Continuous improvement

30 March 2015Arauco’s acquisition of Flakeboard was one of the biggest developments in the North American panel industry in recent years. Stephen Powney talks to Arauco North America President Kelly Shotbolt about the benefits of the move; and his thoughts on the industry’s future prospects.

Flakeboard has been a name synonymous with innovation and leadership in the North American panels industry for decades.

In its 50-plus years of panel manufacturing history it has achieved a number of industry firsts - including the first North American continuous Mende thin board line (1972) and the first North American particleboard producer to utilise continuous technology (1985). The bold 2006 acquisition of Weyerhaeuser's six panel mills quadrupled its capacity, making it the largest composite panel producer in North America at the time.

Its products include FIBREX® HDF, MDF, particleboard, TFL/melamine, as well as coating and paper overlay operations.

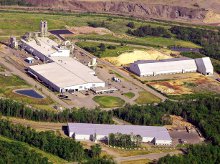

In 2012, a landmark announcement came when the South American-based forest products group Arauco acquired Flakeboard's seven mills.

Arauco, one of the world's largest forestry companies with panel production, sawmilling, pulp and forestry operations serving multiple markets, already had eight panel mills in South America.

In Chile it operates two plywood facilities (Arauco and Nueva Aldea), an MDF/hardboard mill (Cholguán) and an MDP operation (Teno), while in Argentina there is an MDF facility (Piray) and a particleboard plant (Zárate). It also operates two MDF plants (Jaguariaíva and Pién) in Brazil.

The takeover of the Moncure MDF/ particleboard facility from Pfleiderer in 2012 gave Arauco a foothold in North American production, while the Flakeboard acquisition that followed was a big demonstration of its belief in market prospects there.

For Kelly Shotbolt, longstanding president and ceo of Flakeboard, and now president of Arauco North America, the new ownership is an opportunity for further growth.

"Arauco's acquisition of Flakeboard is a platform for its growth in North America, with the expectation that business will continue to grow on this continent," he said.

"They want to take part in the renewal of the North American composite panels industry."

"The first area of focus will be MDF and particleboard because that is where the experience lies within Flakeboard."

"As Arauco deepens its understanding of North America and the opportunities that exist here, we will likely look at other investment possibilities: it is entirely possible to explore the additional product categories where Arauco has expertise such as pulp, lumber and plywood, in the future."

As of August 1, 2014 all Arauco's sales and operations in the US and Canada were combined under one organisation operating as Arauco North America. This change was aimed at strengthening and consolidating its headquarters in Atlanta, Georgia for all its North American operations - both manufacturing facilities and imports from offshore group mills.

The Flakeboard name is still present and legally doing business under the Arauco umbrella, but the name is expected to be phased out by mid-2015, when the Arauco branding takes over as a means of communicating its comprehensive product offering.

Although Mr Shotbolt's family has been part of Flakeboard's ownership since the early days of the company (1966), he is not sentimental about the Flakeboard name disappearing, but looks forward to the next chapter.

"We are every bit as proud to be part of Arauco as we were Flakeboard. It's much more about our quality, service, facilities and especially our people, than the name.

"Arauco has the vision, expertise, financial wherewithal and a deep desire to grow in North America. It is a privilege to work with the company."

Arauco certainly has the resources as a leading forest products company and Mr Shotbolt said this backing bodes well for the future development of the North American operations.

"If the market demands more products, we believe Arauco will be one of the companies to meet those needs. Whether that will be some form of modernisation of old sites, or a new greenfield site, is not possible to say at the moment."

Current investments at the Flakeboard mills include a US$30m project at the South Carolina particleboard facility, dealing with a bottleneck in the green end of the mill, adding 100,000m3 of capacity and adding another TFL press.

Many of the company's plants have undergone big investments in recent years, spurred on by the company's philosophy of "continuous improvement" for both its products and employees.

The Sault Ste Marie operation in Canada, formerly a joint venture with Georgia-Pacific, produces the largest volume of MDF of all single line presses in North America, utilising advanced automation, dual refining and specialised quality measurement systems.

The St Stephen, New Brunswick, facility has continuous panel production technology on two particleboard lines, two thin MDF lines and one single-opening particleboard line. More than 80% of products made here have value-added finishes, such as TFL, decorative paper, direct print or a paint finish.

This plant alone operates nine value-added finishing lines, featuring one continuous and two single-opening melamine presses, single or dual sided paper lamination, nine-stage direct print-and-paint line and a pegboard press.

Mr Shotbolt said the wider North American panel industry needs investment in facilities.

"I do not expect to see new continuous presses in the next couple of years," he said, as the industry continues to deal with a surplus of capacity.

"But beyond that period, however, North America will need modernised facilities. It's a matter of trying to more precisely determine what the market demands will be in coming years."

He said it was a matter of "when, not if" more continuous presses come to North America. "The industry has been waiting for this to happen and it will be imperative if North America is to compete effectively with other parts of the world."

"The market is moving much more slowly than we thought, so there remains a surplus of capacity in the North American particleboard and MDF industries.

"Industry shipment data was flat to down in 2014 compared to 2013, in clear contrast to what had been forecast.

"There is no doubt that the housing industry is healing more slowly than forecasters had predicted; the economy generally has recovered more slowly from the global economic crisis.

"Prices have been more or less stable in 2014 [for particleboard and MDF] and I would expect a similar pricing profile for 2015, with a modest increase in demand.

"The US dollar has been strengthening and energy prices have been reducing, which is influencing freight costs. So the question of imports for 2015 is a more important issue than it was a year ago and importers will try to take advantage of the situation.

"For those who have contemplated onshoring furniture manufacture in the US, I would think those plans may be pushed back once again.

"That's not to say there won't be additional on-shoring of furniture in North America, but the pace will be muted by recent events in currency and transport costs.

"The technology of furniture manufacturing has moved to more automated factories, which poses a challenge to North America. Some of the requisite skills do not exist to the extent they do elsewhere, such as in Europe."

With regard to the housing market - an important driver of panel demand in the US - Mr Shotbolt said the pace of growth was more modest than some of the predictions.

"This is mainly attributed to a dichotomy in the class of younger consumers: lower quality jobs and under-employment. The typical firsttime buyer - those in their early 20s and 30s - are lacking the impetus to buy because they are facing a much higher level of student debt than in the past. It's a growing crisis in the US.

"Those faced with these obstacles are hesitating to move out of their family homes, which is one reason we are seeing lower household formation in the US."

In terms of panel production innovation, he said North America was catching up with Europe.

"I think we will continue to lag Europe in this regard, but the time it has taken in the past for North America to adopt product innovations from Europe is shrinking; it is now going to happen much faster."

He cited registered embossed products and their expanding applications as an example of the way North American producers were speeding up product development.

When asked about prospects for the various lightweight and hollow-core panels manufactured in Europe, Mr Shotbolt said he expected this to be limited in North America to the likes of IKEA, which had the experience and technical know-how in working with these products.

"I do not think the rest of the industry is ready [to produce] this hollow-core product." Could we see further changes in the structure and ownership of the North American panels industry?

"Our view is there will be more industry consolidation," said Mr Shotbolt.

"Some of the existing players will exit the business, and some new ones will enter the business, especially those with the required financial backing.

"I believe there will be more foreign players [entering the sector] that have a deeper understanding of prevailing technology; and the expertise to execute it."