Cranking up the action

15 May 2014With the US housing market recovery standing on more solid ground during the second part of 2013, the major producers have cranked up the action in this past year, with several long-curtailed mills now ramping up production, and one important merger nearing completion.

The OSB field is getting smaller and some say that's no bad thing if it means capacity comes back in a controlled way.

Control over North American OSB production capacity is going to be in fewer hands, now the recession is over, than it was in 2004. The consolidation of the supply base, however, has occurred with surprisingly little drama.

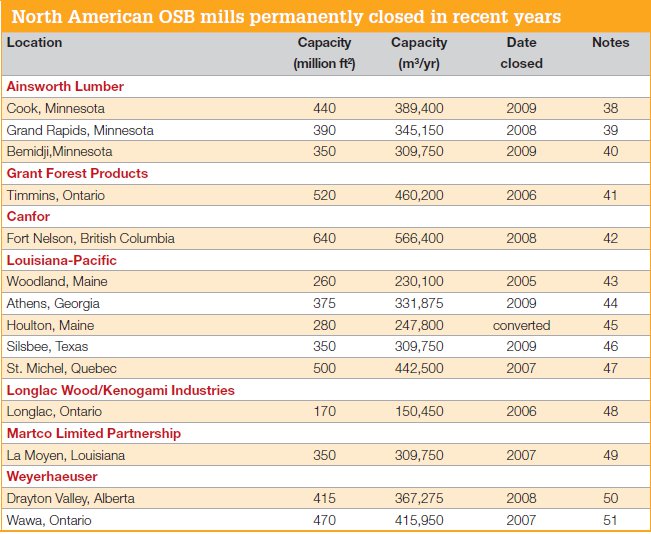

In 2010, we saw Georgia-Pacific LLC (GP) acquire the OSB assets of bankr upt Grant Forest Products Inc, including two shiny new state-of-the-art mills in South Carolina, one of them still under construction.

The big news in 2013 for this industr y sector, obviously, was the announcement in September that Louisiana-Pacific Corp (LP) would be acquiring Ainsworth Lumber Co Ltd.

In May 2013, LP had already bought out Canfor Corp's share of the Peace Valley joint venture OSB mill in For t St John, British Columbia, which put the Canadian lumber giant out of the OSB business altogether. Canfor confirmed early last year that its PolarBoard OSB mill, also in British Columbia, was permanently closed.

In November 2013, Tolko Industries Ltd announced it had secured full control of the Meadow Lake OSB mill in Saskatchewan, as outlined in the partnership agreement it struck with the provincial government and First Nations stakeholders in 2001 to build the mill.

Prior to the LP-Ainsworth deal, the top five North American OSB producers represented about 77% of capacity and in 2011 accounted for about 82% of production, according to investment analyst Paul Quinn of RBC Capital Markets in a research note last year.

As we enter 2014, with the LP/ Ainsworth deal on the verge of completing but not yet finalised, this is what the OSB landscape across the US and Canada looks like.

With Ainsworth's production added to LP's portfolio, the Nashville, Tennessee based building products giant will account for about 32% of North American OSB capacity, according to industry analysts, with almost double the output of each of its two nearest competitors.

LP was already North America's largest OSB producer, with annual capacity (excluding Ainsworth's) of 5.97 billion ft2 (3/8in basis), including the 820 million ft 2 per year Peace Valley OSB former joint venture with Canfor.

LP's Canadian OSB mills are: Chambord and Maniwaki in Quebec, with respective annual capacities of 470 million ft 2 and 650 million ft2; Swan Valley in Manitoba (410 Million ft2 per year); and Dawson Creek in British Columbia (380 million ft2 per year).

Chambord was curtailed for market reasons in 2008 and is still not operating. LP recently restarted Dawson Creek, which had been shut since 2011, although executives indicated in a financial conference call in February that the mill's current output is limited.

In the US, LP's OSB mills are: Sagola, OSB mill in Spring City, Tennessee, has been indefinitely closed since 2011. The Chattanoogan reported in October 2011 that Huber had announced the indefinite closure of the facility, based on the continued weakness in residential construction. An analyst with Raymond James Ltd, in a research note on Ainsworth in June 2013, also indicated that Huber's Spring City mill continues to be closed.

Tolko Industries, when all its mills are operating, has about two billion ft 2 of rated OSB capacity, though for much of the recession only Meadow Lake, Saskatchewan (700 million ft2 per year) has been r unning. Tolko announced in December 2013 that it was ramping up its state-of-the-ar t Athabasca Division engineered wood facility (800 million ft2 per year) at Slake Lake, Alberta and had previously stated it was aiming to bring the mill back online in Q1, 2014.

Tolko has not spoken yet of re-opening the smaller, older, Slave Lake mill (250 million ft2 per year), which was going to be switched to value-added production to support the new Athabasca facility, nor the High Prairie, Alberta, mill (640 million ft2 per year) curtailed for market reasons in February 2008.

In fact, in August 2013 Tolko was reported in the Canadian media as categorically stating it would not reopen High Prairie without evidence of a sustainable housing recovery, after the decision to restart the Athabasca OSB mill had raised hopes in the High Prairie community.

To the best of our knowledge, there has been no change in status since last year of the mills owned by any of the remaining OSB companies in North America, which are:-

- Arbec Forest Products, with total rated capacity of 700 million ft2 per year of OSB from its 294mmsf/year former Tembec OSB mill in St Georges de Champlain, Quebec, and the former Weyerhaeuser Miramichi, New Brunswick, OSB mill (407mmsf/year) acquired in 2012.

- Martco Limited Partnership (Roy O Martin), with 850 million ft2 per year from its single OSB mill in Oakdale, Louisiana.

- Langboard in Quitman, Georgia (440 million ft2 per year ).

The state of the market in 2013

Total North American structural panel production in 2013 reached 29.898 billion ft2, up 7.6% from 27.785 billion ft 2 in 2012, according to statistics released in January 2014 by APA-The Engineered Wood Association.

North American OSB production in 2013 was 18.760 billion ft2, up 11.8% from 16.780 billion ft2 in 2012.

Of that volume, US OSB production was 12.492 billion ft2, up 13.1% from 11.038 billion ft2 in 2012, and Canadian production was 6.268 billion ft2, up 9.2% from 5.742 billion ft2 in the previous year.

North American OSB consumption in 2013 was 18.055 billion ft2, up 12% from 16.121 billion ft2 in 2012, with the US consuming 16.153 billion ft2 of OSB - 14.5% more than 2012's OSB consumption of 14.109 billion ft2.

Canada consumed 1.902 billion ft2 of OSB in 2013, compared with 2.012 billion ft 2 a year earlier.

Total North American offshore imports of structural panels for the whole of 2013 were 4.607 billion ft2, compared with 3.804 billion ft2 in 2012, of which 3.991 billion ft 2 was OSB, according to APA statistics.

Meanwhile, exports of OSB in 2013 from the US were 331 million ft2, up from 307 million ft2 in 2012.

Canada exported 4.506 billion ft2 of OSB, up from 3.844 billion ft2 in 2012.

Offshore OSB exports from the US and Canada were up 8% from 2012 at 724 million ft2, APA noted.

Prospects for reviving new mill plans

With OSB demand and supply seemingly coming more into balance, it's worth looking at whether any of those new mill plans on the table at the height of the OSB market boom almost a decade ago could be revived. After all, the propensity for the OSB industry to shoot itself in the foot by building new capacity at the first whiff of a market opportunity is practically the stuff of legend.

Deutsche Bank Securities Inc noted in a September 2013 research note related to the LP-Ainsworth news: "There is still significant idled/semi-finished supply sitting on the sidelines. In a segment legendary for aggressive and destructive 'herd behaviour', consolidation places latent capacity in a smaller number of hands and reduces the risk of too many players restarting too much capacity too quickly".

If housing starts return to normalised levels of 1.4-1.5 million/year, the OSB industry could enjoy a healthy market over the next few years, said Deutsche Bank. "However, if capacity comes back too quickly, the party could end even before it starts."

Deutsche Bank was among those who linked the rush of OSB capacity restart announcements since the fourth quarter of 2012 - amounting to about 4.5 billion ft 2 per year - and the slower-than-expected ramp-up in housing demand as being largely responsible for the sharp OSB price correction in Q2, 2013. So Deutsche Bank's analyst seemed to welcome the prospect of further consolidation among OSB producers, which he said: "Could mean a more disciplined restoration of supply and more muted swings in OSB prices".

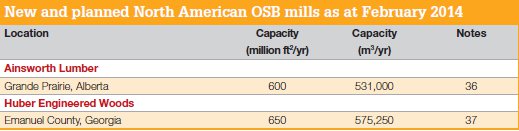

As of the start of 2014, there have been no murmurings about any company reviving long-mothballed plans to build new OSB mills in North America. (Ainsworth's new line at Grande Prairie and GP's Clarendon County mill don't count, as they were almost completed when the recession came along).

In fact, the only one not for mally written off in recent years is the mill which Huber had planned to build in Emanuel County, Georgia with a proposed capacity of 650 million ft2 per year, which should have commenced construction in 2007.

The US$280m project announced in 2006 was put on hold because of market conditions. As noted in this repor t last year, local media had reported a Huber executive saying the company still sees Swainsboro as an "ideal location for an OSB mill", but that economic conditions had to improve before the company could move forward with a new plant. As repor ted last year, Huber supported the decision of local authorities to cancel a bond designed to pave the way for the proposed mill.

Is the day of the 'megamill' done?

If and when there is a demand for new OSB mills to be built in North America, they may not be on the scale seen in projects that were announced and/or built since the start of this century, judging from comments made by LP's ceo Curt Stevens last summer.

In a conference call related to LP's second-quarter 2013 financials, Mr Stevens chatted with an analyst about the best mill sizes and configurations to provide the flexibility to weather market turbulence.

Vertical Research Partners analyst Chip Dillon had asked whether new mills in future would be of a similar size to new mills built immediately before the recession, noting the slowness of all the large new mills to come back on stream as demand has improved.

Mr Dillon asked whether there was a "lesson here in terms of maybe the scale of new capacity, maybe we've hit a point of diminishing returns and one day we will need more capacity? And do you think it will come in smaller chunks or do you think that they will still be of this size?".

Stevens said it was a "good question", noting that, when large mills go down, "they go down and you lose all of it, where if you have different configurations I think you have more flexibility".

LP's ceo said he "really liked" the configuration of the company's Hayward, Wisconsin mill, which was converted primarily to siding production when the Thomasville OSB mill was built, and has two lines.

"It gives me the flexibility to do siding on one of them and OSB on the other and then convert back to siding when the demand takes on/takes off. So I think that's a pretty good configuration," he said during the call.

When adding capacity in future, said Mr Stevens, LP is "going to take a page from the book of siding where we've added capacity in existing facilities to the extent we can by adding plans or adding additional peripheral equipment".

Housing market projections for 2014

Regardless of their size, whether and when new OSB mills are built in North America in future will be dictated by the fortunes of the all-important new single-family homes market, on which OSB continues to be heavily dependent. Its mixed fortunes in the past two years have contributed much to the erratic nature of OSB sales and prices.

As mentioned, analysts attributed the sharp OSB price correction in the second quarter of 2013 to a combination of news emerging about mills being brought back on line just as the ramp-up in housing demand proved slower than expected.

Since last autumn, however, US homebuilders have seemed more solidly optimistic. In November 2013, new-home production topped one million starts, led by a strong increase in both single-family and multi-family starts, the National Association of Homebuilders (NAHB) reported on December 18.

The November figures released by the US Department of Housing and Urban Development and the US Census Bureau were in line with the NAHB's survey around the same time, which showed builders were "increasingly confident that buyers who have sat on the sidelines are feeling more secure about their economic situation and are now moving to purchase new homes," said NAHB Chairman Rick Judson.

NAHB Chief Economist David Crowe said the five-year highs attained by single-family and multi-family starts had provided "additional evidence that the recovery is here to stay," despite a "soft spot" in autumn 2013 when interest rates jumped and the federal government closed down.

"Mortgage rates still remain very affordable and pent-up demand is helping to boost the housing market," Mr Crowe noted. "We expect a continued steady, gradual growth in starts and home sales in 2014".

The December figures weakened slightly, to just under one million starts, but the Washington-based NAHB was unphased, with Mr Judson noting in a January 17 release:

"Total housing starts of just under one million units in December was the third-highest monthly level of production in 2013. This rate is in line with our builder surveys, and tells us we are seeing a return to trend after a strong November."

Mr Crowe added: "Last year was a good year for home building, with overall production up 18% from 2012. As pent-up demand is unlocked and the labour market improves, we anticipate that 2014 should be an even better year for home construction".

In LP's conference call on February 13, 2014, relating to its 2013 financial results, Curt Stevens said there was "definitely momentum in the housing market, as both single-family and multi-family housing starts were higher last year than the prior year. There was a nearly 20% increase in 2013, and an additional 20% increase is forecast for both this year and next".

Mr Stevens based his view of the market on a review of the official data, discussions with customers and builders at February's International Builders Show (IBS) in Las Vegas, and conversations and presentations of the Policy Advisory Board meeting in early February at the Harvard Joint Center for Housing Studies.

"The single-family segment is still focused on more affluent buyers, as evidenced by the average square footage being the highest ever," said Mr Stevens.

Discussions at the JCHS Policy Advisory Board meeting suggested "There's still a strong belief that the first-time home buyer is unlikely to participate until there is more job growth and an increased availability of financing."

There was a general feeling at the JCHS meeting that the price increases experienced across the country in 2013 will moderate in all but the best markets, but the general mood on the market was upbeat, with "lots of comments on pent-up demand," said Mr Stevens.

"Consensus estimates from this group were also in the 1.1 million [housing] start range for 2014."

He also supported the NAHB view that builders are optimistic about 2014, with the number of exhibitors at the IBS up about 20%.

Prognosis for 2014 and beyond

North America is in year three of a recovery that follows four years of downturn, according to RBC Capital Markets analyst Paul Quinn, in a research note released in January related to Norbord's financials.

"While year-on-year growth will most probably be weaker than in prior cycles, the duration of this recovery should be longer, as we are still far below historical trends with respect to housing starts (latest figures under one million SAAR [seasonally adjusted annual rate] vs long-term average of 1.3-1.5 million annual starts)," stated Mr Quinn.

Demand from US new home construction continues to be strong relative to recent years, with housing starts and building permits showing robust year-on-year growth until quite recently, although the pace of housing growth has stagnated in recent months, which Mr Quinn credited as "primarily due to what is possibly one of the worst winters in a generation." As a result, OSB markets at the turn of the year into 2014 were rather soft, although Mr Quinn noted that inventories "remain razor thin".

While expecting the next couple of months to provide very weak US home building data because of the weather disruptions across several markets, Mr Quinn said: "As builders play catch-up once the weather finally breaks, we expect strong momentum from a number of construction statistics. At [plus or minus] 1.1 million housing starts (expected by the end of 2014 according to the median of economists' estimates), the current OSB capacity should be fully absorbed by the market".

TD Securities, commenting on the OSB market in a research note related to LP's Q4 financial results, said earnings in the sector would likely weaken further in the first quarter of 2014 as OSB prices had continued to decline.

"We note that the industry is only part way through the much-discussed capacity ramp up. Of the 4.4 billion ft2 of announced industry annual capacity restarts between Q4, 2012 and Q1, 2014, we estimate that around 50% is currently operating (protracted ramp up curves for several assets).

"We forecast improved prices by Q2, 2014, but expect that the recovery will be tempered by ongoing supply additions until 2015."