Better than the headlines suggest?

15 May 2012With the US single-family homes market continuing to languish during 2011, OSB producers have seen little change in demand and mills that were indefinitely closed in the last five to six years are still shut

Little changed in the past year with respect to the physical production capacity or output of North American OSB producers.

None of the top players seem interested in reopening curtailed mills this year, though 2012 does seem to have brought some cause for optimism.

The key companies seem to have focused a lot on maximising efficiencies and identifying new opportunities to reduce their dependence on the recalcitrant US new single-family homes market, which has proved resistant to recovery.

In its most recent quarterly production statistics, for fourth-quarter 2011, APA-The Engineered Wood Association, reported that North American structural panel production had dropped during 2011 by 132 million ft2 year-on-year to 26.070 billion ft2 (3/8in basis).

However, total North American OSB production in 2011 was up slightly, to 15.305 billion ft2, from 15.297 billion ft2 in 2010. Of that total, 2011 OSB production in the US was 10.039 billion ft2 - 2.52% lower than 2010's 10.299 billion ft2; while Canadian OSB production was 5.266 billion ft2 in 2011, up 5.36% from 2010's 4.998 billion ft2.

Consumption of US and Canadian structural panels overall dropped 202 million ft2 (1.48%) in 2011, to 25.355 billion ft2 in 2010. consumption in the US accounted for 21.302 billion ft2, down 1.5% year-on-year, while Canadian consumption rose by 3%, to 4.053 billion ft2.

Of those totals, North American OSB consumption in 2011 was 14.529 billion ft2, down from 14.655 billion ft2 in 2010. Consumption of OSB in the US was down 1.72% to 12.626 billion ft2, while Canadian OSB consumption increased by 5.25% to reach 1.903 billion ft2.

Setting the stage for those downward-trending US consumption figures was the all-important housing market, which during 2011 not only failed to improve, but actually ended up delivering less than the industry's modest expectations.

US single-family housing starts ended 2011 at 428,000 units, down 9% compared with 2010, and according to LP executives in their February 2012 financial conference call, the lowest since these statistics started to be collated more than 60 years ago. Single- and multi-family starts combined ended the year at around 607,000 units.

In its September 2011 Market Forecast, APA stated: "The set of assumptions that would result in a marked improvement in housing starts have been pushed another year into the future."

An apparent shift in the US toward a growth in multi-family housing starts at the expense of single-family starts was a topic raised by several analysts during the spring round of financial conference calls - for the simple reason that single-family homes use about three times more OSB than multi-family housing.

During Norbord's January 2012 conference call, RBC Capital analyst Paul Quinn noted that a shift in the ratio that prevailed in the middle of the last decade of 80% single-family, 20% multi-family to more of a 70-30% split today represented about a 10% drop in OSB consumption.

Weyerhaeuser's ceo Daniel Fulton, also in a recent call, acknowledged that there had been a swing to multi-family during the recession, as well as a reduction in the average square footage of single-family homes.

Mr Fulton noted that there was a record low vacancy rate for multi-family homes in many markets, though he said a lot of that could be attributed to buyer uncertainty "more than a shift long-term in choice of multi-family versus single-family."

While Weyerhaeuser has the ability to sell all its wood products into the multi-family market, said Mr Fulton, "Multi-family units generally have a lower square footage - on average, roughly 50% of the single-family," and use about a third of both lumber and OSB that single-family units do.

Mr Fulton said his personal view was that, once people start to re-enter the single-family market, vacancies in multi-family would rise and people would take advantage of record low interest rates and low prices for single-family housing.

A similarly-themed discussion on LP's conference call in February ended with ceo Rick Frost saying he believed the noted trend towards multi-family housing was a temporary one - a reaction to all the foreclosures - and that the American dream of owning a home was not dead.

No sign of consolidation

The weak OSB market notwithstanding, there was still in 2011 no formal announcement from any North American producer confirming the permanent closure of mills whose futures have long been debatable. Nothing short of an OSB boom is likely to make some of the smaller, older curtailed mills viable again, and no variation of the words 'OSB boom' left any executive's lips during the spring financial reporting season.

In terms of overall permanent capacity, nothing much has changed for the past two years. Physical OSB production is still trailing rated capacity, and no projects that were proposed and/or started during the boom era in the middle of the last decade have been completed, gone on line, or been publicly declared abandoned.

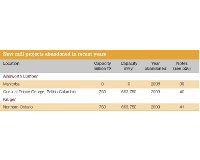

Several brand-new mills that were on the verge of being completed when the recession bit (Ainsworth's second line at Grande Prairie, Alberta, and Georgia Pacific LLC's former Grant Forest Products Inc mill in Clarendon County, South Carolina) or had just started up and were promptly closed (LP's Thomasville, Alabama, mill and Tolko's Slave Lake, Alberta, facility), are exactly where they were two years ago: Not on line. Waiting for a market recovery.

There has also been no further consolidation between companies since last year, when GP acquired the Grant OSB assets out of bankruptcy, although here and there the fortunes of individual mills have changed.

The former Grant Timmins, Ontario, mill, which stood no real chance of reopening once the recession bit and Grant hit financial problems, has now gone; the mill - closed amid a labour dispute in 2006 and not a part of GP's acquisition package - was being demolished at the start of 2012, finally removing 520 million ft2/year of 'ghost' capacity.

In August 2011, LP announced it planned to curtail OSB press production at its 380 million ft2 Dawson Creek, British Columbia, mill, while continuing production of TechShield Radiant Barrier Sheathing to support its customers' needs in West Coast markets.

In its August 24, 2011, release, LP said the Dawson Creek OSB mill, built in 1987, would reduce its staff numbers from 114 to about 26, who would be retained to operate the TechShield Radiant Barrier line and to maintain plant and equipment.

Although Executive VP of OSB, Jeff Wagner, was quoted in LP's release saying: "We firmly believe that we will resume OSB press production at the mill as housing starts to improve," and that the company was maintaining its wood license and mill equipment to that end, senior LP executives during February's conference call seemed to throw doubt on Dawson Creek's future with respect to producing commodity grade OSB.

During that call, CEO Rick Frost said: "During the fourth quarter, we did complete the ramp down of our Dawson Creek mill in British Columbia and we are now only running the TechShield line at Dawson, and the press is not running. During the quarter, our effective operating rate for the OSB business was 68%. And going forward, when I offer you that number in 2012, we will eliminate Dawson Creek's capacity from that calculation."

In LP's 10-K, available since February 29 on the company's website, it simply identifies Dawson Creek as one of its indefinitely-curtailed OSB mills.

Another mill that has seen some movement in the past year is one this report had previously consigned to the 'permanently closed' basket: Weyerhaeuser's 430 million ft2 Miramichi, New Brunswick, facility.

At the start of 2012, Arbec Forest Products - identified as a potential buyer of the long-mothballed Miramichi mill some time ago - finally closed a deal with Weyerhaeuser. While the news appears to have left some industry executives and analysts scratching their heads - the mill has been idle since 2006 - Arbec seems determined to reopen it; and the provincial government is so keen to restore jobs in the region that it is throwing in a C$15m financial aid package and a wood allocation agreement more generous than Weyerhaeuser had, to ensure it happens.

The players

The North American OSB market has a high level of concentration, with the top five producers representing 75% of capacity and more than 80% of production in 2011, Paul Quinn noted in a recent research note.

Although in recent years LP has closed some mills and converted others out of commodity grade OSB to value-added products, it remains North America's largest producer of OSB, with 5.56 billion ft2/year of rated capacity if you include its half-share in the Peace Valley OSB venture with Canfor; the 200 million ft2 still being produced at Hayward, Wisconsin; Dawson Creek (380 million ft2), and its two other curtailed mills, Chambord, Quebec (470 million ft2) and Thomasville, Alabama (750 million ft2).

It's debatable whether Norbord or Georgia-Pacific comes next. Norbord's rated capacity for all North American OSB mills is 4.42 billion ft2, including its two curtailed mills: Huguley, Alabama (500 million ft2) and Jefferson, Texas (415 million ft2).

Georgia-Pacific on the face of it has rated capacity of 4.24 billion ft2, although that includes the former Grant Englehart, Ontario, mill (760 million ft2), which we have not been able to verify is actually producing commodity grade OSB. If you take that volume off GP's total, but add the not-quite-finished Clarendon County mill (800 million ft2), it would take GP to 4.28 billion ft2 and slightly ahead of Norbord.

However, the GP capacity numbers also include all its indefinitely-closed OSB mills, some of which are small and have been offline for a long time.

Of GP's nine North American OSB mills that were ever on line, three have been indefinitely closed for quite some time: Dudley, North Carolina (170 million ft2), Grenada, Mississippi (375 million ft2) and Mount Hope, West Virginia (375 million ft2). In summer 2011, GP also started indefinite downtime at its 365 million ft2 Skippers, Virginia, mill, according to local media reports.

Unfortunately, privately owned GP will not confirm capacities and has not responded to several requests for information, so we cannot be certain that all four of those curtailed mills are still shut. We can say, however, that there has been no improvement in the market conditions that caused them to shut, and that the reopening of any long-shuttered OSB mills, with jobs as scarce as they are, would have at least made local headlines.

The fourth-largest OSB producer by rated capacity is Weyerhaeuser, with 3.48 billion ft2 out of seven mills in the US and Canada. However, that figure includes Wawa, Ontario (470 million ft2), the status of which has not been confirmed but its future was looking less than bright this time last year. If Wawa, which has not operated since October 2007, were to be permanently closed, that would take Weyerhaeuser's total rated capacity to slightly more than three billion ft2, still ahead of Ainsworth with 2.47 billion ft2 (including the 860 million ft2 curtailed Footner mill in Alberta).

Huber Engineered Woods is another private company that plays its cards close to its chest. We have no further information on Huber's five mills; to the best of our knowledge they are operating - though obviously we have no idea at what production/capacity ratio. Huber's rated capacity from the five mills is 2.1 billion ft2.

Tolko continues to have only one of its four OSB mills operating - Meadow Lake, Saskatchewan, capacity 640 million ft2/year. A company spokesperson confirmed in January 2012 that nothing had changed.

Tolko's High Prairie, Alberta, mill (640 million ft2/year) was curtailed for market reasons in February 2008; and both the Athabasca Division engineered wood facility (800 million ft2/year) in Slave Lake, Alberta, and Tolko's smaller, older Slave Lake mill (250 million ft2/year) which was going to be switched to value-added production to support the new facility, remain indefinitely curtailed.

If all of Tolko's rated capacity came back on line (excluding the small Slave Lake mill), the company would account for slightly more than two billion ft2.

Canfor's total rated OSB capacity is slightly more than one billion ft2, comprising its PolarBoard mill, with a rated capacity of 640 million ft2/year, which has been indefinitely curtailed since 2008, and its half of the 820 million ft2/year Peace Valley, British Columbia, OSB mill that is a joint venture with LP.

Martco Limited Partnership (Roy O Martin) has just one mill, in Oakdale, Louisiana, with a rated capacity of 850 million ft2/year.

Arbec Forest Products' small OSB mill (170 million ft2/year) in St Georges de Champlain, Quebec, acquired from Tembec Inc in 2006, appears to have survived the recession. We have not added Arbec's newly-acquired Miramichi mill to the existing-capacity table this year, but when and if it gets that mill back on line, Arbec will have a total of 600 million ft2/year of OSB. The only other producer is the Langboard mill in Quitman, Georgia, with 440 million ft2/year capacity, which we believe has remained online during the recession.

Still hampered by over-capacity

In Norbord's January 27 conference call with analysts, CEO Barrie Shineton said North American OSB markets "continue to be hampered by over-capacity, and it's my view that any meaningful growth is likely [to be] a few years away".

Both Mr Shineton and LP's Mr Frost, in their respective calls with investment analysts, indicated there was no plan to restart mothballed mills during 2012.

In answer to an analyst's question on possible restarting of mills, Mr Frost said: 'We don't see that happening in 2012. Just as we look at the landscape".

Mr Shineton, also responding to an analyst, said: "If your question is, do we intend to put either of our two mothballed plants back into production in 2012, we don't see that scenario at all".

Analysts on Norbord's call in January noted that people generally talk of the OSB capacity sitting idle in North America as being in the region of five billion ft2.

Our total figure for indefinitely closed mills is somewhat higher, even if you remove the Longlac Wood Industries mill (170 million ft2, sold by Kruger in December 2009 to buyers who seem to have no intention of restarting it); Weyerhaeuser's Wawa mill; Tolko's small Slave Lake mill; and GP's Dudley mill - all of which have doubtful futures. We make the remaining volume of indefinitely-idled capacity to be 6.19 billion ft2. But that includes several mills in our 'existing mills' table that companies and investment analysts might consider to be already permanently closed, whether the companies have formalised it or not.

RBC's Paul Quinn asked Mr Shineton in January how much 'of the five-plus billion' he would expect to eventually come back to the market when a more normalised US housing-starts level of 1.2-1.3 million is restored.

Mr Shineton replied: "Some of that capacity, and I've said this before I think, is really closed capacity, not mothballed capacity. But companies aren't prepared to make those calls, perhaps, because there are asset write-downs and stuff associated with them. But some part of it will come back at 1.2 million housing starts, some part of it won't. I don't want to speculate on what other people will do".

He noted that, in deciding whether to restart a mill, companies have to factor in whether logging infrastructure is available and whether workers can easily be brought back in or new people trained. "I think there are a whole lot of considerations, but the one thing I am pretty certain of is that everybody in the industry will want to see sustained good housing numbers before they make those calls."

Mr Shineton also observed that several new mills which were either complete or nearly complete had been sitting idle during the downturn "and they obviously have the latest technology in them. And so, I would expect that those mills certainly would come back when the time is right. But as I said, I think there are a lot of mothballed mills where companies would make mothballed or indefinite kind of curtailment announcements when in fact the mills are effectively closed."

LP's Thomasville facility and Tolko's Athabasca Engineered Wood mill in Slave Lake, Alberta, were both brand new mills in start-up mode when they were curtailed for different reasons, while GP's under-construction Clarendon County mill and Ainsworth's almost-completed second line in Grande Prairie are also state-of-the-art, large-capacity mills.

Ainsworth confirmed earlier this year that little has changed in terms of its production capacity - or its intentions with respect either to reopening the Footner Forest Products Inc mill in Alberta (which has been shut since late 2007) nor completing the second line in Grande Prairie.

According to Ainsworth's investor relations executive, Bruce Gibson, the 690 million ft2 second line at Grande Prairie is 75% complete, but there are no immediate plans to restart construction.

Mr Gibson had noted when interviewed for this report last year that the mill could take six to 18 months to bring on line once the decision was taken to reopen it.

He also said Footner's design capacity is 860 million ft2/year, though it was running at less than 800 million ft2 prior to its curtailment: this survey had it down as 700-750 million ft2/year for several years.

Capacity versus output

Total rated capacity for the North American market this time last year was 28 billion ft2/year (28,033 million ft2) but that included several questionable-future mills. As we said last year, a more accurate figure for rated capacity would already have removed Grant's Timmins, Ontario, mill (520 million ft2/year); GP's Dudley mill (170 million ft2/year); Longlac, Ontario (170 million ft2/year); Tolko's small Slave Lake mill (250 million ft2/year); and Weyerhaeuser's Wawa, Ontario, mill (470 million ft2/year), for a total of 26.4 billion ft2/year (26,453 million ft2).

This year's total of 27.4 billion ft2 (27,408 million ft2) removed Timmins and includes some minor capacity tweaks for individual mills. Take the other four 'debatable' mills away and it comes down to 26.34 billion ft2.

It is harder to place a figure on actual production for 2011, given much of the operating and indefinitely-shut capacity is in private hands, but we believe rated capacity of the online mills is a little under 20 billion ft2/year. Of that, many operational mills are operating below full capacity.

LP's North American OSB mills were producing at 72% of capacity during 2011, according to executives during February's conference call; Norbord operated at 65% (down from 70% in 2010), according to a research note from Paul Quinn; and Weyerhaeuser's OSB mills operated at 72%. One could assume that most of the other top-volume producers had output during 2011 on or around the 70% mark.

New mills still on hold

Short of further economic catastrophe, we can reasonably expect, within the next couple of years, to see Ainsworth, GP, LP and Tolko bring online their shiny new mills.

There's zero fresh insight into Huber Engineered Woods' plans for Emanuel County, Georgia, announced in 2006, as no-one - including local sources who were happy to speak of the project's progress up to a couple of years ago - is talking.

Another project developer that went pretty quiet in the last year is Arizona Forest Restoration Products (AZFRP), which announced plans for a new OSB mill near Flagstaff, Arizona, just prior to the market nose-diving. Although we said last year that proposed mill still seemed to be bubbling along with enough activity to suggest it was not dead, recent requests to the CEO for updates have fallen on deaf ears.

Given the scepticism that surrounded this venture from the start - mainly because it would depend on US Forest Service wood fibre - perhaps the chances of the western US having its own OSB production facility any time soon are looking more remote.

At time of going to press, AZFRP had not confirmed whether there is a new timeline for construction to begin on the OSB mill.

Addressing slow US housing recovery

One of the more interesting things to come out of the recent round of fourth-quarter and year-end financial conference calls was LP's clear commitment to growing its South American business. Rick Frost said in February's call that South America had "finally become large enough that our accounting rules now force us to report it separately as a segment".

During 2011, that business really seems to have gathered momentum for LP.

Last June, its subsidiary, LP South America (LPSA), acquired, for US$24M, the remaining 25% equity interest in LP-Brasil OSB Industria é Comercio SA from Masisa SA subsidiary Masisa do Brasil LTDA. LP Brasil operates the OSB plant in Ponta Grossa, Brazil.

"The completion of this purchase is an important next step in our strategic focus on growing business in South America," said Rick Olszewski, LP's executive vice-president of sales and president of LPSA, in a release at the time.

"The Ponta Grossa operations position us to help satisfy the growing need for structural panels in South America and to support the burgeoning demand for affordable housing in Brazil," Mr Olszewski added.

The Ponta Grossa OSB plant started up in 2003 and has an annual production capacity of 390 million ft2. LPSA also owns two OSB mills in Chile with a combined annual production capacity of 290 million ft2.

LP's South American sales for 2011 were US$145 million versus US$125 million in 2010, which is up 16%, Mr Frost noted in February.

"Both mills in Chile are currently running full, and the Brazil mill is running at about 50% of its rated capacity. Most of the Chilean production is staying in Chile and about 20% of Brazil's volume is going to China at this time. Our largest opportunity in South America right now is to figure out how to increase the profitable volume in Brazil to utilise the additional available capacity of the Ponta Grossa mill."

In November 2011, LP revealed it was considering building a second mill in Brazil.

Looking ahead to 2012 and beyond

The APA, in its September 2011 market forecast, said US housing starts were expected to increase only slightly in 2012.

Single-family starts are forecast for 2012 at around 430,000, slightly up on 2011 because of improving consumer sentiment, pent-up demand and house price improvement in a few scattered geographic areas, APA noted.

However, "If consumer pessimism about the future lingers for another year, single-family starts could languish at the 410,000 level," APA warned. "The outlook is for a slow recovery in 2012 and 2013 with the assumption that job increases, a reduction in existing house inventory and a better economy will eventually lift housing."

On the upside, APA's forecast stated, US wood product demand could improve more than expected in all markets if consumer and business confidence are better than expected and boost growth. Government initiatives to stimulate the housing market - such as incentivising a wave of home mortgage refinancing at today's low rates - could act as a strong stimulus to the economy.

A downside scenario, on the other hand, could see near-zero growth in the US in the first half of 2012, chopping 30,000 single-family and 50,000 multi-family starts from the base case, said APA.

The CEOs of both LP and Norbord, in their respective conference calls, seemed to be going more with the 'hope than despair' outlook.

Mr Frost noted that the consensus of forecasts the APA published in January this year was for total US housing starts to land around 692,000 for 2012, of which 460,000 are single-family - an improvement on the 428,000 of 2011 and better than APA forecast last September.

"Their consensus for 2013 is 896,000 combined single-family and multi-family," said Mr Frost. Significant to us is that these forecasts went up from December to January and we now have several months in a row that the forecasters have upped their projections after living through about three and-a-half years where every month of projections was lower than the month before."

Speaking in the run up to the International Builders Show in Orlando, Florida, that took place in early February, Mr Frost said there he noted 'cautious' enthusiasm. "It just feels a heck of a lot different than it did a year ago...it actually feels and sounds, in our interactions with our customers, better than it's actually happening."

According to Mr Shineton, "The North American housing picture appears to be getting brighter in spite of the structural issues that remain. And while I believe overall OSB pricing will generally trend sideways for most of 2012, early indicators suggest some upside in OSB demand as we move into the first quarter. Supply chain inventories are lean, less capacity appeared to be available at the end of last year and the latest housing numbers were stronger than most forecasters had predicted".

Noting there was "more work to be done," Mr Shineton said the US housing sector was "now in the early phase of a more gradual rebound." US job creation had been positive in recent months, new home inventories were below historical levels, housing affordability is at historically highs and mortgage availability "is better than headlines suggest," he noted.

Analysts seem to agree. In a research brief on LP in February, Paul Quinn cited RBC Capital Markets' US Building Products analyst Robert Wetenhall's expectation that US housing starts will rise 8.5% in 2012 to 650,000 units. Although this is well below the long-term annual average of 1.5 million housing starts, Quinn said: "We believe the housing market is finally beginning on its long journey to recovery, and will slowly build on current activity levels through 2012 and into 2013."