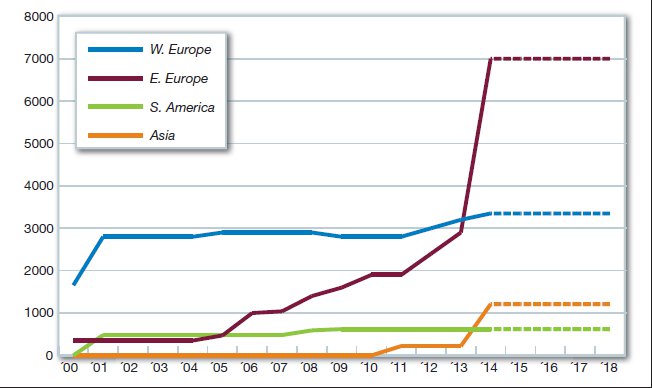

Look east for the future

15 May 2014This year’s survey, of existing capacities in 2013, and future planned capacity, shows some interesting trends. Western Europe at last has two new mills planned (one definite), but eastern Europe is forging ahead in total volume to a very big lead by 2017. Mike Botting summarises his findings.

The western European OSB industry continued its positive story in 2013, building on the recovery which began, perhaps surprisingly, in mid-recession 2009.

Producers are again reporting strong sales in 2013, with all saying they have been able to sell all they produce - and producing at or above the designed capacity of their plants.

As 2014 began, some sensed a slowing down of the market, but it has since picked up again - perhaps assisted by an unusually warm western European winter enabling more housebuilding projects to continue, unhampered by snow and ice.

Our surveys of the last few years have only been able to report mostly incremental increases to line capacities among the western Europe producers - such as the 20,000m3/year increase in the capacity of the existing line, from 460,000m3 to 480,000m3/ year, at Glunz's plant in Nettgau, Germany in 2012; and 25,000m3 added to 325,000m3 at Smartply in Ireland (Eire) in the same year.

However, this year we can report on two major expansion projects in the region.

The aforementioned Smartply, owned by Coillte Panel Products, the panel making arm of the state-owned forestry company, plans to install a complete new line at its Waterford factory, releasing the following press release on December 5, 2013:

"Coillte Panel Products and SmartPly are pleased to announce that they have received shareholder approval for a substantial investment in SmartPly, to include a state-ofthe art [Siempelkamp] ContiRoll press, as well as new forming and finishing lines. The new line will dramatically increase the capacity of the current mill, firmly establishing SmartPly's commitment to the future OSB requirements of its customers".

The new line will increase capacity at Waterford from 350,000 to 500,000m3 per year, replacing the existing Washington Iron Works multi-daylight press.

Start-up of the new line, interestingly described by Andrew MacDonald, sales and marketing director, as "phase 1", is anticipated in Q1, 2015. He added that the order for the continuous press line was "imminent", when interviewed in mid-March.

"We are hoping to appoint [site] contractors in the next 10 days. We are going to run the new pressing and finishing line in parallel with the existing one, in a brand new building adjacent to the existing production hall, and then we'll switch over the green end. The old line will then be removed and sold and the building re-used.

"This will allow us to bring a beautiful board and value-added products to the market and to be stronger on the European continent in markets that we can't currently access, because of our limitations in panel sizes. A lot of the extra capacity will go to central Europe," said Mr MacDonald.

"Importantly, we are fully-sourced for logs in Eire, and fully integrated as a company, which is a huge USP for us."

This will be the first completely new line to be installed in western Europe for quite a few years.

But it may not be the only one.

Norbord of Canada which, as Norbord Europe, has OSB mills in Inverness, Scotland and Genk, Belgium, is also looking seriously at increasing its capacity at its Inverness factory.

A spokesman, who mentioned it as a 'wish' during last year's survey, told WBPI in March that the new line was awaiting approval from the management board of Norbord and that he hoped that would be received in April, after we went to press with this issue.

"We are already doing the preparatory work and we are hoping to have an annual capacity of 600,000m3 towards the end of 2016," he said.

"Brookfield Properties is a major shareholder in Norbord and has been for many years and is always very supportive of the business," said the spokesman.

The new continuous line, for which the supplier has obviously yet to be chosen, would replace the existing two Siempelkamp eight-daylight press lines, bringing the mill leaping into the 21st century.

We have not included this prospective new line in the totals in the table for new mills, but we have shown it as 'subject to approval'.

If both these new lines - at Smartply and Norbord - with their increased capacities compared with the existing ones, do both come to fruition, as seems likely, then that could be a challenge for the western European OSB supply industry unless and until markets are found for the extra 400,000m3/year or so produced.

"The current UK market for OSB is around 400-450,000m3 /year, so exports would have to be increased," pointed out the Norbord spokesman.

He contended that in the UK at least, there is still plenty of scope for plywood substitution.

"We have taken a lot of market share from plywood in the last five years and we need to take another 2-300,000m3 away from that product, so it is not just export markets we will be looking at, but further product substitution in the UK as well. There is 8-900,000m3/year of plywood coming into the UK and we want to replace at least one third of that."

He went on to say that the quality of much of that imported plywood is very poor (especially that from China) and often unfit for purpose where OSB would, in his opinion, do a much better job.

Not only is Norbord's UK mill doing well, but its continuous Dieffenbacher line in Genk is also selling to full capacity, said the spokesman.

On the continent, western European demand is also growing and that growth looks set to continue.

As in the UK, this is partly due to substitution for plywood.

However, In some countries - notably Germany and Switzerland - it is also due to the increasing demand for more environmentally-friendly construction methods - and for better-insulated 'eco homes'. The increased use of OSB, for walls, floors and roofs is of course a good way to meet these demands.

The Glunz OSB mill in Nettgau in Germany is also selling all the board it can produce and not experiencing as much competition from the growing capacities in eastern Europe as it once feared it would. In fact, Glunz is selling to Russia and the Ukraine and a spokesman for the factory said that he felt that its quality was well-accepted in those markets.

However, the feeling is that the evergrowing volumes coming out of eastern Europe will continue to make it difficult to increase prices in real terms.

In the far north of Germany, Egger's Wismar plant is also selling all the 360,000m3/ year or so that it produces (depending on specification of course), but a spokeswoman admitted that the planned new volumes in Eire and the UK could be a problem when, and if, respectively, they come on stream.

Meanwhile, Egger has reported that the capacity of its plant in Romania, at Radauti, Has been increased from 300,000m3/year to 490,000m3/year during 2013 (this is thus shown in Table 1).

Kronofrance in Sully-sur-Loire also had a good 2013 for sales and a good start to 2014. Nominal capacity is still 400,000m3/year, but the company plans to increase this by up to 25% by tweaking the existing line, with some of that increase anticipated to come on stream during this year (2014).

The company was able to increase its prices by more than its increased costs during 2013, but these gains were soon eroded by those rises in costs, particularly for logs.

An additional problem in the winter of 2013/14 was raised by the extremely wet conditions in France, which hampered the extraction of logs from the forest. Standing wood supply is more than adequate in this part of the country, but if the trees cannot be harvested, it is no help. Other countries were also affected by the heavy rains of course.

Prices for the western European OSB producers do not appear to have made great real-term gains in 2013 and the same is generally forecast for this year.

Increases have been achieved by the major players, but in general these seem to have covered rising costs in wood, resin, energy and logistics, rather than providing any increase in operating profits for the mills.

Another problem for western/central European producers continues to be the biomass policies of the EU, where government subsidies to energy generators give that industry substantial advantages over the panel producers and make the competition for wood more fierce.

There is further unwelcome competition from the growing numbers of eastern European OSB producers which are causing serious concern to one western producer at least.

"Some of them are disturbing the market with seriously aggressive pricing policies and dropping their prices with no reason," said a spokesman for one major producer.

"The prolonged rain has been a problem for everyone in terms of log supply, so we should see increased, or at least stable, prices for OSB but there is just stupid competition coming from the east.

"I think this year will see a very tough market and further new capacity in the east will damage our market and the price level. The picture could be very dark because the price of wood will continues to increase.

"There is no problem in demand for OSB at present, but it is very difficult to forecast that, even three months ahead."

In this year's survey, we have added two mills to Table 1: Existing mill capacities excluding North America for 2013.

In Italy, the Ipan mill, supplied entirely by Italian machinery group Imal-Pal, is shown for the first time as it began commercial production in January 2013.

Meanwhile, in Russia, we have added the Novovyatski Ski factory's 100,000m3/year line as that was also launched in early 2013. We do not have information about the equipment used in that factory.

South America

Demand for OSB continues to grow in South America, reports our correspondent for the region, Richard Higgs. This is thanks chiefly to the pioneering presence of US giant Louisiana Pacific, though it felt the impact of competition recently from rival US groups in its Chilean backyard.

Nashville-based LP, which runs OSB mills in Chile and Brazil, saw its Chilean sales volume slide by 7% in the final three months of 2013 and its regional pre-tax profit was halved to US$5m for the quarter against the same period in 2012.

This the firm blamed mainly on the availability of imported board due to "opportunistic" offloading of excess capacity by North American producers, along with strengthening of the US dollar.

Even so, in contrast, LP's Brazilian OSB business enjoyed a 16% jump in Q4 sales volume on the back of higher exports to other Latin American countries and increasing penetration of the local market.

Overall in 2013, LP South America continued to grow, recording net sales up 2% at US$172m - a modest rise against the 16% jump recorded in 2012 - with EBITDA up slightly at US$31m, reported the group.

In 2012, OSB sales in Chile grew strongly, partly thanks to greater plywood substitution, but the latter effect will have lessened last year with the launch of a second plywood line by local forest products group CMPC; and the return of Arauco's rebuilt Nueva Aldea plywood plant.

The LP group is committed to Latin America and its sights remain focused on the region's long-term growth prospects for OSB. It has been debating proposals to boost regional capacity for some years, by adding a second OSB plant in Brazil and expanding again in Chile.

LP South America is now in the preliminary planning stage of a project to add a third OSB line in Chile, with strong indications it may install a larger used unit next year, from one of its idled US mills, at the southern site in Panguipulli [we have not included that line in our new mills table yet - editor].

LP, which is planning capital spending in 2014 of around US$100m across the group, has earmarked half that sum for maintenance and productivity improvement, with part of the remaining US$50m dedicated to the third Chilean plant.

The group's Chilean management team have been awaiting the project green light and last August, after reviewing the investment plan with group directors, were said to be keen to get started on expansion right away.

Today, LP has OSB capacity of 270,000m3/ year in Chile, on ex-US batch lines, including its original 120,000m3/year unit at Panguipulli in the Valdivia region and 150,000m3/year unit at the newer Lautaro plant, launched in 2008. LP shed more light on its expansion plan last summer at a 2nd quarter 2013 results presentation to analysts. The group was looking at transferring a larger-capacity line from the US to an existing Chilean mill, idling the current line while the new unit ramps up.

The new line could later be dedicated to siding production, explained LP ceo Curt Stevens. The company recently enjoyed strong growth in its SmartSide siding products in North and South America and it now needs more capacity in the southern sub continent.

A formal decision on the Chile expansion plan was scheduled for a board meeting in February or May 2014 and if positive, "limited production" on the new line could be achieved by the end of 2015, said the chief executive in August 2013. There is no news yet.

In the past, he suggested that LP would need to install in Chile a used US line of 310,000 to 350,000m3/year. Suitable possible sources among the group's redundant North American plants include Silsbee, Texas and Athens, Georgia, but a bigger line at its Canadian St Michel site in Quebec would.