's panel making facilities - and you won't.

To think about Smartply's new line as just a new continuous press line, is to miss a major part of the point of buying it. Importantly, it also means Smartply can enter markets that were previously closed to it, or difficult for it to access, because the ContiRoll will produce a wider range of panel sizes from its ribbon of OSB output than could the WIW press.

"I believe the business in 2016 will continue to grow in all our markets as demand increases and capacity-utilisation becomes more balanced and I hope this will also lead to opportunities for price increases.

"Meanwhile, timber frame construction is holding its own and taking advantage of an increase in demand for housing, especially in the UK."

The spokesman declined to comment on the likely consequences of the forthcoming new OSB line across the Irish Sea.... However, of course, his counterpart at Norbord in Scotland had no such restraints.

The world was perhaps rather shocked by the announcement of the merger between Ainsworth Lumber Co Ltd of Vancouver British Columbia, Canada and Norbord of Toronto, Ontario, on March 31, 2015.

This preceded another major announcement, rumoured for some time, that Norbord was to invest in a completely new line at its OSB factory in Inverness, Scotland.

Norbord, which first bought the Inverness factory in 1988 - becoming in the process the only North American OSB producer in Europe - has continually expanded the output from the two eight-daylight Siempelkamp press lines ever since. That expansion has culminated in a 350,000m3/ year capacity today.

Now the company intends to build a completely new, continuous press, OSB line on the site.

"The contracts have not yet been placed with any machinery suppliers, but engineering design has been done and we are in final negotiations on each part of the project," said Mr Morris, managing director of Norbord Europe, when interviewed for our 'The Interview' feature elsewhere in this issue of WBPI. He also said: "The anticipated capacity of the new continuous line will be 640,000m3/year and it is being built as a 'brownfield' development on the Inverness site, meaning that the old lines can be phased out when the new one is up and running.

"When we are comfortable that we can service customers from the new line, we will switch off the existing ones and remove them".

Obviously, given that comment about machinery suppliers not yet being selected, no firm date can be given for start-up of the new line, but now the green light has been lit, expect it to be in "at least two years" as stated by a Norbord spokesman.

Just as mentioned earlier for that other multi-opening line in Ireland, having a continuous press to replace multi-opening technology will give the company a wider range of board sizes to offer.

A spokesman at Norbord Scotland, interviewed for this report, said that the market for OSB had grown by 15% in the UK during 2015.

He again cited substitution for plywood among the strong positives for OSB sales growth, adding that there was a lot more plywood to be replaced.

Norbord will need that growth, as the spokesman said the new line is set to have that large capacity increase: potentially by 290,000m3 over the existing two lines in Inverness (to a total of 640,000m3). "That will make us a low-cost supplier to the UK and Europe," he said.

"There have been a lot of cheap [OSB] imports coming into the UK from the Continent because the pound/euro exchange rate has been a problem over the last 12 months. However, at one point, plywood was 40% more expensive than OSB and we are highlighting that price difference to our customers.

He said that there is, though, "a lot" of OSB coming in from some producers in Europe that doesn't even meet EN300, due to lack of correct gluing for one thing. "A lot of timber frame makers are using sub-standard OSB, even though it only comprises less than 4% of the cost of the house kit," alleged the spokesman. Norbord of course also has a foot in the European continent with its OSB mill in Genk, Belgium.

Karl Morris, MD of Norbord Europe, said that Genk is fully invested now and there is only room for 'tweaking' of the line to get any more volume out of it.

Mr Morris said that: "After several years of de-bottlenecking, and considerable capital investment, we increased the plated capacity significantly at Genk by 2014". Over the border in Luxembourg, Kronolux's OSB mill sold to full capacity in 2015. A spokesman said the company managed to increase its prices towards the end of last year, but that there are still cheap prices around.

"In 2014-15, the OSB market price in Europe dropped a lot - 20-35% - and it will not recover in a short time," he said. "This was due to too much capacity and a shrinking market in eastern Europe after the Ukraine/Russia business and so on." He also said that he thought Smartply's new capacity would keep the price down as it enters new markets with its new formats.

He then pointed to the Krono Hungary start-up due in August 2016. "There will be a 30% overall increase in capacity in Europe over the next two years," he suggested. "Consumption was quite nice in 2015, with western Europe, the Netherlands, Belgium and Germany running well. Western Europe as a whole was quite good, with Spain and Portugal picking up.

"Increasing consumption will be a question of other international markets as several producers will ship worldwide." He pointed out that the advantage of a lower price is that the competition goes to a wider market. "For instance, the US is competing with Europe in Asia; plus there is the question of currency fluctuations.

"Consumption will increase in the coming yeas, but in different areas. It is not realistic to just return to the old [higher] prices. I think that a 5 to 10% increase is possible, but prices in Europe go down quickly and up slowly, unlike in the US."

In Germany, Glunz's mill in Nettgau also reported a full order book. "I am also thinking of about the same production for this year," said a spokesman. "I thought that November/December 2015 and January/ February 2016 would not be good for us, but it was the opposite. We managed to increase our prices recently, to compensate for fuel and wood costs, etc.

"Yes, capacity is growing in eastern Europe, but the west likes our quality. Demand, as far as we can see from our orders, is still there and some customers are waiting six weeks for delivery."

Glunz's mill produced 450,000m3 in 2015, but the spokesman said it could be the full 480,000m3 this year.

At the end of 2015, we announced in WBPI that Glunz's parent company Sonae, and Arauco of Chile, had set up a joint venture in wood based panels.

One result of this, apparently, is that the wood procurement of the two companies has been combined, with advantages for both.

"OSB is in a good situation now and I think it will continue to be so for the rest of this year," concluded the spokesman.

Also in Germany, Egger's Wismar plant in the north of the country continued to produce to its capacity of 360,000m3/year. No increase in this figure is planned. "We definitely produced to capacity in 2015. Market conditions were not so good, but we sold all the volume, so we are quite satisfied.

"The prices have definitely been under pressure in the last months but we have been able to improve them in Germanspeaking markets, which are in better shape than other European markets, so we were able to improve our results in the end."

He felt that the new western European capacity in Ireland and Scotland would impact markets. "But every year one or two new mills open and these are just two more. They will have an impact but how dramatically and when will the European market recover? It has been generally weak for a few years now. Eastern Europe is also not in good shape at the moment.

"If Europe calms down, there might be an even better chance for OSB than there is today."

Egger of course also has a mill in eastern Europe - in Radauti in Romania - and the spokesman said that mill is also doing well, but trades in more volatile markets than its German sister.

"In January, we thought that the negative impact on Romania might be huge, but it was not as bad as we thought. We are quite happy with our sales volume - we sold 100% of our 490,000m3 capacity."

The spokesman admitted that the biomass issue has been impacting wood supply in general for some years now and that mills' procurement departments had to do what they could.

"I am optimistic about 2016 - building is continuing and there is demand and that is also a western European indicator of economic recovery. There is also definitely demand from construction in eastern Europe.

"I am certainly optimistic for this year. It has started well and I hope that will continue for the whole year."

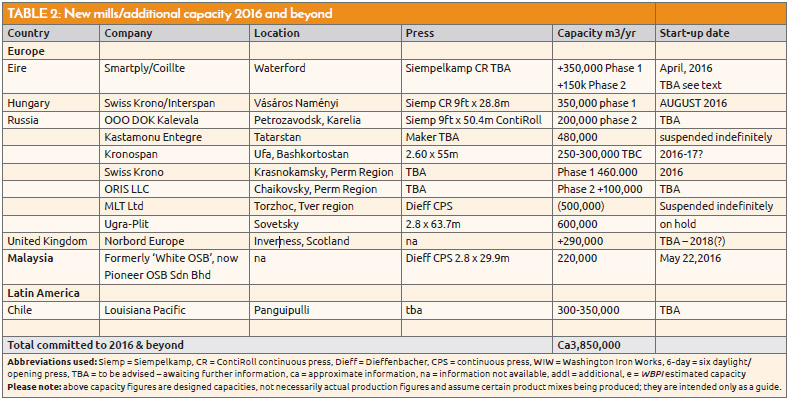

The total designed capacity for mills operating in greater Europe in 2015 is 7,088,000m3/year (see Table 1) and the total for the 'rest of the world', outside North America, is 8,698,000m3/year.

Eastern Europe

We have mentioned Egger's mill in Romania, but eastern Europe also offers some 'new' mills for this year's report, which are now in production. These were in Table 2, 2014 as projects not yet onstream.

In Belarus, Kronospan's line at Mogilev has been moved to Table 1, 'Existing mill capacities in Europe in 2015' as it started production in the last quarter of 2014. This line has a design capacity of 300,000m3/year.

In Russia, OOO Kronospan's line in Egorievsk also began production in late 2014, so has also moved to Table 1. This is a secondhand line from Grant Forest Products and is phase one of a two-phase plan. Phase 1 is 350,000m3/year capacity, while phase 2 will take it up to 700,000m3, according to an expert on the Russian industry, Igor Novoselov, who spoke at the 2015 EPF AGM in Vienna.Also in Russia, but remaining in Table 2, New mills/additional capacity 2016 & beyond, OOO DOK Kalevala is still on hold. It is a Siempelkamp ContiRoll contract but has no start-up date set at this time.

A Kronospan line in Ufa, Bashkortostan, has been rumoured for some time, to start up in 2016/17 with a capacity of 250- 300,000m3/year, but we have been unable to obtain any precise information about it. This is mainly because we understand it to be a secondhand line, rather than new supply; and the company is notoriously secretive about capacities.

Again in Russia, the proposed Ugra-Plit line in Sovetsky has been on hold since 2015, according to Siempelkamp, which has a contract for a ContiRoll line there. It has already supplied a 300,000m3/year particleboard line to the same company and site.

The MLT line in Russia is still shown in Table 2, but is now postponed indefinitely so is not included in the total for Table 2.

Finally for anticipated new lines in Russia, Kastamonu of Turkey has been planning a new OSB line in Tatarstan for some time, but advises that the project is still suspended with no suggested start-up date, while the ORIS LLC line is still suspended "indefinitely".

In Hungary, meanwhile, Kronotec's Interspan mill is due to start production in mid-2016, as advised last year.

Finally for new capacity in greater Europe, the Dieffenbacher line in Poland for Kronospan, which is located in Strzelce Opolski, produced its first board on April 2, 2015, so again is in Table 1 now.

Looking now to Malaysia, Pioneer OSB's new line is due to produce its first board on May 22, 2016.

In China, the Dieffenbacher-supplied Kangxin line in Hubei province produced its first board on April 15, 2015.

Another Chinese project for Dieffenbacher was Shouguang Luli. The first board came off the line on July 30, 2015. Finally for China, the Dieffenbacher line at Guizhou Yuanfang produced its first board on September 25, 2015.

All three lines have thus been moved to Table 1 for 2015.

South America

Nashville-based Louisiana-Pacific's second plant, with a capacity of 300,000-350,000m3/ year, will be located near its first Chilean mill at Panguipulli in the Valdivia region. Like the firm's other two local lines, the plant will feature used machinery shipped from idled group plants in North America.

We still await confirmation of an intended start-up date for this mill.

Louisiana-Pacific (LP) South America runs a 350,000m3/year continuous Dieffenbacher OSB line at Ponta Grossa, Brazil. In Chile, LP also has its 150,000m3/year capacity line at Lautaro (both in Table 1).

Planned capacity, 'Rest of the world'

Table 2 shows the mills that are currently planned or under construction in all countries and regions of the world for start-up in 2016 and beyond and has been updated from last year's table as mentioned above, when mills have commenced production and therefore been moved to Table 1.

Looking at Table 2 we can see that there are still many new mills 'in the pipeline'. These are: Belarus (1); Irish Republic (Smartply phase 1 & 2); Hungary (1); Russia (7); UK (1); Malaysia (1); Chile (1). Some of those are TBA for start-up so timing is obviously unknown, but we have assumed they will all go ahead. However, as the ORIS line is "suspended indefinitely", we have not included it in the total for anticipated capacity, which is thus ca3.85 million m3.

Conclusion

This year's report shows no new mills planned that weren't included in last year's lists, but does give the latest situation, as far as we are aware, concerning which mills are now in production and which are still planned for start-up in 2016 and beyond.

We can see that there is 8.698 million m3 of current production (Table 1) and 3.850 million m3 of capacity still to come onstream in 2016 and beyond.

However, we must recognise that some of those planned lines which have been repeatedly delayed may not come to fruition.

Worthy of note is the fact that this year's report shows no new OSB mills in China because all planned new capacity is now in production.

China now has a total national capacity in production of 990,000m3 - and that is quite a jump from 220,000m3 in one mill last year. Greater Europe (east and west combined) has a lot of capacity running and planned and it seems there must be some hard times ahead for pricing as all that capacity tries to find a home.

However, the markets are growing, by substitution for other sheet materials, mainly plywood, and by increasing use of timber frame construction methods.

Overall, the mood in the European industry seems unerringly positive and that has to be a good thing.

Meanwhile, China is moving forward after a very late and slow start.